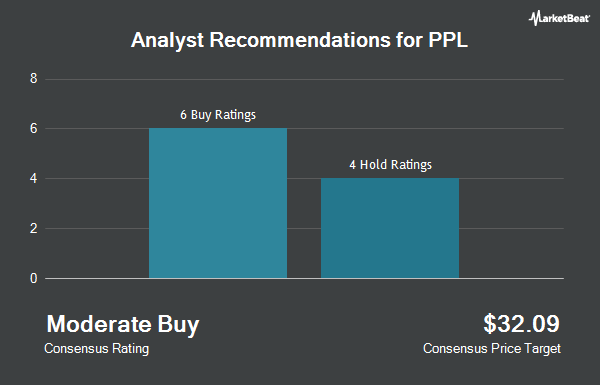

PPL Co. (NYSE:PPL - Get Free Report) has received a consensus rating of "Moderate Buy" from the ten brokerages that are covering the firm, MarketBeat reports. Two equities research analysts have rated the stock with a hold rating, seven have issued a buy rating and one has issued a strong buy rating on the company. The average 12-month target price among brokerages that have issued ratings on the stock in the last year is $36.90.

Several analysts have issued reports on the stock. Guggenheim boosted their target price on shares of PPL from $38.00 to $40.00 and gave the company a "buy" rating in a research note on Thursday, May 1st. Citigroup raised PPL from a "hold" rating to a "strong-buy" rating in a research report on Monday, March 10th. Wall Street Zen raised PPL from a "sell" rating to a "hold" rating in a research note on Friday, May 9th. Barclays lifted their target price on PPL from $33.00 to $36.00 and gave the company an "equal weight" rating in a research note on Tuesday, February 25th. Finally, UBS Group increased their price target on shares of PPL from $35.00 to $36.00 and gave the stock a "neutral" rating in a research report on Friday, March 21st.

Check Out Our Latest Stock Analysis on PPL

Insider Transactions at PPL

In other PPL news, COO David J. Bonenberger sold 1,767 shares of the company's stock in a transaction that occurred on Tuesday, May 27th. The stock was sold at an average price of $34.98, for a total transaction of $61,809.66. Following the completion of the sale, the chief operating officer now owns 45,485 shares of the company's stock, valued at $1,591,065.30. This represents a 3.74% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. 0.28% of the stock is currently owned by company insiders.

Institutional Trading of PPL

A number of institutional investors and hedge funds have recently modified their holdings of the company. Pinnacle Bancorp Inc. raised its holdings in PPL by 141.0% in the 1st quarter. Pinnacle Bancorp Inc. now owns 723 shares of the utilities provider's stock worth $26,000 after acquiring an additional 423 shares during the period. Summit Securities Group LLC acquired a new stake in shares of PPL in the fourth quarter valued at about $26,000. Whittier Trust Co. of Nevada Inc. increased its stake in shares of PPL by 94.3% in the first quarter. Whittier Trust Co. of Nevada Inc. now owns 818 shares of the utilities provider's stock worth $30,000 after purchasing an additional 397 shares during the period. Ancora Advisors LLC lifted its position in shares of PPL by 8,350.0% during the 1st quarter. Ancora Advisors LLC now owns 845 shares of the utilities provider's stock worth $31,000 after purchasing an additional 835 shares during the last quarter. Finally, TruNorth Capital Management LLC acquired a new position in shares of PPL during the 1st quarter worth about $32,000. 76.99% of the stock is currently owned by institutional investors and hedge funds.

PPL Trading Down 0.4%

Shares of NYSE:PPL traded down $0.15 during midday trading on Wednesday, reaching $34.03. The company had a trading volume of 3,536,631 shares, compared to its average volume of 5,361,703. The company has a fifty day simple moving average of $35.14 and a two-hundred day simple moving average of $34.17. The firm has a market cap of $25.15 billion, a price-to-earnings ratio of 28.12, a price-to-earnings-growth ratio of 2.77 and a beta of 0.65. PPL has a 1-year low of $27.24 and a 1-year high of $36.70. The company has a debt-to-equity ratio of 1.13, a quick ratio of 0.71 and a current ratio of 0.86.

PPL (NYSE:PPL - Get Free Report) last announced its earnings results on Wednesday, April 30th. The utilities provider reported $0.60 EPS for the quarter, topping the consensus estimate of $0.53 by $0.07. PPL had a net margin of 10.49% and a return on equity of 8.88%. The company had revenue of $2.50 billion during the quarter, compared to analysts' expectations of $2.15 billion. During the same period last year, the company posted $0.54 earnings per share. The business's revenue for the quarter was up 8.7% on a year-over-year basis. Research analysts predict that PPL will post 1.83 earnings per share for the current year.

PPL Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, July 1st. Shareholders of record on Tuesday, June 10th will be paid a $0.2725 dividend. This represents a $1.09 dividend on an annualized basis and a yield of 3.20%. The ex-dividend date of this dividend is Tuesday, June 10th. PPL's dividend payout ratio (DPR) is presently 80.74%.

About PPL

(

Get Free ReportPPL Corporation, an energy company, focuses on providing electricity and natural gas to approximately 3.6 million customers in the United States. It operates through three segments: Kentucky Regulated, Pennsylvania Regulated, and Rhode Island Regulated. The company delivers electricity to customers in Pennsylvania, Kentucky, Virginia, and Rhode Island; delivers natural gas to customers in Kentucky and Rhode Island; and generates electricity from power plants in Kentucky.

See Also

Before you consider PPL, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PPL wasn't on the list.

While PPL currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.