Rambus (NASDAQ:RMBS - Get Free Report) had its price objective upped by equities research analysts at Susquehanna from $70.00 to $75.00 in a research report issued on Tuesday,Benzinga reports. The brokerage currently has a "positive" rating on the semiconductor company's stock. Susquehanna's price objective points to a potential downside of 0.12% from the stock's previous close.

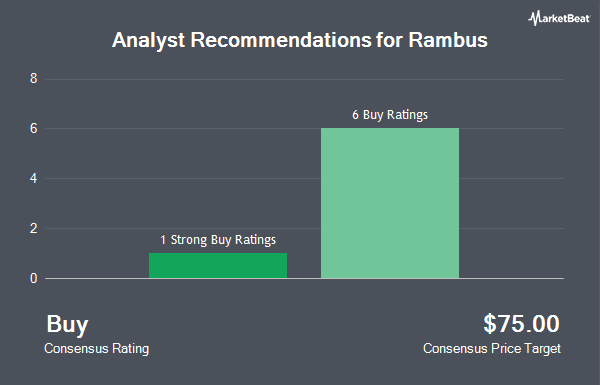

RMBS has been the subject of several other reports. Rosenblatt Securities reissued a "buy" rating and set a $80.00 price target on shares of Rambus in a report on Tuesday, April 29th. Wall Street Zen raised shares of Rambus from a "buy" rating to a "strong-buy" rating in a research note on Friday, July 18th. Seven research analysts have rated the stock with a buy rating and two have given a strong buy rating to the stock. According to MarketBeat, the stock has a consensus rating of "Buy" and a consensus target price of $77.71.

Read Our Latest Report on Rambus

Rambus Stock Up 2.7%

NASDAQ RMBS traded up $1.94 during trading hours on Tuesday, hitting $75.09. 2,292,829 shares of the stock were exchanged, compared to its average volume of 1,123,822. The company has a market cap of $8.07 billion, a price-to-earnings ratio of 35.42 and a beta of 1.24. Rambus has a 12-month low of $37.42 and a 12-month high of $76.07. The stock has a 50-day moving average of $61.82 and a 200 day moving average of $57.56.

Insider Buying and Selling

In related news, Director Steven Laub sold 1,847 shares of the stock in a transaction that occurred on Tuesday, May 27th. The shares were sold at an average price of $55.12, for a total transaction of $101,806.64. Following the completion of the sale, the director directly owned 9,057 shares of the company's stock, valued at $499,221.84. This represents a 16.94% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 1.00% of the stock is currently owned by corporate insiders.

Institutional Trading of Rambus

Institutional investors and hedge funds have recently added to or reduced their stakes in the business. Corient Private Wealth LLC purchased a new stake in shares of Rambus in the 4th quarter valued at approximately $269,000. LPL Financial LLC boosted its holdings in Rambus by 16.9% in the 4th quarter. LPL Financial LLC now owns 63,364 shares of the semiconductor company's stock valued at $3,349,000 after purchasing an additional 9,183 shares during the period. Mitsubishi UFJ Trust & Banking Corp bought a new position in shares of Rambus during the 4th quarter worth about $431,000. JPMorgan Chase & Co. lifted its holdings in shares of Rambus by 1.7% during the 4th quarter. JPMorgan Chase & Co. now owns 4,184,370 shares of the semiconductor company's stock worth $221,186,000 after acquiring an additional 68,975 shares during the period. Finally, Norges Bank bought a new position in shares of Rambus during the 4th quarter worth about $94,368,000. 88.54% of the stock is owned by institutional investors and hedge funds.

About Rambus

(

Get Free Report)

Rambus Inc provides semiconductor products in the United States, South Korea, Singapore, and internationally. The company offers DDR memory interface chips, including DDR5 and DDR4 memory interface chips to module manufacturers, OEMs, and hyperscalers; silicon IP, such as interface and security IP solutions that move and protect data in advanced data center, government, and automotive applications; and interface IP solutions for high-speed memory and chip-to-chip digital controller IP.

See Also

Before you consider Rambus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rambus wasn't on the list.

While Rambus currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.