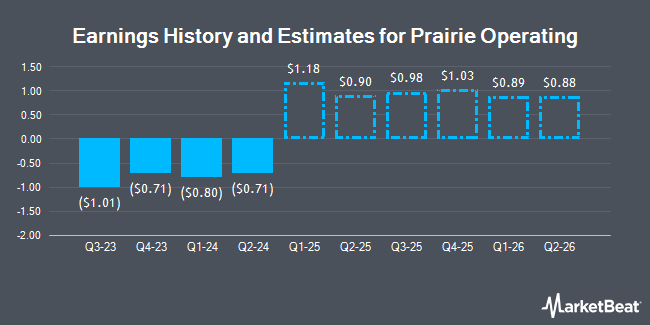

Prairie Operating Co. (NASDAQ:PROP - Free Report) - Analysts at Roth Capital decreased their Q1 2026 earnings per share (EPS) estimates for Prairie Operating in a research report issued on Thursday, September 11th. Roth Capital analyst L. Mariani now anticipates that the company will post earnings per share of $0.70 for the quarter, down from their prior estimate of $0.78. Roth Capital currently has a "Buy" rating and a $8.00 target price on the stock. The consensus estimate for Prairie Operating's current full-year earnings is ($2.13) per share. Roth Capital also issued estimates for Prairie Operating's Q3 2026 earnings at $0.90 EPS, Q4 2026 earnings at $0.95 EPS and FY2026 earnings at $3.31 EPS.

A number of other equities analysts have also weighed in on the company. Wall Street Zen upgraded Prairie Operating from a "sell" rating to a "hold" rating in a research note on Saturday, August 16th. Piper Sandler lowered Prairie Operating from an "overweight" rating to a "neutral" rating in a research note on Monday, August 18th. KeyCorp initiated coverage on Prairie Operating in a research note on Thursday, July 3rd. They set a "sector weight" rating on the stock. Finally, Citigroup initiated coverage on Prairie Operating in a research note on Monday, June 2nd. They set a "buy" rating and a $8.00 target price on the stock. Three equities research analysts have rated the stock with a Buy rating and two have issued a Hold rating to the company. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $8.50.

View Our Latest Analysis on Prairie Operating

Prairie Operating Stock Performance

Shares of NASDAQ PROP traded down $0.15 during trading hours on Monday, reaching $1.87. 4,134,061 shares of the stock were exchanged, compared to its average volume of 1,689,870. The firm has a market capitalization of $94.02 million, a price-to-earnings ratio of -0.62 and a beta of 2.15. The company has a debt-to-equity ratio of 4.13, a quick ratio of 0.58 and a current ratio of 0.60. Prairie Operating has a 52 week low of $1.84 and a 52 week high of $11.00. The stock's fifty day simple moving average is $2.87 and its 200 day simple moving average is $3.85.

Prairie Operating (NASDAQ:PROP - Get Free Report) last announced its earnings results on Tuesday, August 12th. The company reported $0.18 earnings per share for the quarter, missing analysts' consensus estimates of $1.28 by ($1.10). The firm had revenue of $68.10 million during the quarter, compared to the consensus estimate of $125.50 million.

Institutional Investors Weigh In On Prairie Operating

A number of large investors have recently added to or reduced their stakes in PROP. Bank of America Corp DE grew its position in Prairie Operating by 203.8% during the second quarter. Bank of America Corp DE now owns 9,812 shares of the company's stock worth $29,000 after buying an additional 6,582 shares in the last quarter. JPMorgan Chase & Co. boosted its holdings in shares of Prairie Operating by 411.4% in the 2nd quarter. JPMorgan Chase & Co. now owns 10,740 shares of the company's stock valued at $32,000 after purchasing an additional 8,640 shares in the last quarter. State of Wyoming acquired a new stake in shares of Prairie Operating in the 2nd quarter valued at $32,000. XTX Topco Ltd acquired a new stake in shares of Prairie Operating in the 2nd quarter valued at $32,000. Finally, OMERS ADMINISTRATION Corp acquired a new stake in shares of Prairie Operating in the 2nd quarter valued at $35,000. Institutional investors and hedge funds own 34.28% of the company's stock.

Insider Transactions at Prairie Operating

In related news, Director Jonathan H. Gray purchased 89,000 shares of Prairie Operating stock in a transaction that occurred on Friday, September 5th. The shares were acquired at an average price of $2.11 per share, with a total value of $187,790.00. Following the completion of the transaction, the director directly owned 675,817 shares of the company's stock, valued at $1,425,973.87. This represents a 15.17% increase in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Insiders purchased a total of 442,480 shares of company stock worth $937,103 over the last 90 days. Corporate insiders own 15.44% of the company's stock.

About Prairie Operating

(

Get Free Report)

Prairie Operating Co, an independent energy company, engages in the development, exploration, and production of oil, natural gas, and natural gas liquids in the United States. The company holds assets in the Denver-Julesburg Basin in Colorado; and the Niobrara and Codell formations. Prairie Operating Co is based in Houston Texas.

Further Reading

Before you consider Prairie Operating, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prairie Operating wasn't on the list.

While Prairie Operating currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.