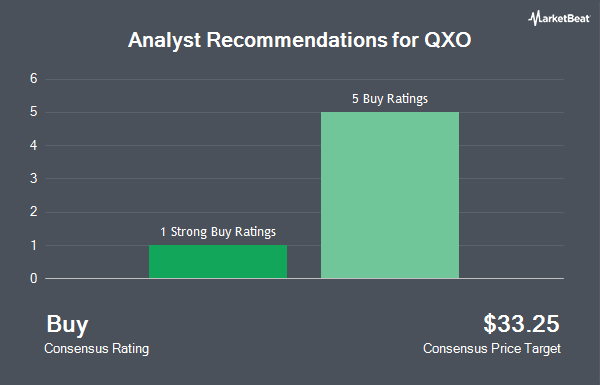

Shares of QXO, Inc. (NASDAQ:QXO - Get Free Report) have earned a consensus rating of "Buy" from the fourteen ratings firms that are presently covering the firm, MarketBeat Ratings reports. One analyst has rated the stock with a hold rating, eleven have issued a buy rating and two have assigned a strong buy rating to the company. The average 12-month target price among analysts that have updated their coverage on the stock in the last year is $33.7273.

A number of research analysts have recently commented on the company. Stephens began coverage on QXO in a report on Wednesday, August 13th. They set an "overweight" rating and a $29.00 price target for the company. Baird R W upgraded QXO to a "strong-buy" rating in a research report on Thursday, June 12th. Truist Financial initiated coverage on shares of QXO in a report on Tuesday, July 1st. They set a "buy" rating and a $30.00 target price for the company. Citigroup assumed coverage on QXO in a report on Wednesday, July 16th. They set a "buy" rating and a $33.00 price target for the company. Finally, Raymond James Financial assumed coverage on QXO in a research note on Friday, September 5th. They issued an "outperform" rating and a $28.00 price target for the company.

Get Our Latest Research Report on QXO

QXO Trading Down 1.0%

QXO stock traded down $0.22 during trading hours on Friday, hitting $20.81. 2,280,780 shares of the stock traded hands, compared to its average volume of 6,046,708. The company has a market cap of $14.01 billion, a P/E ratio of -2.28, a P/E/G ratio of 4.09 and a beta of 2.35. QXO has a one year low of $11.85 and a one year high of $24.69. The stock has a 50-day simple moving average of $20.78 and a 200 day simple moving average of $17.75.

Institutional Investors Weigh In On QXO

A number of hedge funds and other institutional investors have recently bought and sold shares of the business. Northern Trust Corp raised its holdings in QXO by 46.9% in the 4th quarter. Northern Trust Corp now owns 731,610 shares of the company's stock worth $11,633,000 after purchasing an additional 233,538 shares during the period. Bank of America Corp DE lifted its stake in QXO by 1,162.9% in the 4th quarter. Bank of America Corp DE now owns 285,585 shares of the company's stock worth $4,541,000 after purchasing an additional 262,972 shares in the last quarter. Cetera Investment Advisers raised its holdings in shares of QXO by 219.1% in the 4th quarter. Cetera Investment Advisers now owns 37,602 shares of the company's stock valued at $598,000 after buying an additional 25,818 shares during the period. Deutsche Bank AG purchased a new position in QXO during the 4th quarter worth approximately $255,000. Finally, Ensign Peak Advisors Inc purchased a new stake in shares of QXO in the fourth quarter valued at approximately $1,049,000. Hedge funds and other institutional investors own 58.68% of the company's stock.

QXO Company Profile

(

Get Free Report)

QXO, Inc operates as a business application, technology, and consulting company in North America. The company provides solutions for accounting and business management, financial reporting, enterprise resource planning, human capital management, warehouse management systems, customer relationship management, and business intelligence.

See Also

Before you consider QXO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and QXO wasn't on the list.

While QXO currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.