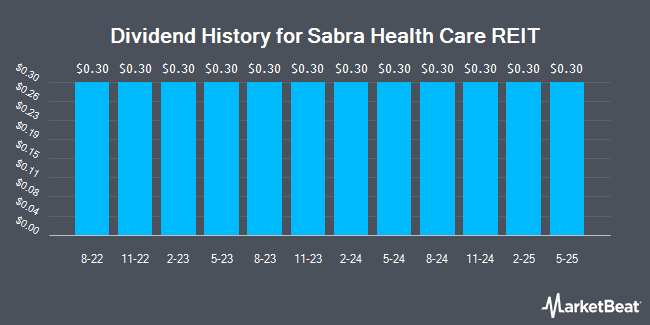

Sabra Healthcare REIT, Inc. (NASDAQ:SBRA - Get Free Report) declared a quarterly dividend on Monday, August 4th, NASDAQ Dividends reports. Shareholders of record on Friday, August 15th will be paid a dividend of 0.30 per share by the real estate investment trust on Friday, August 29th. This represents a c) dividend on an annualized basis and a yield of 6.4%. The ex-dividend date is Friday, August 15th.

Sabra Healthcare REIT has a dividend payout ratio of 153.8% meaning the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Equities research analysts expect Sabra Healthcare REIT to earn $1.50 per share next year, which means the company should continue to be able to cover its $1.20 annual dividend with an expected future payout ratio of 80.0%.

Sabra Healthcare REIT Trading Up 0.2%

NASDAQ:SBRA traded up $0.04 on Friday, hitting $18.72. 1,270,951 shares of the stock were exchanged, compared to its average volume of 2,435,750. The company has a debt-to-equity ratio of 0.91, a quick ratio of 4.22 and a current ratio of 4.80. The stock has a market capitalization of $4.49 billion, a price-to-earnings ratio of 24.63, a P/E/G ratio of 1.53 and a beta of 0.86. The company's 50-day moving average price is $18.22 and its 200 day moving average price is $17.54. Sabra Healthcare REIT has a 52 week low of $15.60 and a 52 week high of $20.03.

Sabra Healthcare REIT (NASDAQ:SBRA - Get Free Report) last released its earnings results on Monday, August 4th. The real estate investment trust reported $0.38 EPS for the quarter, topping analysts' consensus estimates of $0.36 by $0.02. Sabra Healthcare REIT had a net margin of 24.87% and a return on equity of 6.69%. The firm had revenue of $189.15 million during the quarter, compared to analyst estimates of $185.64 million. During the same quarter in the previous year, the business earned $0.36 EPS. The business's quarterly revenue was up 7.4% compared to the same quarter last year. On average, equities research analysts forecast that Sabra Healthcare REIT will post 1.45 earnings per share for the current year.

Wall Street Analysts Forecast Growth

Several equities analysts have recently issued reports on SBRA shares. Scotiabank boosted their price target on shares of Sabra Healthcare REIT from $19.00 to $20.00 and gave the company a "sector perform" rating in a report on Monday, June 23rd. JMP Securities boosted their price target on shares of Sabra Healthcare REIT from $20.00 to $22.00 and gave the stock a "market outperform" rating in a research report on Wednesday. Three investment analysts have rated the stock with a hold rating, three have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $20.00.

Get Our Latest Report on SBRA

About Sabra Healthcare REIT

(

Get Free Report)

Sabra Health Care REIT, Inc engages in the business of acquiring, financing, and owning real estate property. The company was founded on May 10, 2010 and is headquartered in Tustin, CA.

Featured Articles

Before you consider Sabra Healthcare REIT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sabra Healthcare REIT wasn't on the list.

While Sabra Healthcare REIT currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.