Renaissance Technologies LLC increased its position in Provident Financial Services, Inc. (NYSE:PFS - Free Report) by 26.9% in the fourth quarter, according to its most recent disclosure with the SEC. The institutional investor owned 496,583 shares of the savings and loans company's stock after purchasing an additional 105,209 shares during the period. Renaissance Technologies LLC owned 0.38% of Provident Financial Services worth $9,371,000 at the end of the most recent reporting period.

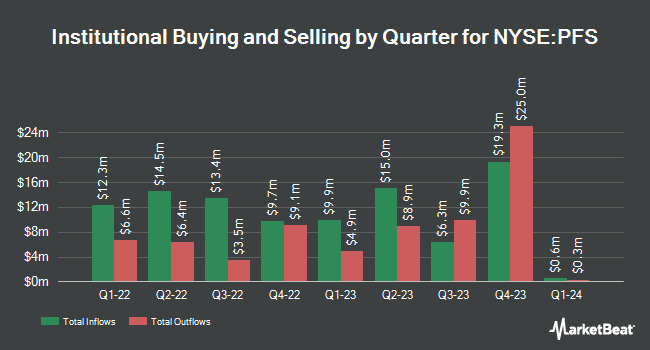

Several other institutional investors and hedge funds have also recently bought and sold shares of the business. Federated Hermes Inc. acquired a new position in shares of Provident Financial Services in the fourth quarter worth about $55,000. Steward Partners Investment Advisory LLC acquired a new position in Provident Financial Services in the fourth quarter worth approximately $99,000. KBC Group NV raised its holdings in shares of Provident Financial Services by 40.7% during the 4th quarter. KBC Group NV now owns 6,387 shares of the savings and loans company's stock valued at $121,000 after purchasing an additional 1,848 shares in the last quarter. Smartleaf Asset Management LLC raised its holdings in Provident Financial Services by 141.1% during the fourth quarter. Smartleaf Asset Management LLC now owns 7,533 shares of the savings and loans company's stock valued at $142,000 after buying an additional 4,408 shares in the last quarter. Finally, Allworth Financial LP lifted its holdings in Provident Financial Services by 35,936.4% in the 4th quarter. Allworth Financial LP now owns 7,928 shares of the savings and loans company's stock worth $151,000 after purchasing an additional 7,906 shares during the last quarter. Institutional investors and hedge funds own 71.97% of the company's stock.

Analyst Ratings Changes

Several equities research analysts have recently issued reports on the company. StockNews.com raised Provident Financial Services from a "sell" rating to a "hold" rating in a research report on Saturday, February 15th. Royal Bank of Canada lowered their target price on Provident Financial Services from $24.00 to $23.00 and set an "outperform" rating on the stock in a report on Thursday, January 30th. One research analyst has rated the stock with a hold rating and four have given a buy rating to the company's stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $24.00.

View Our Latest Report on Provident Financial Services

Provident Financial Services Stock Performance

Provident Financial Services stock traded up $0.46 on Wednesday, hitting $16.47. The company's stock had a trading volume of 78,328 shares, compared to its average volume of 685,544. The company has a quick ratio of 1.01, a current ratio of 1.01 and a debt-to-equity ratio of 0.95. The company has a fifty day moving average price of $16.83 and a 200-day moving average price of $18.62. Provident Financial Services, Inc. has a one year low of $13.07 and a one year high of $22.24. The firm has a market cap of $2.15 billion, a P/E ratio of 15.69 and a beta of 0.84.

Provident Financial Services (NYSE:PFS - Get Free Report) last released its quarterly earnings data on Tuesday, January 28th. The savings and loans company reported $0.37 earnings per share for the quarter, missing analysts' consensus estimates of $0.50 by ($0.13). Provident Financial Services had a net margin of 10.13% and a return on equity of 5.60%. On average, equities analysts anticipate that Provident Financial Services, Inc. will post 2.14 earnings per share for the current year.

Provident Financial Services Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, February 28th. Stockholders of record on Friday, February 14th were paid a $0.24 dividend. This represents a $0.96 dividend on an annualized basis and a dividend yield of 5.83%. The ex-dividend date was Friday, February 14th. Provident Financial Services's dividend payout ratio (DPR) is currently 91.43%.

Provident Financial Services Profile

(

Free Report)

Provident Financial Services, Inc operates as the bank holding company for Provident Bank that provides various banking products and services to individuals, families, and businesses in the United States. Its deposit products include savings, checking, interest-bearing checking, money market deposit, and certificate of deposit accounts, as well as IRA products.

Further Reading

Before you consider Provident Financial Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Provident Financial Services wasn't on the list.

While Provident Financial Services currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.