Piedmont Realty Trust (NYSE:PDM - Get Free Report) is expected to announce its Q3 2025 results after the market closes on Monday, October 27th. Analysts expect the company to announce earnings of $0.35 per share and revenue of $141.4550 million for the quarter. Piedmont Realty Trust has set its FY 2025 guidance at 1.380-1.440 EPS.Investors may visit the the company's upcoming Q3 2025 earningresults page for the latest details on the call scheduled for Tuesday, October 28, 2025 at 9:00 AM ET.

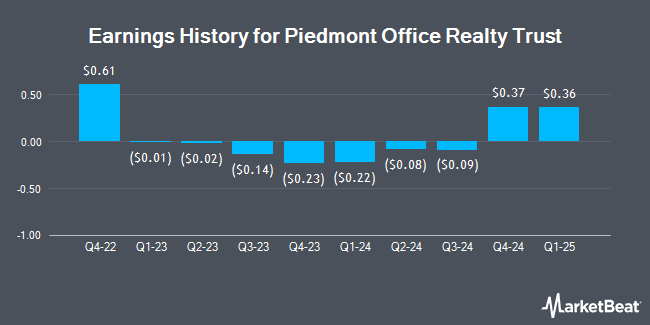

Piedmont Realty Trust (NYSE:PDM - Get Free Report) last announced its earnings results on Monday, July 28th. The real estate investment trust reported $0.36 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.35 by $0.01. The firm had revenue of $111.13 million for the quarter, compared to analysts' expectations of $141.96 million. Piedmont Realty Trust had a negative net margin of 12.10% and a negative return on equity of 4.32%. The business's revenue was down 2.1% compared to the same quarter last year. During the same period in the prior year, the company earned $0.37 EPS. On average, analysts expect Piedmont Realty Trust to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Piedmont Realty Trust Stock Up 0.4%

Shares of NYSE PDM opened at $8.19 on Monday. The firm's 50-day moving average price is $8.44 and its 200-day moving average price is $7.55. The company has a current ratio of 1.67, a quick ratio of 1.67 and a debt-to-equity ratio of 1.41. The stock has a market capitalization of $1.02 billion, a price-to-earnings ratio of -14.88 and a beta of 1.52. Piedmont Realty Trust has a 12-month low of $5.46 and a 12-month high of $11.11.

Wall Street Analyst Weigh In

Several analysts have recently issued reports on PDM shares. Weiss Ratings restated a "sell (d-)" rating on shares of Piedmont Realty Trust in a research report on Wednesday, October 8th. Wall Street Zen upgraded shares of Piedmont Realty Trust from a "sell" rating to a "hold" rating in a research report on Saturday, August 23rd. One research analyst has rated the stock with a Buy rating, three have assigned a Hold rating and one has given a Sell rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus price target of $8.67.

Check Out Our Latest Stock Analysis on Piedmont Realty Trust

Hedge Funds Weigh In On Piedmont Realty Trust

Hedge funds have recently added to or reduced their stakes in the company. EverSource Wealth Advisors LLC grew its holdings in Piedmont Realty Trust by 214.6% during the 2nd quarter. EverSource Wealth Advisors LLC now owns 4,405 shares of the real estate investment trust's stock valued at $32,000 after purchasing an additional 3,005 shares during the last quarter. BNP Paribas Financial Markets grew its holdings in Piedmont Realty Trust by 59.7% during the 2nd quarter. BNP Paribas Financial Markets now owns 10,741 shares of the real estate investment trust's stock valued at $78,000 after purchasing an additional 4,015 shares during the last quarter. Pitcairn Co. bought a new position in Piedmont Realty Trust during the 2nd quarter valued at about $96,000. M&T Bank Corp grew its holdings in Piedmont Realty Trust by 12.8% during the 2nd quarter. M&T Bank Corp now owns 13,549 shares of the real estate investment trust's stock valued at $99,000 after purchasing an additional 1,540 shares during the last quarter. Finally, Tower Research Capital LLC TRC grew its holdings in Piedmont Realty Trust by 68.3% during the 2nd quarter. Tower Research Capital LLC TRC now owns 14,468 shares of the real estate investment trust's stock valued at $105,000 after purchasing an additional 5,871 shares during the last quarter. 84.48% of the stock is currently owned by institutional investors.

Piedmont Realty Trust Company Profile

(

Get Free Report)

Piedmont Office Realty Trust, Inc (also referred to herein as "Piedmont" or the "Company") NYSE: PDM is an owner, manager, developer, redeveloper and operator of high-quality, Class A office properties located primarily in major U.S. Sunbelt markets. The Company is a fully-integrated, self-managed real estate investment trust ("REIT") with local management offices in each of its markets and is investment-grade rated by Standard & Poor's and Moody's.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Piedmont Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Piedmont Realty Trust wasn't on the list.

While Piedmont Realty Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.