Analysts at Needham & Company LLC started coverage on shares of Red Cat (NASDAQ:RCAT - Get Free Report) in a research report issued on Friday, Marketbeat reports. The brokerage set a "buy" rating and a $17.00 price target on the stock. Needham & Company LLC's price target points to a potential upside of 31.89% from the company's current price.

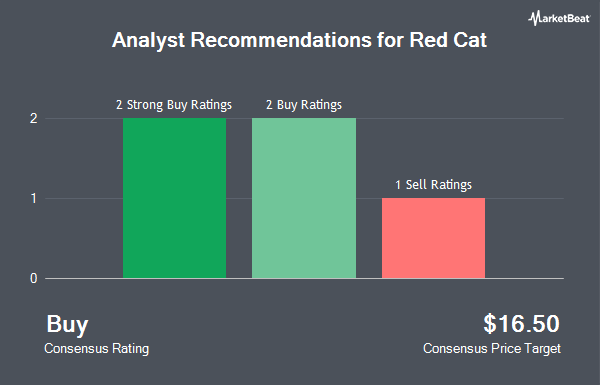

Several other research analysts have also recently commented on RCAT. Weiss Ratings restated a "sell (d-)" rating on shares of Red Cat in a research report on Saturday, September 27th. Wall Street Zen downgraded Red Cat from a "hold" rating to a "sell" rating in a research report on Saturday. LADENBURG THALM/SH SH upgraded Red Cat to a "strong-buy" rating in a research report on Thursday. Finally, Northland Securities set a $16.00 price target on Red Cat in a research report on Friday, August 15th. Two analysts have rated the stock with a Strong Buy rating, two have issued a Buy rating and one has issued a Sell rating to the stock. According to MarketBeat, Red Cat currently has a consensus rating of "Buy" and an average price target of $16.50.

Read Our Latest Stock Report on RCAT

Red Cat Price Performance

Shares of NASDAQ RCAT opened at $12.89 on Friday. The firm has a market capitalization of $1.52 billion, a PE ratio of -23.87 and a beta of 1.45. Red Cat has a 1-year low of $2.66 and a 1-year high of $15.27. The business's fifty day moving average price is $9.64 and its two-hundred day moving average price is $7.85.

Insiders Place Their Bets

In other news, Director Christopher R. Moe sold 10,000 shares of Red Cat stock in a transaction that occurred on Monday, September 29th. The shares were sold at an average price of $10.91, for a total value of $109,100.00. Following the transaction, the director owned 53,073 shares of the company's stock, valued at $579,026.43. The trade was a 15.85% decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this link. Over the last three months, insiders have sold 86,833 shares of company stock valued at $861,560. 15.30% of the stock is currently owned by corporate insiders.

Institutional Trading of Red Cat

Hedge funds have recently bought and sold shares of the company. Geode Capital Management LLC grew its holdings in Red Cat by 142.7% during the second quarter. Geode Capital Management LLC now owns 1,656,720 shares of the company's stock valued at $12,063,000 after purchasing an additional 974,121 shares during the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. boosted its holdings in shares of Red Cat by 125.5% during the 2nd quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 517,061 shares of the company's stock worth $3,764,000 after buying an additional 287,802 shares during the period. AWM Investment Company Inc. grew its stake in Red Cat by 15.3% in the 2nd quarter. AWM Investment Company Inc. now owns 2,037,616 shares of the company's stock valued at $14,834,000 after buying an additional 269,942 shares during the last quarter. GW Henssler & Associates Ltd. bought a new position in Red Cat in the 1st quarter worth $1,297,000. Finally, XTX Topco Ltd lifted its position in Red Cat by 510.9% during the 2nd quarter. XTX Topco Ltd now owns 237,927 shares of the company's stock worth $1,732,000 after acquiring an additional 198,982 shares during the last quarter. 37.97% of the stock is owned by hedge funds and other institutional investors.

Red Cat Company Profile

(

Get Free Report)

Red Cat Holdings, Inc engages in the provision of various products, services, and solutions to the drone industry. The company operates through two segments: Enterprise and Consumer. It built infrastructure to manages drone fleets and fly, and provide services remotely, navigate confined industrial interior spaces and dangerous military environment.

Featured Articles

Before you consider Red Cat, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Red Cat wasn't on the list.

While Red Cat currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.