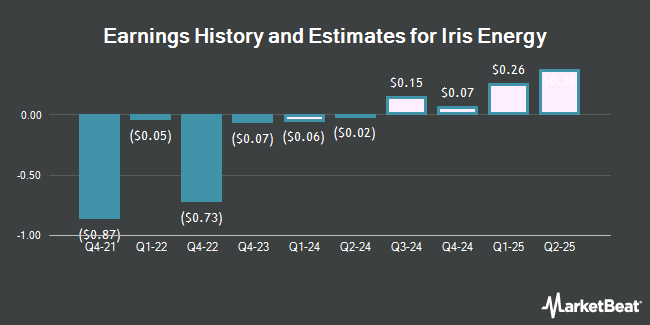

IREN Limited (NASDAQ:IREN - Free Report) - Roth Capital boosted their Q3 2026 earnings per share (EPS) estimates for IREN in a research note issued on Friday, August 29th. Roth Capital analyst D. Aftahi now anticipates that the company will earn $0.29 per share for the quarter, up from their prior forecast of $0.26. Roth Capital has a "Buy" rating and a $35.00 price objective on the stock. The consensus estimate for IREN's current full-year earnings is $0.43 per share. Roth Capital also issued estimates for IREN's FY2026 earnings at $1.11 EPS.

Several other analysts have also commented on the company. Wall Street Zen upgraded IREN from a "sell" rating to a "hold" rating in a report on Saturday, July 12th. B. Riley increased their price objective on IREN from $22.00 to $29.00 and gave the company a "buy" rating in a report on Friday, August 29th. HC Wainwright increased their price objective on IREN from $21.00 to $36.00 and gave the company a "buy" rating in a report on Friday, August 29th. JPMorgan Chase & Co. reissued a "neutral" rating and issued a $16.00 target price (up from $12.00) on shares of IREN in a research report on Monday, July 28th. Finally, Canaccord Genuity Group upped their target price on IREN from $23.00 to $37.00 and gave the company a "buy" rating in a research report on Friday, August 29th. Eight investment analysts have rated the stock with a Buy rating and three have given a Hold rating to the company. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $30.44.

Get Our Latest Stock Report on IREN

IREN Stock Down 2.5%

IREN stock traded down $0.72 during mid-day trading on Monday, reaching $28.40. 23,700,504 shares of the company were exchanged, compared to its average volume of 19,635,375. IREN has a 12-month low of $5.13 and a 12-month high of $30.02. The business has a fifty day moving average of $18.31 and a 200 day moving average of $11.50. The company has a debt-to-equity ratio of 0.53, a quick ratio of 0.46 and a current ratio of 4.29. The firm has a market cap of $5.33 billion, a P/E ratio of 47.92 and a beta of 4.03.

IREN (NASDAQ:IREN - Get Free Report) last posted its earnings results on Thursday, August 28th. The company reported $0.19 earnings per share for the quarter, topping analysts' consensus estimates of $0.17 by $0.02. The company had revenue of $187.30 million during the quarter, compared to analyst estimates of $187.51 million. IREN had a return on equity of 1.34% and a net margin of 33.03%.

Hedge Funds Weigh In On IREN

A number of institutional investors and hedge funds have recently added to or reduced their stakes in IREN. Hood River Capital Management LLC acquired a new position in IREN during the second quarter worth $74,228,000. Situational Awareness LP acquired a new position in IREN during the 1st quarter worth about $20,500,000. Merewether Investment Management LP acquired a new position in IREN during the 2nd quarter worth about $21,025,000. Two Sigma Investments LP increased its holdings in IREN by 193.2% during the 4th quarter. Two Sigma Investments LP now owns 1,602,642 shares of the company's stock worth $15,738,000 after purchasing an additional 1,056,005 shares during the period. Finally, Alkeon Capital Management LLC purchased a new stake in IREN during the 2nd quarter worth about $14,570,000. Institutional investors and hedge funds own 41.08% of the company's stock.

About IREN

(

Get Free Report)

IREN Limited, formerly known as Iris Energy Limited, owns and operates bitcoin mining data centers. The company was incorporated in 2018 and is headquartered in Sydney, Australia.

Recommended Stories

Before you consider IREN, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IREN wasn't on the list.

While IREN currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.