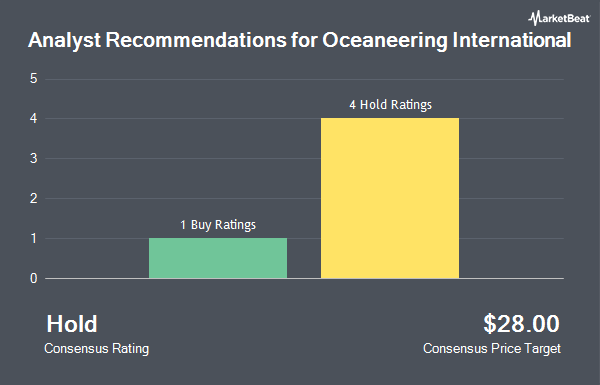

Oceaneering International (NYSE:OII - Get Free Report) was downgraded by Wall Street Zen from a "buy" rating to a "hold" rating in a report released on Sunday.

Separately, Barclays boosted their target price on Oceaneering International from $21.00 to $22.00 and gave the stock an "equal weight" rating in a report on Friday, August 1st. Five analysts have rated the stock with a hold rating and one has given a buy rating to the stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus target price of $28.25.

Get Our Latest Analysis on Oceaneering International

Oceaneering International Price Performance

NYSE:OII traded down $0.28 during trading hours on Friday, hitting $22.08. 155,532 shares of the stock were exchanged, compared to its average volume of 874,755. Oceaneering International has a 52-week low of $15.46 and a 52-week high of $30.98. The firm's fifty day moving average price is $21.39 and its 200 day moving average price is $20.88. The company has a current ratio of 2.00, a quick ratio of 1.67 and a debt-to-equity ratio of 0.57. The company has a market cap of $2.21 billion, a P/E ratio of 11.16 and a beta of 1.55.

Oceaneering International (NYSE:OII - Get Free Report) last posted its quarterly earnings data on Wednesday, July 23rd. The oil and gas company reported $0.49 EPS for the quarter, topping the consensus estimate of $0.42 by $0.07. The company had revenue of $698.16 million during the quarter, compared to analyst estimates of $676.81 million. Oceaneering International had a return on equity of 22.09% and a net margin of 7.31%. Oceaneering International's quarterly revenue was up 4.5% on a year-over-year basis. During the same period in the previous year, the business earned $0.28 EPS. As a group, equities research analysts anticipate that Oceaneering International will post 1.78 EPS for the current fiscal year.

Institutional Inflows and Outflows

Large investors have recently added to or reduced their stakes in the business. Sumitomo Mitsui Trust Group Inc. lifted its holdings in Oceaneering International by 62.3% in the first quarter. Sumitomo Mitsui Trust Group Inc. now owns 27,675 shares of the oil and gas company's stock valued at $604,000 after acquiring an additional 10,628 shares during the last quarter. Principal Financial Group Inc. lifted its holdings in Oceaneering International by 2.3% in the first quarter. Principal Financial Group Inc. now owns 539,234 shares of the oil and gas company's stock valued at $11,761,000 after acquiring an additional 12,085 shares during the last quarter. Harbor Capital Advisors Inc. acquired a new position in Oceaneering International in the first quarter valued at approximately $546,000. Envestnet Asset Management Inc. lifted its holdings in Oceaneering International by 1.5% in the first quarter. Envestnet Asset Management Inc. now owns 326,978 shares of the oil and gas company's stock valued at $7,131,000 after acquiring an additional 4,950 shares during the last quarter. Finally, Wedge Capital Management L L P NC lifted its stake in Oceaneering International by 21.1% during the first quarter. Wedge Capital Management L L P NC now owns 69,897 shares of the oil and gas company's stock worth $1,524,000 after purchasing an additional 12,199 shares in the last quarter. 93.93% of the stock is currently owned by institutional investors and hedge funds.

Oceaneering International Company Profile

(

Get Free Report)

Oceaneering International, Inc provides engineered services and products, and robotic solutions to the offshore energy, defense, aerospace, manufacturing, and entertainment industries worldwide. It operates through Subsea Robotics, Manufactured Products, Offshore Projects Group, Integrity Management & Digital Solutions, and Aerospace and Defense Technologies segments.

Featured Articles

Before you consider Oceaneering International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oceaneering International wasn't on the list.

While Oceaneering International currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.