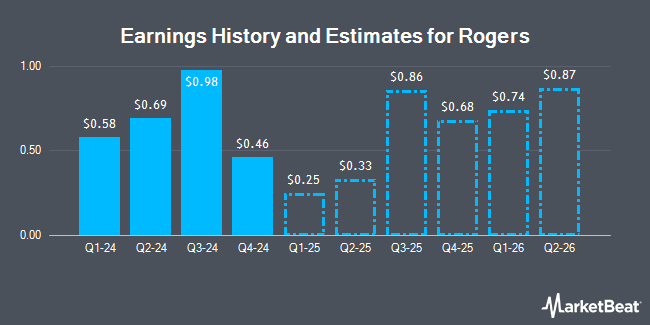

Rogers (NYSE:ROG - Get Free Report) issued an update on its third quarter 2025 earnings guidance on Thursday morning. The company provided earnings per share guidance of 0.500-0.900 for the period, compared to the consensus earnings per share estimate of 0.840. The company issued revenue guidance of $200.0 million-$215.0 million, compared to the consensus revenue estimate of $205.7 million.

Rogers Price Performance

Shares of Rogers stock traded down $0.77 on Thursday, reaching $65.63. 395,870 shares of the company were exchanged, compared to its average volume of 221,327. Rogers has a 1-year low of $51.43 and a 1-year high of $126.70. The company has a market cap of $1.22 billion, a P/E ratio of 72.12 and a beta of 0.44. The stock's 50 day moving average price is $68.35 and its 200-day moving average price is $72.90.

Rogers (NYSE:ROG - Get Free Report) last issued its quarterly earnings data on Thursday, July 31st. The electronics maker reported $0.34 earnings per share for the quarter, missing analysts' consensus estimates of $0.50 by ($0.16). Rogers had a net margin of 2.09% and a return on equity of 3.52%. On average, research analysts predict that Rogers will post 3.57 earnings per share for the current fiscal year.

Analyst Ratings Changes

Separately, B. Riley increased their price objective on Rogers from $80.00 to $85.00 and gave the stock a "buy" rating in a research report on Wednesday, April 30th.

Read Our Latest Analysis on ROG

Institutional Trading of Rogers

Large investors have recently made changes to their positions in the stock. Jane Street Group LLC acquired a new stake in shares of Rogers during the first quarter valued at $4,345,000. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC lifted its position in Rogers by 4.9% during the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 51,135 shares of the electronics maker's stock worth $3,453,000 after buying an additional 2,405 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. lifted its position in Rogers by 5.0% during the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 11,221 shares of the electronics maker's stock worth $758,000 after buying an additional 536 shares during the period. AQR Capital Management LLC lifted its position in Rogers by 121.3% during the first quarter. AQR Capital Management LLC now owns 8,376 shares of the electronics maker's stock worth $566,000 after buying an additional 4,591 shares during the period. Finally, Royal Bank of Canada lifted its position in Rogers by 15.7% during the first quarter. Royal Bank of Canada now owns 4,276 shares of the electronics maker's stock worth $288,000 after buying an additional 580 shares during the period. Institutional investors and hedge funds own 96.02% of the company's stock.

About Rogers

(

Get Free Report)

Rogers Corporation engages in the design, development, manufacture, and sale of engineered materials and components worldwide. It operates through Advanced Electronics Solutions (AES), Elastomeric Material Solutions (EMS), and Other segments. The AES segment offers circuit materials, ceramic substrate materials, busbars, and cooling solutions for applications in electric and hybrid electric vehicles (EV/HEV), wireless infrastructure, automotive, renewable energy, aerospace and defense, mass transit, industrial, connected devices, and wired infrastructure.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Rogers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rogers wasn't on the list.

While Rogers currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.