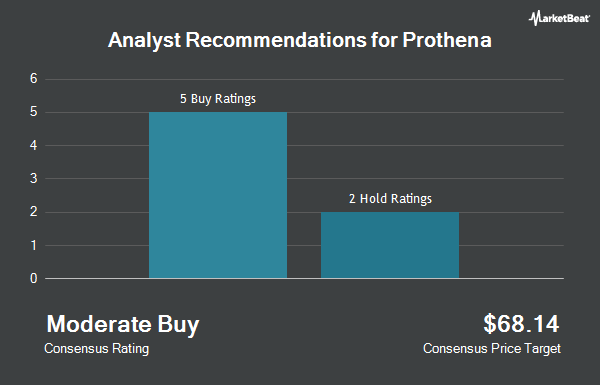

Shares of Prothena Corporation plc (NASDAQ:PRTA - Get Free Report) have been assigned a consensus rating of "Hold" from the nine brokerages that are covering the firm, Marketbeat.com reports. One equities research analyst has rated the stock with a sell rating, four have assigned a hold rating and four have assigned a buy rating to the company. The average twelve-month target price among brokers that have covered the stock in the last year is $30.25.

A number of equities analysts have weighed in on PRTA shares. HC Wainwright restated a "buy" rating and issued a $14.00 price target on shares of Prothena in a report on Tuesday, August 5th. Royal Bank Of Canada reduced their target price on Prothena from $18.00 to $10.00 and set a "sector perform" rating for the company in a research note on Tuesday, August 5th. Piper Sandler reduced their target price on Prothena from $110.00 to $81.00 and set an "overweight" rating for the company in a research note on Tuesday, May 27th. Bank of America reiterated an "underperform" rating on shares of Prothena in a research note on Wednesday, May 28th. Finally, Cantor Fitzgerald reiterated a "neutral" rating on shares of Prothena in a research note on Friday, June 20th.

View Our Latest Report on PRTA

Institutional Investors Weigh In On Prothena

Institutional investors and hedge funds have recently made changes to their positions in the company. Deutsche Bank AG raised its position in shares of Prothena by 195.7% during the 4th quarter. Deutsche Bank AG now owns 95,970 shares of the biotechnology company's stock valued at $1,329,000 after acquiring an additional 63,512 shares in the last quarter. Barclays PLC increased its position in Prothena by 10.6% in the fourth quarter. Barclays PLC now owns 105,338 shares of the biotechnology company's stock worth $1,458,000 after buying an additional 10,116 shares during the period. Cambridge Investment Research Advisors Inc. acquired a new stake in Prothena in the first quarter worth $126,000. Susquehanna Fundamental Investments LLC acquired a new stake in Prothena in the fourth quarter worth $1,117,000. Finally, SG Americas Securities LLC increased its position in Prothena by 92.9% in the first quarter. SG Americas Securities LLC now owns 72,559 shares of the biotechnology company's stock worth $898,000 after buying an additional 34,947 shares during the period. 97.08% of the stock is owned by institutional investors and hedge funds.

Prothena Price Performance

NASDAQ PRTA traded up $0.23 on Thursday, reaching $8.48. The company had a trading volume of 666,000 shares, compared to its average volume of 1,061,999. The firm has a market capitalization of $456.21 million, a PE ratio of -1.50 and a beta of -0.03. Prothena has a 1 year low of $4.32 and a 1 year high of $22.83. The firm has a 50-day moving average of $6.49 and a 200-day moving average of $9.33.

Prothena (NASDAQ:PRTA - Get Free Report) last released its quarterly earnings results on Monday, August 4th. The biotechnology company reported ($1.86) earnings per share for the quarter, missing analysts' consensus estimates of ($1.11) by ($0.75). The company had revenue of $4.42 million during the quarter, compared to analysts' expectations of $5.36 million. Prothena had a negative return on equity of 62.17% and a negative net margin of 2,929.30%. As a group, sell-side analysts expect that Prothena will post -4.04 EPS for the current fiscal year.

About Prothena

(

Get Free Report)

Prothena Corporation plc, a late-stage clinical biotechnology company, focuses on discovery and development of novel therapies to treat diseases caused by protein dysregulation in the United States. The company is involved in developing birtamimab, an investigational humanized antibody that is in Phase III clinical trial for the treatment of AL amyloidosis; Prasinezumab, a humanized monoclonal antibody, for the treatment of Parkinson's disease and other related synucleinopathies which is in Phase IIb clinical trial; NNC6019 that is in Phase lI clinical trial for the treatment of ATTR amyloidosis; and BMS-986446 and PRX012, which is in Phase I clinical trial for the treatment of Alzheimer's disease.

Featured Stories

Before you consider Prothena, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prothena wasn't on the list.

While Prothena currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.