Penske Automotive Group (NYSE:PAG - Get Free Report) is expected to be issuing its Q3 2025 results before the market opens on Wednesday, October 29th. Analysts expect the company to announce earnings of $3.65 per share and revenue of $7.7112 billion for the quarter. Parties are encouraged to explore the company's upcoming Q3 2025 earningoverview page for the latest details on the call scheduled for Wednesday, October 29, 2025 at 2:00 PM ET.

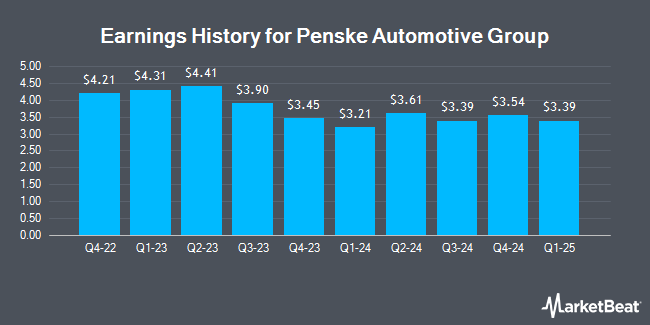

Penske Automotive Group (NYSE:PAG - Get Free Report) last released its earnings results on Wednesday, July 30th. The company reported $3.78 earnings per share (EPS) for the quarter, topping the consensus estimate of $3.56 by $0.22. The company had revenue of $7.66 billion during the quarter, compared to analyst estimates of $7.98 billion. Penske Automotive Group had a net margin of 3.13% and a return on equity of 17.43%. The firm's quarterly revenue was down .4% compared to the same quarter last year. During the same period in the prior year, the firm posted $3.61 EPS. On average, analysts expect Penske Automotive Group to post $14 EPS for the current fiscal year and $14 EPS for the next fiscal year.

Penske Automotive Group Trading Up 1.3%

Penske Automotive Group stock opened at $171.62 on Wednesday. The firm has a 50 day moving average of $178.18 and a 200 day moving average of $170.01. The firm has a market capitalization of $11.33 billion, a price-to-earnings ratio of 11.94 and a beta of 0.88. Penske Automotive Group has a 12-month low of $134.05 and a 12-month high of $189.51. The company has a current ratio of 0.90, a quick ratio of 0.21 and a debt-to-equity ratio of 0.16.

Penske Automotive Group Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 2nd. Investors of record on Friday, November 14th will be issued a $1.38 dividend. The ex-dividend date of this dividend is Friday, November 14th. This represents a $5.52 annualized dividend and a yield of 3.2%. This is a positive change from Penske Automotive Group's previous quarterly dividend of $1.32. Penske Automotive Group's payout ratio is currently 36.74%.

Wall Street Analysts Forecast Growth

PAG has been the subject of several analyst reports. Morgan Stanley increased their target price on shares of Penske Automotive Group from $180.00 to $190.00 and gave the stock an "overweight" rating in a report on Thursday, August 14th. JPMorgan Chase & Co. increased their target price on shares of Penske Automotive Group from $175.00 to $180.00 and gave the stock a "neutral" rating in a report on Tuesday, October 14th. Weiss Ratings restated a "buy (b+)" rating on shares of Penske Automotive Group in a research note on Wednesday, October 8th. Benchmark upped their price target on Penske Automotive Group from $185.00 to $190.00 and gave the stock a "buy" rating in a research note on Wednesday, September 17th. Finally, Citigroup upped their price target on Penske Automotive Group from $200.00 to $206.00 and gave the stock a "buy" rating in a research note on Thursday, September 25th. Five equities research analysts have rated the stock with a Buy rating and two have given a Hold rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $185.17.

Get Our Latest Research Report on PAG

Insider Buying and Selling

In related news, Director Lisa Ann Davis sold 1,604 shares of the firm's stock in a transaction on Monday, August 18th. The stock was sold at an average price of $180.74, for a total value of $289,906.96. Following the completion of the sale, the director directly owned 1,529 shares in the company, valued at $276,351.46. This trade represents a 51.20% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CFO Michelle Hulgrave sold 1,100 shares of the firm's stock in a transaction on Tuesday, August 19th. The stock was sold at an average price of $182.55, for a total value of $200,805.00. Following the completion of the sale, the chief financial officer owned 18,922 shares of the company's stock, valued at approximately $3,454,211.10. This represents a 5.49% decrease in their ownership of the stock. The disclosure for this sale can be found here. 52.40% of the stock is currently owned by corporate insiders.

Institutional Trading of Penske Automotive Group

A number of institutional investors have recently bought and sold shares of the stock. AQR Capital Management LLC lifted its position in Penske Automotive Group by 21.1% in the second quarter. AQR Capital Management LLC now owns 681,741 shares of the company's stock worth $116,953,000 after buying an additional 118,976 shares during the last quarter. Goldman Sachs Group Inc. lifted its position in Penske Automotive Group by 28.4% in the first quarter. Goldman Sachs Group Inc. now owns 380,267 shares of the company's stock worth $54,751,000 after buying an additional 84,045 shares during the last quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC lifted its position in Penske Automotive Group by 4.7% in the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 68,884 shares of the company's stock worth $9,918,000 after buying an additional 3,100 shares during the last quarter. Quantinno Capital Management LP lifted its position in Penske Automotive Group by 124.1% in the second quarter. Quantinno Capital Management LP now owns 67,211 shares of the company's stock worth $11,548,000 after buying an additional 37,221 shares during the last quarter. Finally, Ameriprise Financial Inc. lifted its position in Penske Automotive Group by 33.4% in the second quarter. Ameriprise Financial Inc. now owns 46,230 shares of the company's stock worth $7,943,000 after buying an additional 11,571 shares during the last quarter. 77.08% of the stock is currently owned by institutional investors.

Penske Automotive Group Company Profile

(

Get Free Report)

Penske Automotive Group, Inc, a diversified transportation services company, operates automotive and commercial truck dealerships worldwide. The company operates through four segments: Retail Automotive, Retail Commercial Truck, Other, and Non-Automotive Investments. It operates dealerships under franchise agreements with various automotive manufacturers and distributors.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Penske Automotive Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Penske Automotive Group wasn't on the list.

While Penske Automotive Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.