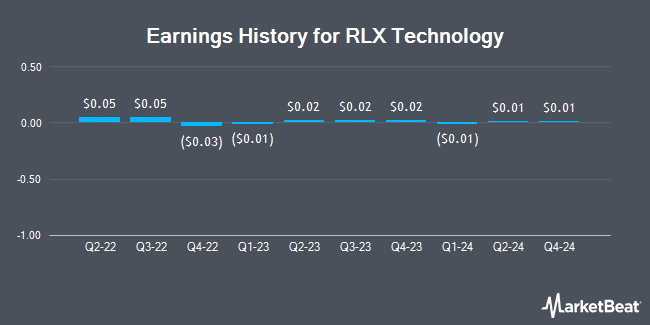

RLX Technology (NYSE:RLX - Get Free Report) released its earnings results on Friday. The company reported $0.02 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.18 by ($0.16), Zacks reports. RLX Technology had a net margin of 21.38% and a return on equity of 4.05%.

RLX Technology Stock Performance

NYSE RLX opened at $2.2450 on Friday. The business has a 50 day simple moving average of $2.24 and a 200 day simple moving average of $2.11. RLX Technology has a 52-week low of $1.57 and a 52-week high of $2.69. The stock has a market cap of $3.53 billion, a price-to-earnings ratio of 37.42 and a beta of 1.09.

Analyst Upgrades and Downgrades

RLX has been the topic of a number of research reports. Citigroup cut their target price on shares of RLX Technology from $2.50 to $2.25 and set a "neutral" rating on the stock in a research report on Monday, May 19th. Wall Street Zen downgraded shares of RLX Technology from a "hold" rating to a "sell" rating in a research report on Saturday, August 16th. One research analyst has rated the stock with a Hold rating, Based on data from MarketBeat, RLX Technology has a consensus rating of "Hold" and a consensus price target of $2.25.

Read Our Latest Analysis on RLX Technology

Institutional Trading of RLX Technology

A number of large investors have recently bought and sold shares of RLX. Tower Research Capital LLC TRC increased its stake in RLX Technology by 308.2% during the 2nd quarter. Tower Research Capital LLC TRC now owns 54,064 shares of the company's stock worth $119,000 after purchasing an additional 40,819 shares in the last quarter. Marshall Wace LLP grew its stake in shares of RLX Technology by 29.3% during the 2nd quarter. Marshall Wace LLP now owns 1,133,093 shares of the company's stock worth $2,504,000 after acquiring an additional 257,103 shares in the last quarter. Finally, Canada Pension Plan Investment Board grew its stake in shares of RLX Technology by 53.7% during the 2nd quarter. Canada Pension Plan Investment Board now owns 3,804,284 shares of the company's stock worth $8,407,000 after acquiring an additional 1,329,500 shares in the last quarter. 22.68% of the stock is owned by institutional investors.

About RLX Technology

(

Get Free Report)

RLX Technology Inc, together with its subsidiaries, engages in the manufacture and sale of e-vapor products in the People's Republic of China and internationally. It serves partner distributors and retail outlets. The company was founded in 2018 and is headquartered in Beijing, China.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider RLX Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RLX Technology wasn't on the list.

While RLX Technology currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.