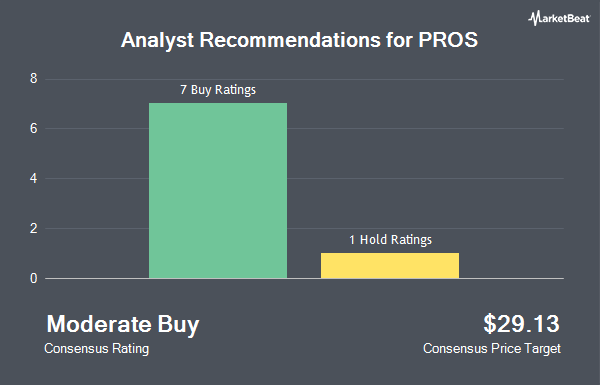

PROS (NYSE:PRO - Get Free Report) was downgraded by investment analysts at Northland Capmk from a "strong-buy" rating to a "hold" rating in a research note issued to investors on Tuesday,Zacks.com reports.

PRO has been the topic of a number of other reports. KeyCorp downgraded shares of PROS from an "overweight" rating to a "sector weight" rating in a research note on Tuesday, September 23rd. Robert W. Baird downgraded shares of PROS from an "outperform" rating to a "neutral" rating and reduced their price objective for the company from $27.00 to $18.00 in a research note on Monday, June 16th. Stifel Nicolaus reduced their price objective on shares of PROS from $24.00 to $20.00 and set a "buy" rating on the stock in a research note on Tuesday, July 8th. Needham & Company LLC downgraded shares of PROS from a "buy" rating to a "hold" rating and set a $25.00 price objective on the stock. in a research note on Tuesday, September 23rd. Finally, Baird R W cut shares of PROS from a "strong-buy" rating to a "hold" rating in a report on Monday, June 16th. Three research analysts have rated the stock with a Buy rating and six have assigned a Hold rating to the company's stock. According to data from MarketBeat, PROS has a consensus rating of "Hold" and an average price target of $23.75.

Read Our Latest Analysis on PRO

PROS Price Performance

NYSE PRO opened at $22.92 on Tuesday. PROS has a 12 month low of $13.61 and a 12 month high of $29.84. The company has a market capitalization of $1.10 billion, a price-to-earnings ratio of -104.18 and a beta of 1.02. The company's fifty day moving average price is $16.35 and its two-hundred day moving average price is $16.90.

PROS (NYSE:PRO - Get Free Report) last posted its quarterly earnings data on Thursday, July 31st. The software maker reported $0.13 EPS for the quarter, beating analysts' consensus estimates of $0.06 by $0.07. The company had revenue of $88.72 million for the quarter, compared to the consensus estimate of $87.70 million. During the same quarter last year, the company earned $0.07 earnings per share. The company's revenue was up 8.2% compared to the same quarter last year. PROS has set its FY 2025 guidance at EPS. Q3 2025 guidance at 0.150-0.17 EPS. As a group, analysts anticipate that PROS will post -0.2 EPS for the current year.

Institutional Trading of PROS

A number of large investors have recently modified their holdings of PRO. GAMMA Investing LLC increased its holdings in shares of PROS by 2,716.9% in the 1st quarter. GAMMA Investing LLC now owns 2,169 shares of the software maker's stock worth $41,000 after acquiring an additional 2,092 shares during the period. FNY Investment Advisers LLC acquired a new stake in shares of PROS in the 2nd quarter worth about $70,000. Tower Research Capital LLC TRC increased its holdings in shares of PROS by 319.3% in the 2nd quarter. Tower Research Capital LLC TRC now owns 6,851 shares of the software maker's stock worth $107,000 after acquiring an additional 5,217 shares during the period. CWM LLC increased its holdings in shares of PROS by 153.6% in the 1st quarter. CWM LLC now owns 7,666 shares of the software maker's stock worth $146,000 after acquiring an additional 4,643 shares during the period. Finally, KLP Kapitalforvaltning AS increased its holdings in shares of PROS by 39.4% in the 2nd quarter. KLP Kapitalforvaltning AS now owns 9,900 shares of the software maker's stock worth $155,000 after acquiring an additional 2,800 shares during the period. Institutional investors and hedge funds own 94.27% of the company's stock.

PROS Company Profile

(

Get Free Report)

PROS Holdings, Inc provides software solutions that optimize the processes of selling and shopping in the digital economy in Europe, the Asia Pacific, the Middle East, Africa, and internationally. The company offers PROS Smart Configure Price Quote that improves sales productivity and accelerate deal velocity by automating common sales tasks; and PROS Smart Price Optimization and Management, which enables businesses to optimize, personalize, and harmonize pricing.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PROS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PROS wasn't on the list.

While PROS currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.