Piper Sandler Companies (NYSE:PIPR - Get Free Report) was downgraded by Wall Street Zen from a "buy" rating to a "hold" rating in a note issued to investors on Saturday.

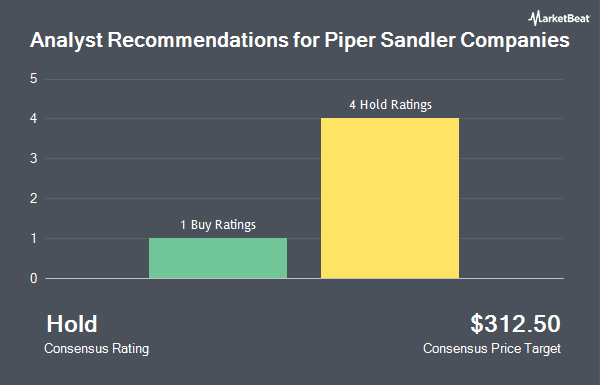

Other equities research analysts have also issued research reports about the stock. Zacks Research lowered shares of Piper Sandler Companies from a "strong-buy" rating to a "hold" rating in a report on Tuesday. Weiss Ratings reissued a "hold (c)" rating on shares of Piper Sandler Companies in a report on Saturday, September 27th. Finally, Wolfe Research raised shares of Piper Sandler Companies from a "peer perform" rating to an "outperform" rating and set a $339.00 price objective for the company in a report on Thursday, July 10th. One research analyst has rated the stock with a Buy rating and four have issued a Hold rating to the company's stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average price target of $312.50.

Read Our Latest Stock Analysis on PIPR

Piper Sandler Companies Price Performance

Piper Sandler Companies stock opened at $341.75 on Friday. Piper Sandler Companies has a 52-week low of $202.91 and a 52-week high of $374.77. The stock has a market capitalization of $6.05 billion, a price-to-earnings ratio of 28.84 and a beta of 1.45. The business's fifty day simple moving average is $335.52.

Piper Sandler Companies (NYSE:PIPR - Get Free Report) last announced its quarterly earnings data on Friday, August 1st. The financial services provider reported $2.95 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.99 by $0.96. Piper Sandler Companies had a net margin of 13.18% and a return on equity of 18.67%. The firm had revenue of $405.39 million during the quarter, compared to analyst estimates of $349.40 million. During the same quarter in the prior year, the firm posted $2.52 earnings per share. Piper Sandler Companies's quarterly revenue was up 13.4% on a year-over-year basis. As a group, equities analysts expect that Piper Sandler Companies will post 14.14 EPS for the current fiscal year.

Insider Buying and Selling at Piper Sandler Companies

In other news, General Counsel John W. Geelan sold 2,000 shares of the stock in a transaction dated Monday, August 11th. The shares were sold at an average price of $322.69, for a total transaction of $645,380.00. Following the sale, the general counsel owned 12,645 shares of the company's stock, valued at approximately $4,080,415.05. This represents a 13.66% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider Jonathan J. Doyle sold 3,536 shares of the firm's stock in a transaction that occurred on Monday, August 4th. The shares were sold at an average price of $316.84, for a total transaction of $1,120,346.24. Following the completion of the sale, the insider directly owned 132,910 shares in the company, valued at approximately $42,111,204.40. This trade represents a 2.59% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 26,136 shares of company stock worth $8,380,342 over the last ninety days. Company insiders own 2.70% of the company's stock.

Institutional Trading of Piper Sandler Companies

Several hedge funds have recently added to or reduced their stakes in the company. Elevation Point Wealth Partners LLC raised its holdings in Piper Sandler Companies by 2.2% in the second quarter. Elevation Point Wealth Partners LLC now owns 1,410 shares of the financial services provider's stock valued at $392,000 after acquiring an additional 30 shares in the last quarter. M&T Bank Corp raised its holdings in Piper Sandler Companies by 3.5% in the second quarter. M&T Bank Corp now owns 905 shares of the financial services provider's stock valued at $251,000 after acquiring an additional 31 shares in the last quarter. Blue Trust Inc. raised its holdings in Piper Sandler Companies by 13.8% in the second quarter. Blue Trust Inc. now owns 288 shares of the financial services provider's stock valued at $80,000 after acquiring an additional 35 shares in the last quarter. AdvisorNet Financial Inc raised its holdings in Piper Sandler Companies by 48.1% in the second quarter. AdvisorNet Financial Inc now owns 114 shares of the financial services provider's stock valued at $32,000 after acquiring an additional 37 shares in the last quarter. Finally, CWM LLC raised its holdings in Piper Sandler Companies by 12.0% in the second quarter. CWM LLC now owns 345 shares of the financial services provider's stock valued at $96,000 after acquiring an additional 37 shares in the last quarter. Institutional investors and hedge funds own 72.79% of the company's stock.

About Piper Sandler Companies

(

Get Free Report)

Piper Sandler Companies operates as an investment bank and institutional securities firm that serves corporations, private equity groups, public entities, non-profit entities, and institutional investors in the United States and internationally. It offers investment banking services and institutional sales, trading, and research services for various equity and fixed income products; advisory services, such as mergers and acquisitions, equity and debt private placements, and debt and restructuring advisory; raises capital through equity and debt financings; underwrites municipal issuances; and municipal financial advisory and loan placement services, as well as various over-the-counter derivative products.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Piper Sandler Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Piper Sandler Companies wasn't on the list.

While Piper Sandler Companies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.