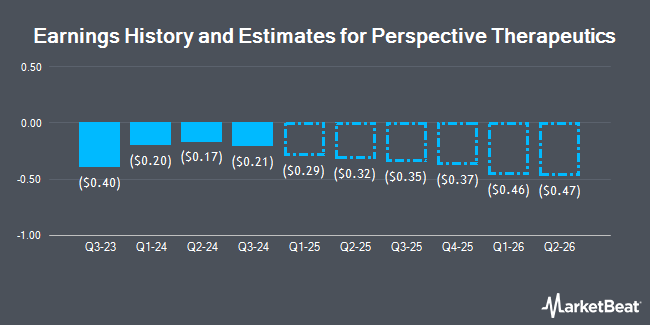

Perspective Therapeutics, Inc. (NYSE:CATX - Free Report) - Investment analysts at Wedbush issued their Q2 2026 EPS estimates for Perspective Therapeutics in a report issued on Wednesday, August 13th. Wedbush analyst D. Nierengarten anticipates that the company will earn ($0.38) per share for the quarter. Wedbush currently has a "Outperform" rating and a $11.00 target price on the stock. The consensus estimate for Perspective Therapeutics' current full-year earnings is ($0.88) per share. Wedbush also issued estimates for Perspective Therapeutics' Q3 2026 earnings at ($0.38) EPS and Q4 2026 earnings at ($0.39) EPS.

A number of other research firms also recently issued reports on CATX. Truist Financial dropped their price objective on shares of Perspective Therapeutics from $10.00 to $8.00 and set a "buy" rating for the company in a report on Wednesday, May 14th. Lifesci Capital upgraded Perspective Therapeutics to a "strong-buy" rating in a research report on Saturday, July 12th. B. Riley restated a "buy" rating and set a $12.00 price target (up previously from $9.00) on shares of Perspective Therapeutics in a research report on Monday, June 23rd. Finally, Royal Bank Of Canada upgraded Perspective Therapeutics from an "outperform" rating to a "moderate buy" rating and raised their price target for the company from $15.00 to $16.00 in a research report on Tuesday, June 3rd. Three investment analysts have rated the stock with a Strong Buy rating, seven have assigned a Buy rating and one has given a Hold rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Buy" and a consensus price target of $12.56.

Get Our Latest Analysis on CATX

Perspective Therapeutics Price Performance

NYSE CATX traded down $0.04 during trading on Friday, reaching $3.38. The company's stock had a trading volume of 497,034 shares, compared to its average volume of 945,307. The firm has a fifty day moving average of $3.77 and a 200 day moving average of $2.96. Perspective Therapeutics has a one year low of $1.60 and a one year high of $16.55.

Hedge Funds Weigh In On Perspective Therapeutics

Hedge funds have recently made changes to their positions in the business. JPMorgan Chase & Co. boosted its stake in shares of Perspective Therapeutics by 498.3% during the 4th quarter. JPMorgan Chase & Co. now owns 149,045 shares of the company's stock valued at $475,000 after purchasing an additional 124,133 shares in the last quarter. Wells Fargo & Company MN lifted its holdings in Perspective Therapeutics by 45.7% in the fourth quarter. Wells Fargo & Company MN now owns 26,462 shares of the company's stock worth $84,000 after buying an additional 8,294 shares during the period. Mariner LLC bought a new stake in Perspective Therapeutics during the 4th quarter valued at approximately $150,000. Walleye Capital LLC boosted its position in Perspective Therapeutics by 2,526.2% during the 4th quarter. Walleye Capital LLC now owns 475,792 shares of the company's stock valued at $1,518,000 after acquiring an additional 457,675 shares in the last quarter. Finally, Jump Financial LLC purchased a new position in shares of Perspective Therapeutics during the 4th quarter worth approximately $688,000. 54.66% of the stock is owned by hedge funds and other institutional investors.

Perspective Therapeutics Company Profile

(

Get Free Report)

Perspective Therapeutics, Inc, together with its subsidiaries, develops precision-targeted alpha therapies (TAT) for oncology that treats cancer patients across multiple tumor types comprising metastatic disease. The company discovers, designs, and develop its initial programs candidates consists of VMT-a-NET, that is currently in Phase 1/2a clinical trials for patients with unresectable or metastatic somatostatin receptor type 2 (SSTR2) expressing tumors that have not previously received peptide-targeted radiopharmaceutical therapy, such as Lutathera, a beta-emitting therapy; and VMT01, which is currently in Phase 1/2a clinical trials for second-line or later treatment of patients with progressive melanocortin 1 receptor (MC1R) positive metastatic melanoma.

See Also

Before you consider Perspective Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Perspective Therapeutics wasn't on the list.

While Perspective Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.