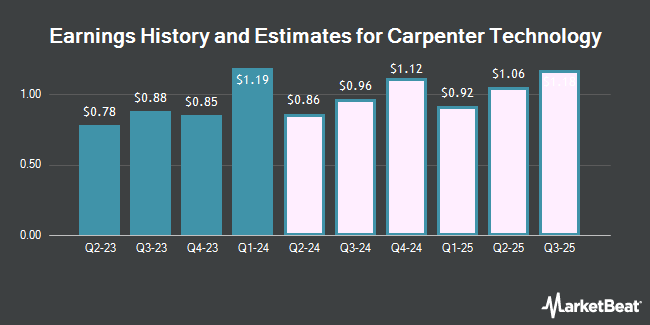

Carpenter Technology Corporation (NYSE:CRS - Free Report) - Investment analysts at Zacks Research upped their Q1 2026 EPS estimates for Carpenter Technology in a research report issued to clients and investors on Friday, September 26th. Zacks Research analyst Team now forecasts that the basic materials company will earn $2.09 per share for the quarter, up from their previous forecast of $2.08. The consensus estimate for Carpenter Technology's current full-year earnings is $6.83 per share. Zacks Research also issued estimates for Carpenter Technology's Q3 2026 earnings at $2.45 EPS, Q4 2026 earnings at $2.79 EPS, FY2026 earnings at $9.45 EPS, Q2 2027 earnings at $2.60 EPS, Q3 2027 earnings at $3.04 EPS, FY2027 earnings at $11.56 EPS and FY2028 earnings at $13.82 EPS.

CRS has been the topic of several other research reports. Cowen reissued a "buy" rating on shares of Carpenter Technology in a research note on Thursday, June 12th. JPMorgan Chase & Co. upped their price objective on shares of Carpenter Technology from $245.00 to $305.00 and gave the company an "overweight" rating in a research note on Tuesday, June 17th. Benchmark upped their price objective on shares of Carpenter Technology from $250.00 to $300.00 and gave the company a "buy" rating in a research note on Monday, June 9th. Finally, BTIG Research reissued a "buy" rating on shares of Carpenter Technology in a research note on Monday, August 4th. Four research analysts have rated the stock with a Buy rating and one has given a Hold rating to the stock. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $278.33.

Check Out Our Latest Report on Carpenter Technology

Carpenter Technology Stock Performance

Shares of CRS opened at $251.16 on Monday. The company has a debt-to-equity ratio of 0.37, a quick ratio of 2.01 and a current ratio of 3.65. The company has a market capitalization of $12.52 billion, a price-to-earnings ratio of 33.85, a PEG ratio of 1.14 and a beta of 1.53. The company's 50 day simple moving average is $249.96 and its 200 day simple moving average is $231.65. Carpenter Technology has a 1 year low of $138.61 and a 1 year high of $290.84.

Carpenter Technology (NYSE:CRS - Get Free Report) last announced its quarterly earnings results on Thursday, July 31st. The basic materials company reported $2.21 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.03 by $0.18. The company had revenue of $755.60 million for the quarter, compared to the consensus estimate of $790.73 million. Carpenter Technology had a net margin of 13.07% and a return on equity of 21.50%. The company's revenue for the quarter was down 5.4% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $1.82 earnings per share.

Carpenter Technology Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Thursday, September 4th. Investors of record on Tuesday, August 26th were given a dividend of $0.20 per share. The ex-dividend date of this dividend was Tuesday, August 26th. This represents a $0.80 annualized dividend and a yield of 0.3%. Carpenter Technology's dividend payout ratio is 10.78%.

Insider Buying and Selling

In other news, Director I Martin Inglis sold 5,691 shares of the stock in a transaction on Monday, August 18th. The shares were sold at an average price of $244.54, for a total value of $1,391,677.14. Following the completion of the sale, the director owned 6,732 shares of the company's stock, valued at $1,646,243.28. This represents a 45.81% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CEO Tony R. Thene sold 19,000 shares of the stock in a transaction on Monday, August 18th. The stock was sold at an average price of $244.99, for a total transaction of $4,654,810.00. Following the completion of the sale, the chief executive officer directly owned 535,019 shares of the company's stock, valued at $131,074,304.81. The trade was a 3.43% decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 28,124 shares of company stock valued at $6,890,250. Insiders own 2.90% of the company's stock.

Institutional Investors Weigh In On Carpenter Technology

Large investors have recently made changes to their positions in the business. Stratos Wealth Partners LTD. increased its position in shares of Carpenter Technology by 22.9% in the first quarter. Stratos Wealth Partners LTD. now owns 2,968 shares of the basic materials company's stock worth $538,000 after acquiring an additional 553 shares in the last quarter. Bessemer Group Inc. increased its position in shares of Carpenter Technology by 50.3% in the first quarter. Bessemer Group Inc. now owns 230 shares of the basic materials company's stock worth $42,000 after acquiring an additional 77 shares in the last quarter. Wealth Enhancement Advisory Services LLC increased its position in shares of Carpenter Technology by 27.8% in the first quarter. Wealth Enhancement Advisory Services LLC now owns 15,953 shares of the basic materials company's stock worth $2,890,000 after acquiring an additional 3,467 shares in the last quarter. Hancock Whitney Corp acquired a new stake in shares of Carpenter Technology in the first quarter worth $819,000. Finally, Fifth Third Bancorp increased its position in shares of Carpenter Technology by 13.6% in the first quarter. Fifth Third Bancorp now owns 651 shares of the basic materials company's stock worth $118,000 after acquiring an additional 78 shares in the last quarter. Institutional investors and hedge funds own 92.03% of the company's stock.

Carpenter Technology Company Profile

(

Get Free Report)

Carpenter Technology Corporation engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally. It operates in two segments, Specialty Alloys Operations and Performance Engineered Products. The company offers specialty alloys, including titanium alloys, powder metals, stainless steels, alloy steels, and tool steels, as well as additives, and metal powders and parts.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Carpenter Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carpenter Technology wasn't on the list.

While Carpenter Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report