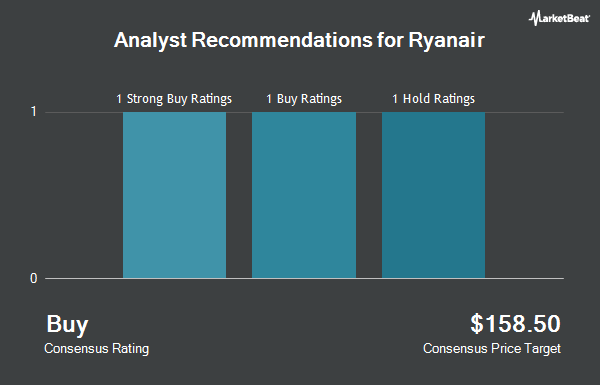

Shares of Ryanair Holdings PLC (NASDAQ:RYAAY - Get Free Report) have been given a consensus recommendation of "Buy" by the ten ratings firms that are currently covering the stock, Marketbeat.com reports. One analyst has rated the stock with a hold rating, six have assigned a buy rating and three have issued a strong buy rating on the company. The average 1 year target price among brokerages that have updated their coverage on the stock in the last year is $76.00.

A number of equities analysts have issued reports on the company. Zacks Research upgraded Ryanair from a "hold" rating to a "strong-buy" rating in a report on Tuesday, August 26th. Wall Street Zen raised shares of Ryanair from a "buy" rating to a "strong-buy" rating in a report on Saturday, July 26th. Raymond James Financial reissued a "strong-buy" rating and set a $76.00 price target (up previously from $70.00) on shares of Ryanair in a research report on Wednesday, July 23rd. Royal Bank Of Canada reaffirmed an "outperform" rating on shares of Ryanair in a research report on Wednesday, May 21st. Finally, The Goldman Sachs Group lowered Ryanair from a "buy" rating to a "neutral" rating in a report on Monday, September 8th.

Get Our Latest Research Report on RYAAY

Ryanair Price Performance

Shares of Ryanair stock traded down $0.31 during trading on Thursday, hitting $57.81. 998,729 shares of the stock traded hands, compared to its average volume of 934,347. The stock has a market cap of $30.62 billion, a price-to-earnings ratio of 13.57, a PEG ratio of 0.69 and a beta of 1.37. Ryanair has a 52 week low of $38.52 and a 52 week high of $67.18. The firm's fifty day moving average is $62.05 and its 200-day moving average is $54.34. The company has a quick ratio of 0.66, a current ratio of 0.66 and a debt-to-equity ratio of 0.02.

Ryanair (NASDAQ:RYAAY - Get Free Report) last announced its quarterly earnings results on Monday, July 21st. The transportation company reported $1.74 EPS for the quarter, topping analysts' consensus estimates of $1.49 by $0.25. The business had revenue of $5.07 billion for the quarter, compared to analysts' expectations of $4.16 billion. Ryanair had a return on equity of 27.91% and a net margin of 14.42%. Research analysts expect that Ryanair will post 3.09 EPS for the current fiscal year.

Ryanair Increases Dividend

The business also recently announced a special dividend, which will be paid on Thursday, September 25th. Shareholders of record on Friday, August 8th will be paid a dividend of $0.534 per share. The ex-dividend date is Friday, September 12th. This is an increase from Ryanair's previous special dividend of $0.47. Ryanair's dividend payout ratio (DPR) is currently 16.90%.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in RYAAY. Evelyn Partners Investment Management Services Ltd increased its position in shares of Ryanair by 40.4% in the second quarter. Evelyn Partners Investment Management Services Ltd now owns 702 shares of the transportation company's stock valued at $44,000 after buying an additional 202 shares in the last quarter. Avantax Advisory Services Inc. grew its stake in Ryanair by 2.6% in the 1st quarter. Avantax Advisory Services Inc. now owns 8,094 shares of the transportation company's stock valued at $343,000 after acquiring an additional 206 shares during the period. Benjamin Edwards Inc. increased its holdings in Ryanair by 3.9% in the 2nd quarter. Benjamin Edwards Inc. now owns 5,834 shares of the transportation company's stock worth $336,000 after acquiring an additional 217 shares in the last quarter. Vident Advisory LLC raised its position in Ryanair by 2.4% during the fourth quarter. Vident Advisory LLC now owns 10,006 shares of the transportation company's stock worth $436,000 after acquiring an additional 230 shares during the period. Finally, SG Americas Securities LLC lifted its holdings in Ryanair by 0.3% during the first quarter. SG Americas Securities LLC now owns 85,781 shares of the transportation company's stock valued at $3,635,000 after purchasing an additional 240 shares in the last quarter. Institutional investors own 43.66% of the company's stock.

About Ryanair

(

Get Free Report)

Ryanair Holdings plc, together with its subsidiaries, provides scheduled-passenger airline services in Ireland, the United Kingdom, Italy, Spain, and internationally. It is also involved in the provision of various ancillary services, such as non-flight scheduled and Internet-related services, as well as in-flight sale of beverages, food, duty-free, and merchandise; and markets car hire, travel insurance, and accommodation services through its website and mobile app.

Further Reading

Before you consider Ryanair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ryanair wasn't on the list.

While Ryanair currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.