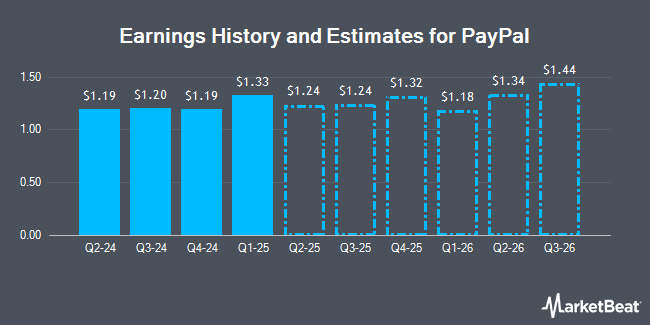

PayPal (NASDAQ:PYPL - Get Free Report) issued an update on its third quarter 2025 earnings guidance on Tuesday morning. The company provided EPS guidance of 1.180-1.220 for the period, compared to the consensus EPS estimate of 1.199. The company issued revenue guidance of -. PayPal also updated its FY 2025 guidance to 5.150-5.300 EPS.

PayPal Stock Up 0.3%

NASDAQ PYPL opened at $78.22 on Tuesday. The company has a debt-to-equity ratio of 0.56, a current ratio of 1.30 and a quick ratio of 1.30. The stock has a market capitalization of $76.07 billion, a PE ratio of 17.50, a PEG ratio of 1.28 and a beta of 1.45. PayPal has a 1 year low of $55.85 and a 1 year high of $93.66. The business's 50-day moving average is $73.31 and its 200 day moving average is $72.69.

PayPal (NASDAQ:PYPL - Get Free Report) last posted its earnings results on Tuesday, July 29th. The credit services provider reported $1.40 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.30 by $0.10. PayPal had a return on equity of 24.59% and a net margin of 14.26%. During the same period in the previous year, the firm earned $1.19 EPS. Sell-side analysts forecast that PayPal will post 5.03 earnings per share for the current year.

Wall Street Analysts Forecast Growth

Several research firms have weighed in on PYPL. Needham & Company LLC reaffirmed a "hold" rating on shares of PayPal in a research report on Wednesday, April 30th. Macquarie cut their price objective on PayPal from $117.00 to $95.00 and set an "outperform" rating on the stock in a research report on Tuesday, April 29th. Piper Sandler set a $74.00 price objective on PayPal in a research report on Tuesday. Seaport Res Ptn raised PayPal from a "strong sell" rating to a "hold" rating in a research report on Monday, July 14th. Finally, Citigroup cut their price objective on PayPal from $98.00 to $95.00 and set a "buy" rating on the stock in a research report on Tuesday, May 6th. Two equities research analysts have rated the stock with a sell rating, seventeen have given a hold rating, eighteen have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus target price of $83.13.

Read Our Latest Report on PYPL

Insider Transactions at PayPal

In other news, insider Suzan Kereere sold 4,162 shares of the stock in a transaction that occurred on Friday, June 6th. The shares were sold at an average price of $73.24, for a total value of $304,824.88. Following the completion of the sale, the insider owned 48,483 shares of the company's stock, valued at $3,550,894.92. This represents a 7.91% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Also, Director Deborah M. Messemer sold 3,795 shares of the company's stock in a transaction that occurred on Friday, June 6th. The stock was sold at an average price of $73.00, for a total transaction of $277,035.00. Following the completion of the transaction, the director owned 13,976 shares in the company, valued at approximately $1,020,248. This represents a 21.36% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 11,796 shares of company stock valued at $863,028 over the last 90 days. Corporate insiders own 0.08% of the company's stock.

Hedge Funds Weigh In On PayPal

A hedge fund recently raised its stake in PayPal stock. Brighton Jones LLC boosted its holdings in shares of PayPal Holdings, Inc. (NASDAQ:PYPL - Free Report) by 15.2% during the 4th quarter, according to its most recent 13F filing with the SEC. The fund owned 6,989 shares of the credit services provider's stock after purchasing an additional 924 shares during the period. Brighton Jones LLC's holdings in PayPal were worth $596,000 as of its most recent filing with the SEC. Institutional investors and hedge funds own 68.32% of the company's stock.

About PayPal

(

Get Free Report)

PayPal Holdings, Inc operates a technology platform that enables digital payments on behalf of merchants and consumers worldwide. It operates a two-sided network at scale that connects merchants and consumers that enables its customers to connect, transact, and send and receive payments through online and in person, as well as transfer and withdraw funds using various funding sources, such as bank accounts, PayPal or Venmo account balance, PayPal and Venmo branded credit products comprising its installment products, credit and debit cards, and cryptocurrencies, as well as other stored value products, including gift cards and eligible rewards.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PayPal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PayPal wasn't on the list.

While PayPal currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.