Oxford Instruments (LON:OXIG - Get Free Report) had its price target dropped by Berenberg Bank from GBX 2,500 to GBX 2,400 in a research note issued on Wednesday,Digital Look reports. The brokerage presently has a "buy" rating on the stock. Berenberg Bank's target price indicates a potential upside of 32.01% from the stock's current price.

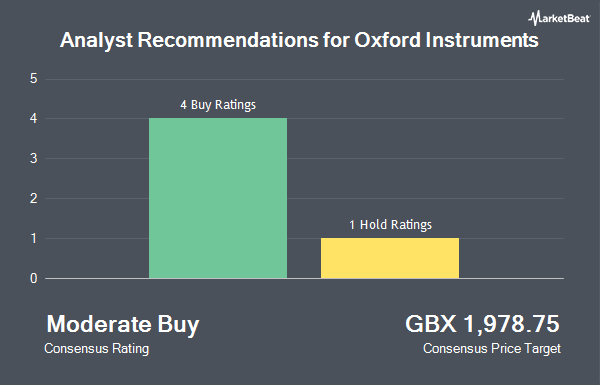

A number of other analysts also recently commented on OXIG. JPMorgan Chase & Co. reduced their price objective on Oxford Instruments from GBX 2,700 to GBX 2,500 and set an "overweight" rating for the company in a research report on Tuesday. Peel Hunt reiterated a "buy" rating and issued a GBX 2,400 price objective on shares of Oxford Instruments in a research report on Monday. Deutsche Bank Aktiengesellschaft reduced their price objective on Oxford Instruments from GBX 2,550 to GBX 2,435 and set a "buy" rating for the company in a research report on Monday. Finally, Shore Capital reiterated a "buy" rating and issued a GBX 2,600 price objective on shares of Oxford Instruments in a research report on Monday. Five research analysts have rated the stock with a Buy rating, Based on data from MarketBeat.com, the stock currently has a consensus rating of "Buy" and an average price target of GBX 2,467.

View Our Latest Stock Report on OXIG

Oxford Instruments Stock Performance

LON:OXIG traded up GBX 36 during mid-day trading on Wednesday, hitting GBX 1,818. 139,782 shares of the company's stock traded hands, compared to its average volume of 203,550. The firm has a 50 day moving average of GBX 1,858.25 and a two-hundred day moving average of GBX 1,822.99. Oxford Instruments has a 12 month low of GBX 1,470 and a 12 month high of GBX 2,224.13. The firm has a market capitalization of £1.03 billion, a price-to-earnings ratio of 4,103.84, a price-to-earnings-growth ratio of -3.56 and a beta of 0.96. The company has a current ratio of 1.64, a quick ratio of 1.11 and a debt-to-equity ratio of 12.96.

Insider Activity

In other Oxford Instruments news, insider Paul Fry bought 98 shares of Oxford Instruments stock in a transaction on Wednesday, September 10th. The shares were purchased at an average cost of GBX 1,824 per share, for a total transaction of £1,787.52. Also, insider Richard Tyson bought 7,479 shares of Oxford Instruments stock in a transaction on Thursday, July 24th. The shares were acquired at an average price of GBX 1,942 per share, for a total transaction of £145,242.18. Over the last quarter, insiders have acquired 7,652 shares of company stock worth $14,839,734. Corporate insiders own 1.43% of the company's stock.

About Oxford Instruments

(

Get Free Report)

Oxford Instruments provides academic and commercial organisations worldwide with market-leading scientific technology and expertise across its key market segments: materials analysis, semiconductor, and healthcare & life science.

Innovation is the driving force behind Oxford Instruments' growth and success, supporting its core purpose to accelerate the breakthroughs that create a brighter future for our world.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Oxford Instruments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oxford Instruments wasn't on the list.

While Oxford Instruments currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.