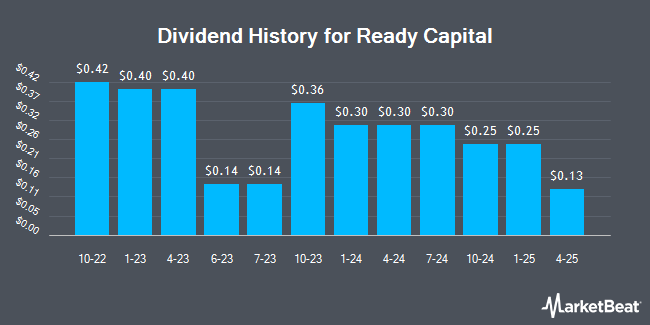

Ready Capital Corp (NYSE:RC - Get Free Report) declared a quarterly dividend on Monday, September 15th, RTT News reports. Stockholders of record on Tuesday, September 30th will be given a dividend of 0.125 per share by the real estate investment trust on Friday, October 31st. This represents a c) dividend on an annualized basis and a dividend yield of 11.6%. The ex-dividend date of this dividend is Tuesday, September 30th.

Ready Capital has a payout ratio of 89.3% meaning its dividend is currently covered by earnings, but may not be in the future if the company's earnings decline. Equities analysts expect Ready Capital to earn $1.05 per share next year, which means the company should continue to be able to cover its $0.50 annual dividend with an expected future payout ratio of 47.6%.

Ready Capital Price Performance

Shares of RC stock remained flat at $4.32 during trading hours on Friday. The stock had a trading volume of 6,411,087 shares, compared to its average volume of 2,108,397. Ready Capital has a 52 week low of $3.70 and a 52 week high of $8.31. The company has a current ratio of 1.61, a quick ratio of 1.61 and a debt-to-equity ratio of 0.76. The firm has a 50 day moving average of $4.18 and a two-hundred day moving average of $4.44. The company has a market capitalization of $709.91 million, a P/E ratio of -2.34 and a beta of 1.38.

Ready Capital (NYSE:RC - Get Free Report) last posted its earnings results on Thursday, August 7th. The real estate investment trust reported ($0.14) earnings per share for the quarter, missing analysts' consensus estimates of ($0.01) by ($0.13). Ready Capital had a negative net margin of 40.59% and a positive return on equity of 3.76%. The company had revenue of ($9.77) million during the quarter, compared to the consensus estimate of $167.26 million. On average, equities research analysts expect that Ready Capital will post 0.93 earnings per share for the current year.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently bought and sold shares of the business. Zurcher Kantonalbank Zurich Cantonalbank lifted its stake in shares of Ready Capital by 6.1% in the 1st quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 45,288 shares of the real estate investment trust's stock valued at $231,000 after acquiring an additional 2,606 shares during the last quarter. CW Advisors LLC increased its stake in Ready Capital by 11.6% in the 2nd quarter. CW Advisors LLC now owns 27,590 shares of the real estate investment trust's stock worth $121,000 after purchasing an additional 2,878 shares during the period. The Manufacturers Life Insurance Company lifted its position in Ready Capital by 3.6% in the second quarter. The Manufacturers Life Insurance Company now owns 84,372 shares of the real estate investment trust's stock valued at $369,000 after purchasing an additional 2,905 shares during the last quarter. Cerity Partners LLC lifted its position in Ready Capital by 29.0% in the second quarter. Cerity Partners LLC now owns 15,220 shares of the real estate investment trust's stock valued at $67,000 after purchasing an additional 3,419 shares during the last quarter. Finally, Nomura Asset Management Co. Ltd. boosted its stake in shares of Ready Capital by 163.6% during the second quarter. Nomura Asset Management Co. Ltd. now owns 5,800 shares of the real estate investment trust's stock valued at $25,000 after purchasing an additional 3,600 shares during the period. 55.87% of the stock is owned by institutional investors.

Ready Capital Company Profile

(

Get Free Report)

Ready Capital Corporation operates as a real estate finance company in the United States. It operates through two segments: LMM Commercial Real Estate and Small Business Lending. The company originates, acquires, finances, and services lower-to-middle-market (LLM) commercial real estate loans, small business administration (SBA) loans, residential mortgage loans, construction loans, and mortgage-backed securities collateralized primarily by LLM loans, or other real estate-related investments.

See Also

Before you consider Ready Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ready Capital wasn't on the list.

While Ready Capital currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.