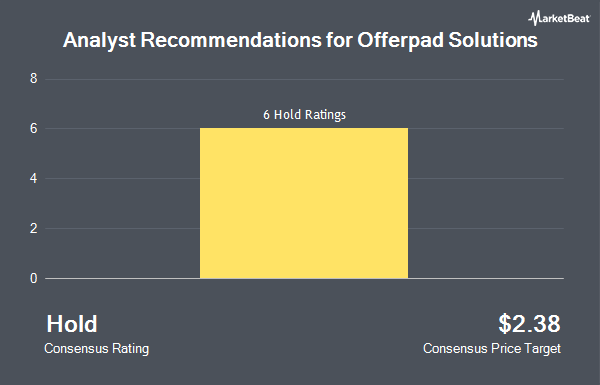

Shares of Offerpad Solutions Inc. (NYSE:OPAD - Get Free Report) have earned a consensus recommendation of "Hold" from the six ratings firms that are covering the stock, MarketBeat Ratings reports. Six research analysts have rated the stock with a hold rating. The average 1 year price target among analysts that have covered the stock in the last year is $2.4125.

Several analysts recently issued reports on the company. Keefe, Bruyette & Woods raised their target price on Offerpad Solutions from $1.00 to $1.15 and gave the stock a "market perform" rating in a research note on Tuesday, August 12th. Wall Street Zen raised Offerpad Solutions to a "sell" rating in a research note on Friday, August 22nd.

Read Our Latest Analysis on OPAD

Institutional Trading of Offerpad Solutions

Several large investors have recently modified their holdings of OPAD. Ieq Capital LLC purchased a new stake in Offerpad Solutions in the first quarter worth about $353,000. Northern Trust Corp lifted its holdings in Offerpad Solutions by 22.1% in the fourth quarter. Northern Trust Corp now owns 95,866 shares of the company's stock worth $273,000 after buying an additional 17,322 shares during the period. Jane Street Group LLC purchased a new stake in Offerpad Solutions in the second quarter worth about $44,000. Deutsche Bank AG purchased a new stake in Offerpad Solutions in the fourth quarter worth about $111,000. Finally, AQR Capital Management LLC lifted its holdings in Offerpad Solutions by 69.6% in the first quarter. AQR Capital Management LLC now owns 24,308 shares of the company's stock worth $40,000 after buying an additional 9,979 shares during the period. 39.44% of the stock is owned by institutional investors.

Offerpad Solutions Trading Down 14.0%

Shares of NYSE:OPAD traded down $0.70 on Tuesday, reaching $4.30. 8,556,657 shares of the company traded hands, compared to its average volume of 24,768,030. The business's 50-day simple moving average is $2.47 and its 200 day simple moving average is $1.72. Offerpad Solutions has a 52 week low of $0.91 and a 52 week high of $6.35. The stock has a market capitalization of $131.49 million, a P/E ratio of -2.09 and a beta of 2.37.

Offerpad Solutions (NYSE:OPAD - Get Free Report) last announced its quarterly earnings data on Monday, August 4th. The company reported ($0.40) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.39) by ($0.01). Offerpad Solutions had a negative net margin of 8.08% and a negative return on equity of 132.77%. The company had revenue of $160.30 million for the quarter, compared to the consensus estimate of $178.91 million. Offerpad Solutions has set its Q3 2025 guidance at EPS. Sell-side analysts expect that Offerpad Solutions will post -2.16 EPS for the current fiscal year.

Offerpad Solutions Company Profile

(

Get Free Report)

Offerpad Solutions Inc, together with its subsidiaries, provides technology-enabled solutions for residential real estate market in the United States. It operates iBuying, a real estate solutions platform for on-demand customer that provides home buyers the opportunity to browse and tour homes online.

Further Reading

Before you consider Offerpad Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Offerpad Solutions wasn't on the list.

While Offerpad Solutions currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.