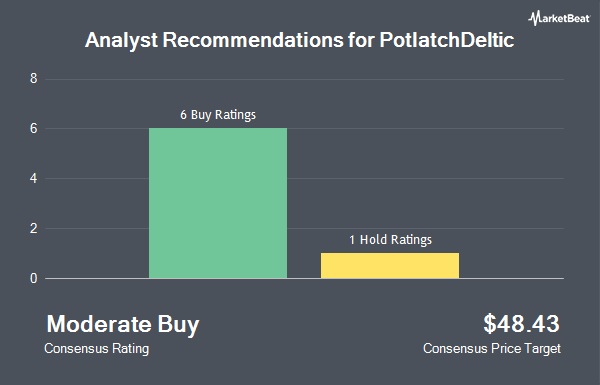

Shares of Potlatch Corporation (NASDAQ:PCH - Get Free Report) have been assigned a consensus recommendation of "Buy" from the seven ratings firms that are currently covering the firm, MarketBeat reports. Seven equities research analysts have rated the stock with a buy recommendation. The average twelve-month target price among brokers that have issued a report on the stock in the last year is $50.00.

PCH has been the subject of a number of analyst reports. Wall Street Zen downgraded Potlatch from a "hold" rating to a "sell" rating in a research note on Saturday. Truist Financial upgraded Potlatch from a "hold" rating to a "buy" rating and lifted their price target for the company from $44.00 to $52.00 in a research note on Wednesday, July 16th. Finally, Citigroup reissued a "buy" rating and set a $47.00 target price (down previously from $49.00) on shares of Potlatch in a research report on Tuesday, June 3rd.

Check Out Our Latest Stock Analysis on PCH

Potlatch Stock Performance

Shares of PCH opened at $42.34 on Tuesday. The company has a debt-to-equity ratio of 0.47, a current ratio of 1.13 and a quick ratio of 0.75. The stock has a 50-day moving average of $39.87 and a 200-day moving average of $41.47. The company has a market cap of $3.33 billion, a PE ratio of 79.89 and a beta of 1.12. Potlatch has a one year low of $36.82 and a one year high of $48.12.

Potlatch (NASDAQ:PCH - Get Free Report) last released its quarterly earnings results on Monday, July 28th. The real estate investment trust reported $0.09 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.07 by $0.02. The business had revenue of $274.99 million during the quarter, compared to the consensus estimate of $267.66 million. Potlatch had a return on equity of 2.10% and a net margin of 3.94%. The company's quarterly revenue was down 14.2% on a year-over-year basis. During the same quarter in the previous year, the business earned $0.17 EPS. On average, equities research analysts predict that Potlatch will post 0.8 EPS for the current fiscal year.

Potlatch Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Monday, June 30th. Shareholders of record on Friday, June 6th were given a dividend of $0.45 per share. The ex-dividend date of this dividend was Friday, June 6th. This represents a $1.80 annualized dividend and a dividend yield of 4.3%. Potlatch's dividend payout ratio (DPR) is currently 339.62%.

Hedge Funds Weigh In On Potlatch

Hedge funds have recently modified their holdings of the company. Legal & General Group Plc raised its holdings in shares of Potlatch by 4.0% in the 4th quarter. Legal & General Group Plc now owns 2,498,762 shares of the real estate investment trust's stock worth $98,076,000 after purchasing an additional 95,485 shares during the period. Westwood Holdings Group Inc. raised its holdings in shares of Potlatch by 12.2% in the 4th quarter. Westwood Holdings Group Inc. now owns 2,404,064 shares of the real estate investment trust's stock worth $94,360,000 after purchasing an additional 260,674 shares during the period. Deprince Race & Zollo Inc. raised its holdings in shares of Potlatch by 17.5% in the 4th quarter. Deprince Race & Zollo Inc. now owns 2,359,832 shares of the real estate investment trust's stock worth $92,623,000 after purchasing an additional 351,777 shares during the period. Charles Schwab Investment Management Inc. raised its holdings in shares of Potlatch by 1.1% in the 1st quarter. Charles Schwab Investment Management Inc. now owns 1,560,123 shares of the real estate investment trust's stock worth $70,393,000 after purchasing an additional 17,352 shares during the period. Finally, Silvercrest Asset Management Group LLC raised its holdings in shares of Potlatch by 1.4% in the 4th quarter. Silvercrest Asset Management Group LLC now owns 1,413,351 shares of the real estate investment trust's stock worth $55,474,000 after purchasing an additional 19,521 shares during the period. Institutional investors own 86.06% of the company's stock.

About Potlatch

(

Get Free Report)

PotlatchDeltic Corporation Nasdaq: PCH is a leading Real Estate Investment Trust (REIT) that owns nearly 2.2 million acres of timberlands in Alabama, Arkansas, Georgia, Idaho, Louisiana, Mississippi and South Carolina. Through its taxable REIT subsidiary, the company also operates six sawmills, an industrial-grade plywood mill, a residential and commercial real estate development business and a rural timberland sales program.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Potlatch, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Potlatch wasn't on the list.

While Potlatch currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.