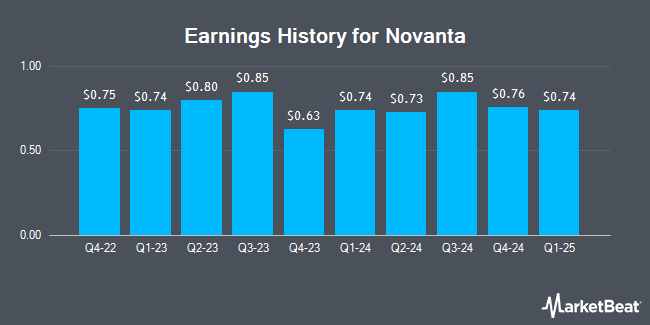

Novanta (NASDAQ:NOVT - Get Free Report) is projected to issue its Q2 2025 quarterly earnings data before the market opens on Tuesday, August 5th. Analysts expect the company to announce earnings of $0.74 per share and revenue of $237.97 million for the quarter. Novanta has set its Q2 2025 guidance at 0.680-0.780 EPS.

Novanta (NASDAQ:NOVT - Get Free Report) last announced its quarterly earnings results on Tuesday, May 6th. The technology company reported $0.74 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.68 by $0.06. Novanta had a return on equity of 15.06% and a net margin of 7.42%. The business had revenue of $233.37 million for the quarter, compared to the consensus estimate of $233.34 million. During the same quarter last year, the business posted $0.74 EPS. The business's revenue was up 1.1% on a year-over-year basis. On average, analysts expect Novanta to post $3 EPS for the current fiscal year and $4 EPS for the next fiscal year.

Novanta Stock Performance

Shares of NOVT stock traded down $0.58 during trading hours on Wednesday, reaching $123.24. The stock had a trading volume of 322,627 shares, compared to its average volume of 229,925. The company has a debt-to-equity ratio of 0.50, a current ratio of 2.56 and a quick ratio of 1.70. The firm has a 50-day simple moving average of $126.04 and a 200-day simple moving average of $130.73. The firm has a market capitalization of $4.43 billion, a PE ratio of 62.88 and a beta of 1.45. Novanta has a twelve month low of $98.76 and a twelve month high of $186.75.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen downgraded Novanta from a "buy" rating to a "hold" rating in a research report on Saturday.

View Our Latest Stock Report on Novanta

Hedge Funds Weigh In On Novanta

A number of institutional investors and hedge funds have recently bought and sold shares of NOVT. AQR Capital Management LLC boosted its holdings in shares of Novanta by 78.9% in the first quarter. AQR Capital Management LLC now owns 4,231 shares of the technology company's stock valued at $537,000 after acquiring an additional 1,866 shares in the last quarter. Goldman Sachs Group Inc. lifted its position in Novanta by 1.6% in the first quarter. Goldman Sachs Group Inc. now owns 419,037 shares of the technology company's stock worth $53,582,000 after purchasing an additional 6,533 shares during the period. Finally, Jane Street Group LLC boosted its stake in Novanta by 1,762.5% during the 1st quarter. Jane Street Group LLC now owns 61,631 shares of the technology company's stock valued at $7,881,000 after purchasing an additional 58,322 shares in the last quarter. Institutional investors own 98.35% of the company's stock.

Novanta Company Profile

(

Get Free Report)

Novanta, Inc engages in the provision of core technology solutions to healthcare and advanced industrial original equipment manufacturers. It operates through the following segments: Photonics, Vision, and Precision Motion. The Photonics segment designs, manufactures, and markets photonics-based solutions, including laser scanning and laser beam delivery, CO2 laser, continuous wave and ultrafast laser, and optical light engine products.

Recommended Stories

Before you consider Novanta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Novanta wasn't on the list.

While Novanta currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.