Ulta Beauty (NASDAQ:ULTA - Get Free Report)'s stock had its "neutral" rating reaffirmed by analysts at Piper Sandler in a report released on Friday,Benzinga reports. They presently have a $437.00 price objective on the specialty retailer's stock, up from their previous price objective of $386.00. Piper Sandler's target price points to a potential downside of 6.96% from the stock's previous close.

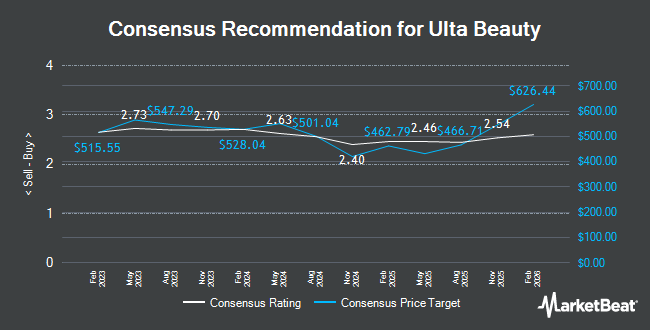

Several other equities analysts have also recently weighed in on ULTA. BMO Capital Markets reduced their price target on Ulta Beauty from $467.00 to $404.00 and set a "market perform" rating for the company in a research report on Friday, March 14th. The Goldman Sachs Group upgraded Ulta Beauty from a "neutral" rating to a "buy" rating and lifted their price target for the company from $384.00 to $423.00 in a research report on Tuesday, April 1st. Oppenheimer reiterated an "outperform" rating and issued a $465.00 price target (up from $435.00) on shares of Ulta Beauty in a research report on Tuesday, May 20th. Morgan Stanley reduced their price target on Ulta Beauty from $500.00 to $460.00 and set an "overweight" rating for the company in a research report on Friday, March 14th. Finally, Barclays reduced their price target on Ulta Beauty from $445.00 to $327.00 and set an "equal weight" rating for the company in a research report on Friday, March 14th. One investment analyst has rated the stock with a sell rating, twelve have issued a hold rating and thirteen have assigned a buy rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Hold" and an average target price of $454.04.

View Our Latest Stock Analysis on Ulta Beauty

Ulta Beauty Stock Performance

NASDAQ:ULTA traded up $47.92 during trading hours on Friday, reaching $469.71. The stock had a trading volume of 4,593,456 shares, compared to its average volume of 1,051,937. The stock has a 50 day simple moving average of $384.70 and a 200 day simple moving average of $388.06. Ulta Beauty has a 12-month low of $309.01 and a 12-month high of $491.98. The stock has a market cap of $21.21 billion, a P/E ratio of 18.80, a price-to-earnings-growth ratio of 0.89 and a beta of 1.06.

Ulta Beauty (NASDAQ:ULTA - Get Free Report) last announced its quarterly earnings results on Thursday, May 29th. The specialty retailer reported $6.70 earnings per share for the quarter, beating the consensus estimate of $5.73 by $0.97. The company had revenue of $2.85 billion during the quarter, compared to analysts' expectations of $2.79 billion. Ulta Beauty had a return on equity of 51.95% and a net margin of 10.58%. The firm's quarterly revenue was up 4.5% compared to the same quarter last year. During the same period in the previous year, the business earned $6.47 earnings per share. On average, equities analysts expect that Ulta Beauty will post 23.96 earnings per share for the current fiscal year.

Insiders Place Their Bets

In other news, insider Jodi J. Caro sold 902 shares of the business's stock in a transaction dated Tuesday, April 1st. The stock was sold at an average price of $369.16, for a total value of $332,982.32. Following the completion of the sale, the insider now owns 7,632 shares of the company's stock, valued at approximately $2,817,429.12. The trade was a 10.57% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Corporate insiders own 0.17% of the company's stock.

Institutional Investors Weigh In On Ulta Beauty

A number of hedge funds and other institutional investors have recently modified their holdings of the stock. Price T Rowe Associates Inc. MD lifted its stake in shares of Ulta Beauty by 128.2% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 1,225,023 shares of the specialty retailer's stock valued at $449,021,000 after acquiring an additional 688,267 shares during the last quarter. Geode Capital Management LLC raised its position in Ulta Beauty by 0.9% during the 4th quarter. Geode Capital Management LLC now owns 1,199,935 shares of the specialty retailer's stock valued at $520,587,000 after purchasing an additional 11,205 shares during the last quarter. Capital World Investors bought a new position in Ulta Beauty during the 4th quarter valued at approximately $430,674,000. T. Rowe Price Investment Management Inc. raised its position in Ulta Beauty by 64.8% during the 1st quarter. T. Rowe Price Investment Management Inc. now owns 931,557 shares of the specialty retailer's stock valued at $341,453,000 after purchasing an additional 366,147 shares during the last quarter. Finally, JPMorgan Chase & Co. raised its position in Ulta Beauty by 81.7% during the 1st quarter. JPMorgan Chase & Co. now owns 913,600 shares of the specialty retailer's stock valued at $334,871,000 after purchasing an additional 410,900 shares during the last quarter. Institutional investors own 90.39% of the company's stock.

Ulta Beauty Company Profile

(

Get Free Report)

Ulta Beauty, Inc operates as a specialty beauty retailer in the United States. The company offers branded and private label beauty products, including cosmetics, fragrance, haircare, skincare, bath and body products, professional hair products, and salon styling tools through its Ulta Beauty stores, shop-in-shops, Ulta.com website, and its mobile applications.

Read More

Before you consider Ulta Beauty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ulta Beauty wasn't on the list.

While Ulta Beauty currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.