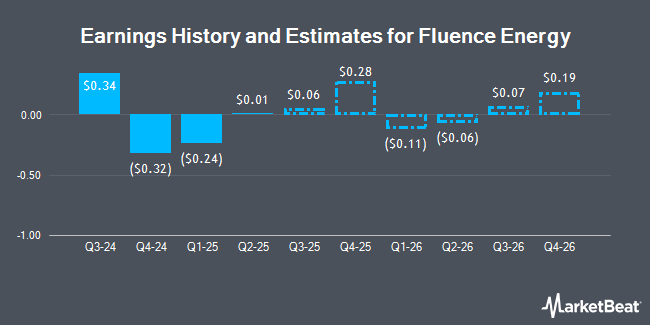

Fluence Energy, Inc. (NASDAQ:FLNC - Free Report) - Roth Capital raised their Q4 2025 earnings per share estimates for Fluence Energy in a report issued on Thursday, August 7th. Roth Capital analyst J. Clare now anticipates that the company will earn $0.29 per share for the quarter, up from their previous forecast of $0.24. The consensus estimate for Fluence Energy's current full-year earnings is $0.08 per share.

Other equities research analysts also recently issued research reports about the company. Guggenheim lowered their price target on Fluence Energy from $6.00 to $2.00 and set a "sell" rating on the stock in a research report on Tuesday, April 15th. Canaccord Genuity Group lowered their price target on Fluence Energy from $14.00 to $10.00 and set a "buy" rating on the stock in a research report on Wednesday, April 16th. Mizuho restated a "neutral" rating and set a $10.00 price target (up previously from $6.00) on shares of Fluence Energy in a research report on Monday, July 14th. JPMorgan Chase & Co. raised their price target on Fluence Energy from $5.00 to $8.00 and gave the company a "neutral" rating in a research report on Tuesday, July 22nd. Finally, HSBC downgraded Fluence Energy from a "buy" rating to a "hold" rating and set a $4.00 price target on the stock. in a research report on Monday, April 28th. Two analysts have rated the stock with a sell rating, nineteen have given a hold rating and four have issued a buy rating to the company. According to MarketBeat, Fluence Energy has a consensus rating of "Hold" and a consensus price target of $7.98.

Read Our Latest Analysis on FLNC

Fluence Energy Price Performance

NASDAQ FLNC traded down $1.82 during trading hours on Friday, reaching $7.32. 8,658,165 shares of the stock traded hands, compared to its average volume of 5,270,613. The stock has a 50 day simple moving average of $7.31 and a two-hundred day simple moving average of $6.43. Fluence Energy has a 1 year low of $3.46 and a 1 year high of $24.00. The company has a debt-to-equity ratio of 0.78, a current ratio of 1.51 and a quick ratio of 0.99. The company has a market cap of $1.33 billion, a price-to-earnings ratio of -33.28 and a beta of 2.67.

Fluence Energy (NASDAQ:FLNC - Get Free Report) last issued its quarterly earnings data on Monday, August 11th. The company reported $0.01 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.02) by $0.03. Fluence Energy had a negative return on equity of 4.40% and a negative net margin of 1.10%. The company had revenue of $602.53 million for the quarter, compared to the consensus estimate of $738.52 million. The company's revenue for the quarter was up 24.7% compared to the same quarter last year.

Institutional Trading of Fluence Energy

Several large investors have recently modified their holdings of FLNC. Parallel Advisors LLC bought a new stake in shares of Fluence Energy in the second quarter worth about $30,000. Altshuler Shaham Ltd bought a new stake in Fluence Energy during the 4th quarter valued at approximately $34,000. SBI Securities Co. Ltd. boosted its position in Fluence Energy by 462.6% during the 1st quarter. SBI Securities Co. Ltd. now owns 8,085 shares of the company's stock valued at $39,000 after acquiring an additional 6,648 shares in the last quarter. TFB Advisors LLC bought a new stake in Fluence Energy during the 1st quarter valued at approximately $53,000. Finally, Voleon Capital Management LP bought a new stake in Fluence Energy during the 1st quarter valued at approximately $55,000. 53.16% of the stock is owned by institutional investors.

Fluence Energy Company Profile

(

Get Free Report)

Fluence Energy, Inc, through its subsidiaries, offers energy storage products and solution, services, and artificial intelligence enabled software-as-a-service products for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. The company sells energy storage products with integrated hardware, software, and digital intelligence.

Featured Stories

Before you consider Fluence Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fluence Energy wasn't on the list.

While Fluence Energy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.