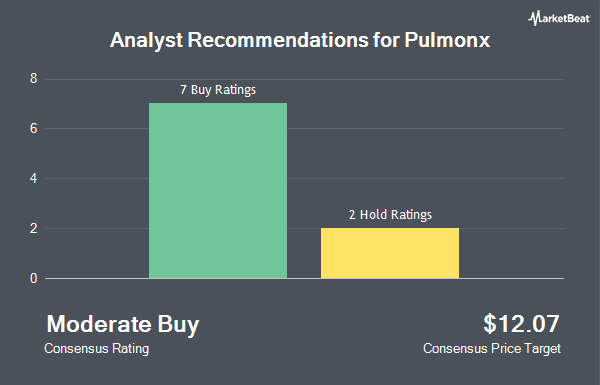

Shares of Pulmonx Corporation (NASDAQ:LUNG - Get Free Report) have received a consensus recommendation of "Moderate Buy" from the nine ratings firms that are covering the stock, Marketbeat reports. Four investment analysts have rated the stock with a hold recommendation and five have given a buy recommendation to the company. The average 1 year price objective among brokers that have issued a report on the stock in the last year is $7.6643.

A number of equities research analysts have weighed in on the stock. Canaccord Genuity Group cut their price target on shares of Pulmonx from $16.00 to $15.00 and set a "buy" rating for the company in a report on Thursday, May 1st. Citigroup cut their price target on shares of Pulmonx from $6.50 to $4.15 and set a "neutral" rating for the company in a report on Thursday, May 22nd. Lake Street Capital cut their price target on shares of Pulmonx from $12.00 to $8.00 and set a "buy" rating for the company in a report on Thursday, July 31st. Wall Street Zen downgraded shares of Pulmonx from a "hold" rating to a "sell" rating in a report on Saturday, August 2nd. Finally, Wells Fargo & Company cut their price target on shares of Pulmonx from $6.00 to $3.00 and set an "equal weight" rating for the company in a report on Friday, August 1st.

Read Our Latest Stock Analysis on Pulmonx

Pulmonx Price Performance

NASDAQ LUNG traded down $0.05 on Monday, reaching $1.71. The company's stock had a trading volume of 398,425 shares, compared to its average volume of 930,463. Pulmonx has a twelve month low of $1.47 and a twelve month high of $9.37. The company has a debt-to-equity ratio of 0.54, a quick ratio of 4.63 and a current ratio of 5.35. The stock has a market cap of $69.68 million, a PE ratio of -1.20 and a beta of 0.43. The firm's 50 day moving average is $2.34 and its two-hundred day moving average is $4.33.

Pulmonx (NASDAQ:LUNG - Get Free Report) last issued its quarterly earnings results on Wednesday, July 30th. The company reported ($0.38) earnings per share for the quarter, beating analysts' consensus estimates of ($0.40) by $0.02. Pulmonx had a negative net margin of 62.88% and a negative return on equity of 69.76%. The company had revenue of $23.86 million during the quarter, compared to the consensus estimate of $23.46 million. Pulmonx has set its FY 2025 guidance at EPS. As a group, sell-side analysts predict that Pulmonx will post -1.55 EPS for the current year.

Insider Activity at Pulmonx

In other Pulmonx news, Director Richard Ferrari sold 8,000 shares of the company's stock in a transaction dated Thursday, June 12th. The shares were sold at an average price of $3.16, for a total transaction of $25,280.00. Following the completion of the sale, the director directly owned 87,024 shares of the company's stock, valued at approximately $274,995.84. This represents a 8.42% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Daniel P. Florin acquired 23,321 shares of Pulmonx stock in a transaction on Thursday, June 5th. The shares were purchased at an average cost of $3.06 per share, with a total value of $71,362.26. Following the completion of the purchase, the director directly owned 117,231 shares of the company's stock, valued at approximately $358,726.86. This represents a 24.83% increase in their position. The disclosure for this purchase can be found here. In the last ninety days, insiders sold 43,388 shares of company stock valued at $136,044. Corporate insiders own 6.80% of the company's stock.

Institutional Trading of Pulmonx

Hedge funds have recently bought and sold shares of the company. BNP Paribas Financial Markets purchased a new stake in Pulmonx during the fourth quarter valued at about $43,000. ProShare Advisors LLC purchased a new stake in Pulmonx during the fourth quarter valued at about $72,000. Stifel Financial Corp purchased a new stake in Pulmonx during the fourth quarter valued at about $81,000. Vontobel Holding Ltd. purchased a new stake in Pulmonx during the first quarter valued at about $82,000. Finally, Corton Capital Inc. acquired a new position in shares of Pulmonx in the 2nd quarter valued at about $32,000. 91.04% of the stock is owned by hedge funds and other institutional investors.

Pulmonx Company Profile

(

Get Free Report)

Pulmonx Corporation, a commercial-stage medical technology company, provides minimally invasive devices for the treatment of chronic obstructive pulmonary diseases. The company offers Zephyr Endobronchial Valve, a solution for the treatment of patients with hyperinflation associated with severe emphysema; and Chartis Pulmonary Assessment System, a balloon catheter and console system with flow and pressure sensors that are used to assess the presence of collateral ventilation.

Featured Articles

Before you consider Pulmonx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pulmonx wasn't on the list.

While Pulmonx currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.