Rambus (NASDAQ:RMBS - Get Free Report) had its price objective hoisted by analysts at Jefferies Financial Group from $69.00 to $75.00 in a research report issued on Tuesday,Benzinga reports. The firm currently has a "buy" rating on the semiconductor company's stock. Jefferies Financial Group's target price would suggest a potential upside of 2.53% from the company's current price.

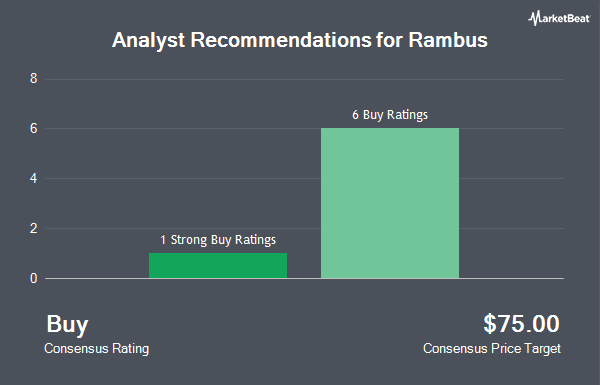

A number of other research firms also recently weighed in on RMBS. Rosenblatt Securities raised their price target on shares of Rambus from $80.00 to $90.00 and gave the stock a "buy" rating in a research report on Tuesday. Susquehanna raised their price target on shares of Rambus from $70.00 to $75.00 and gave the stock a "positive" rating in a research report on Tuesday. Finally, Wall Street Zen raised shares of Rambus from a "buy" rating to a "strong-buy" rating in a research report on Friday, July 18th. Seven equities research analysts have rated the stock with a buy rating and two have issued a strong buy rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Buy" and a consensus target price of $77.71.

Check Out Our Latest Analysis on Rambus

Rambus Price Performance

NASDAQ RMBS traded up $8.91 on Tuesday, reaching $73.15. The company had a trading volume of 3,634,869 shares, compared to its average volume of 1,033,818. The firm has a market capitalization of $7.86 billion, a PE ratio of 38.10 and a beta of 1.24. Rambus has a 1 year low of $37.42 and a 1 year high of $73.30. The firm has a 50-day moving average of $61.06 and a 200-day moving average of $57.33.

Insider Transactions at Rambus

In related news, Director Steven Laub sold 3,653 shares of the firm's stock in a transaction on Monday, May 19th. The stock was sold at an average price of $55.56, for a total transaction of $202,960.68. Following the transaction, the director directly owned 10,904 shares in the company, valued at $605,826.24. This trade represents a 25.09% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. 1.00% of the stock is owned by company insiders.

Hedge Funds Weigh In On Rambus

Large investors have recently added to or reduced their stakes in the company. Banque Cantonale Vaudoise acquired a new position in shares of Rambus during the first quarter valued at $25,000. Tsfg LLC acquired a new position in shares of Rambus during the first quarter valued at $26,000. Orion Capital Management LLC acquired a new position in shares of Rambus during the fourth quarter valued at $37,000. McIlrath & Eck LLC acquired a new position in shares of Rambus during the first quarter valued at $42,000. Finally, Larson Financial Group LLC increased its holdings in shares of Rambus by 1,260.3% during the first quarter. Larson Financial Group LLC now owns 857 shares of the semiconductor company's stock valued at $44,000 after purchasing an additional 794 shares during the period. 88.54% of the stock is currently owned by institutional investors.

Rambus Company Profile

(

Get Free Report)

Rambus Inc provides semiconductor products in the United States, South Korea, Singapore, and internationally. The company offers DDR memory interface chips, including DDR5 and DDR4 memory interface chips to module manufacturers, OEMs, and hyperscalers; silicon IP, such as interface and security IP solutions that move and protect data in advanced data center, government, and automotive applications; and interface IP solutions for high-speed memory and chip-to-chip digital controller IP.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Rambus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rambus wasn't on the list.

While Rambus currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.