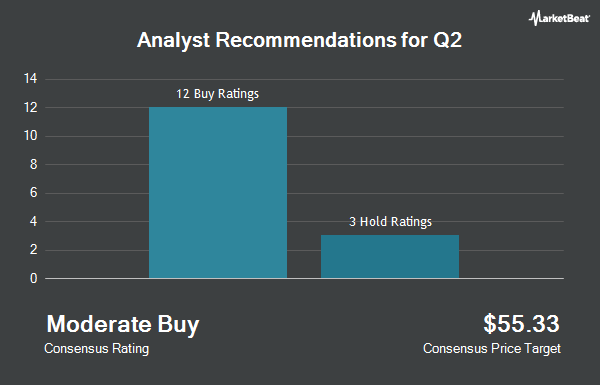

Shares of Q2 Holdings, Inc. (NYSE:QTWO - Get Free Report) have earned an average rating of "Moderate Buy" from the eighteen brokerages that are presently covering the stock, MarketBeat reports. Eight analysts have rated the stock with a hold rating, nine have issued a buy rating and one has issued a strong buy rating on the company. The average 1 year target price among brokers that have issued ratings on the stock in the last year is $101.9375.

A number of equities analysts have issued reports on QTWO shares. Stifel Nicolaus increased their price target on Q2 from $105.00 to $110.00 and gave the stock a "buy" rating in a research report on Thursday, July 31st. Wall Street Zen cut Q2 from a "buy" rating to a "hold" rating in a report on Friday. Needham & Company LLC boosted their price objective on Q2 from $110.00 to $115.00 and gave the stock a "buy" rating in a research note on Thursday, July 31st. Cantor Fitzgerald began coverage on Q2 in a report on Tuesday, June 3rd. They set an "overweight" rating and a $110.00 target price for the company. Finally, Royal Bank Of Canada lifted their price target on Q2 from $101.00 to $102.00 and gave the stock a "sector perform" rating in a research note on Thursday, July 31st.

Get Our Latest Research Report on Q2

Q2 Price Performance

Shares of NYSE QTWO opened at $75.00 on Friday. The stock has a market capitalization of $4.68 billion, a price-to-earnings ratio of 1,500.38 and a beta of 1.49. The firm's 50 day simple moving average is $79.95 and its 200-day simple moving average is $82.94. Q2 has a 12 month low of $63.61 and a 12 month high of $112.82.

Insider Transactions at Q2

In other news, Director James Offerdahl sold 786 shares of the company's stock in a transaction that occurred on Tuesday, August 12th. The stock was sold at an average price of $74.15, for a total value of $58,281.90. Following the completion of the sale, the director directly owned 17,792 shares in the company, valued at $1,319,276.80. This represents a 4.23% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, General Counsel Michael S. Kerr sold 967 shares of Q2 stock in a transaction that occurred on Monday, September 15th. The stock was sold at an average price of $82.60, for a total value of $79,874.20. Following the transaction, the general counsel owned 56,228 shares in the company, valued at approximately $4,644,432.80. The trade was a 1.69% decrease in their position. The disclosure for this sale can be found here. Insiders sold 8,499 shares of company stock valued at $650,658 over the last 90 days. 0.31% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of QTWO. Invesco Ltd. grew its holdings in shares of Q2 by 4.8% in the second quarter. Invesco Ltd. now owns 2,803,611 shares of the technology company's stock valued at $262,390,000 after purchasing an additional 128,387 shares during the period. Wasatch Advisors LP increased its holdings in shares of Q2 by 1.2% during the 2nd quarter. Wasatch Advisors LP now owns 2,098,037 shares of the technology company's stock worth $196,355,000 after buying an additional 25,493 shares during the last quarter. Conestoga Capital Advisors LLC increased its holdings in shares of Q2 by 1.6% during the 1st quarter. Conestoga Capital Advisors LLC now owns 1,957,893 shares of the technology company's stock worth $156,651,000 after buying an additional 30,480 shares during the last quarter. Massachusetts Financial Services Co. MA raised its position in shares of Q2 by 5.9% during the 2nd quarter. Massachusetts Financial Services Co. MA now owns 1,826,001 shares of the technology company's stock valued at $170,895,000 after buying an additional 101,866 shares during the period. Finally, Geode Capital Management LLC lifted its holdings in Q2 by 1.9% in the second quarter. Geode Capital Management LLC now owns 1,470,279 shares of the technology company's stock valued at $137,620,000 after acquiring an additional 26,858 shares during the last quarter.

About Q2

(

Get Free Report)

Q2 Holdings, Inc provides cloud-based digital solutions to regional and community financial institutions in the United States. The company offers Digital Banking Platform, an end-to-end digital banking platform supports its financial institution customers in their delivery of unified digital banking services across digital channels.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Q2, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Q2 wasn't on the list.

While Q2 currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.