Blue Owl Capital (NYSE:OBDC - Get Free Report) had its target price reduced by analysts at Royal Bank of Canada from $17.00 to $16.00 in a report issued on Monday,Benzinga reports. The firm currently has an "outperform" rating on the stock. Royal Bank of Canada's price target points to a potential upside of 15.11% from the stock's current price.

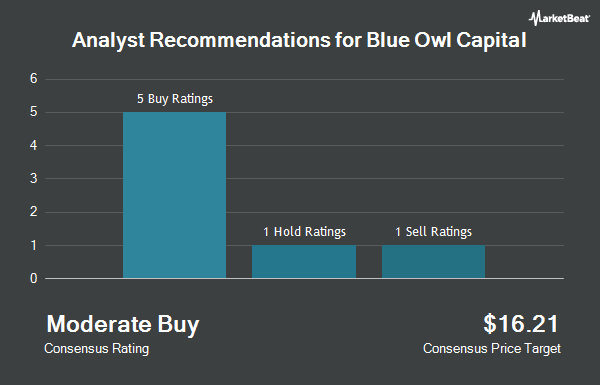

OBDC has been the topic of several other research reports. Citizens Jmp upgraded Blue Owl Capital to a "strong-buy" rating in a report on Monday, February 3rd. JMP Securities reissued an "outperform" rating on shares of Blue Owl Capital in a report on Tuesday, February 4th. Jefferies Financial Group started coverage on shares of Blue Owl Capital in a research note on Friday, April 11th. They issued a "buy" rating and a $16.00 target price for the company. Keefe, Bruyette & Woods decreased their price target on shares of Blue Owl Capital from $15.10 to $14.50 and set a "market perform" rating on the stock in a research note on Tuesday, April 8th. Finally, Wells Fargo & Company dropped their price objective on shares of Blue Owl Capital from $15.00 to $14.00 and set an "equal weight" rating for the company in a research report on Monday, April 28th. Three analysts have rated the stock with a hold rating, five have assigned a buy rating and two have issued a strong buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $15.93.

Read Our Latest Report on OBDC

Blue Owl Capital Price Performance

Shares of NYSE:OBDC traded up $0.02 on Monday, hitting $13.90. The stock had a trading volume of 2,160,929 shares, compared to its average volume of 2,573,636. The company has a market capitalization of $7.10 billion, a price-to-earnings ratio of 9.09 and a beta of 0.71. The company has a debt-to-equity ratio of 1.25, a quick ratio of 1.28 and a current ratio of 1.19. The firm's 50 day moving average price is $14.18 and its 200-day moving average price is $14.79. Blue Owl Capital has a twelve month low of $12.11 and a twelve month high of $16.91.

Blue Owl Capital (NYSE:OBDC - Get Free Report) last issued its quarterly earnings data on Wednesday, May 7th. The company reported $0.39 earnings per share for the quarter, missing the consensus estimate of $0.43 by ($0.04). The firm had revenue of $464.65 million for the quarter, compared to the consensus estimate of $457.88 million. Blue Owl Capital had a return on equity of 12.38% and a net margin of 37.26%. On average, equities research analysts predict that Blue Owl Capital will post 1.71 earnings per share for the current year.

Insider Buying and Selling at Blue Owl Capital

In related news, Director Chris Temple purchased 15,000 shares of the stock in a transaction dated Thursday, March 6th. The stock was bought at an average cost of $14.80 per share, with a total value of $222,000.00. Following the purchase, the director now directly owns 51,000 shares in the company, valued at $754,800. The trade was a 41.67 % increase in their position. The purchase was disclosed in a document filed with the SEC, which is available at this link. Insiders own 0.11% of the company's stock.

Institutional Investors Weigh In On Blue Owl Capital

Several large investors have recently bought and sold shares of the company. Fifth Third Bancorp increased its position in shares of Blue Owl Capital by 192.2% in the 4th quarter. Fifth Third Bancorp now owns 2,922 shares of the company's stock valued at $44,000 after buying an additional 1,922 shares in the last quarter. Anchor Investment Management LLC increased its holdings in shares of Blue Owl Capital by 100.0% in the fourth quarter. Anchor Investment Management LLC now owns 3,000 shares of the company's stock worth $45,000 after acquiring an additional 1,500 shares in the last quarter. Brown Brothers Harriman & Co. acquired a new stake in shares of Blue Owl Capital during the fourth quarter worth about $48,000. Lazard Asset Management LLC bought a new position in shares of Blue Owl Capital during the 4th quarter valued at about $49,000. Finally, Roxbury Financial LLC acquired a new position in shares of Blue Owl Capital in the 1st quarter valued at approximately $50,000. Institutional investors own 42.83% of the company's stock.

About Blue Owl Capital

(

Get Free Report)

Blue Owl Capital Corporation is a business development company. It specializes in direct and fund of fund investments. The fund makes investments in senior secured, direct lending or unsecured loans, subordinated loans or mezzanine loans and also considers equity-related securities including warrants and preferred stocks also pursues preferred equity investments, first lien, unitranche, and second lien term loans and common equity investments.

Read More

Before you consider Blue Owl Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blue Owl Capital wasn't on the list.

While Blue Owl Capital currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.