JPMorgan Chase & Co. upgraded shares of SailPoint (NASDAQ:SAIL - Free Report) from a neutral rating to an overweight rating in a research report sent to investors on Wednesday, Marketbeat Ratings reports. They currently have $26.00 price objective on the stock.

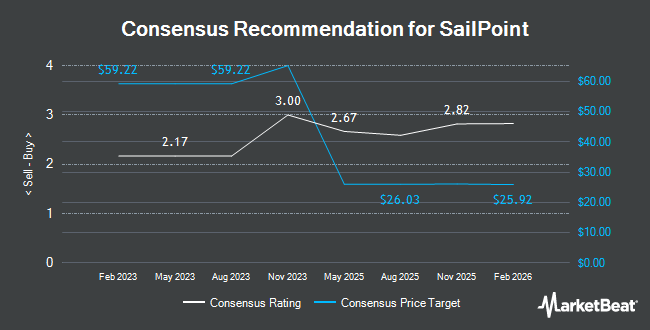

SAIL has been the subject of several other research reports. Morgan Stanley decreased their price objective on SailPoint from $26.00 to $25.00 and set an "equal weight" rating for the company in a report on Wednesday, April 16th. Arete started coverage on SailPoint in a report on Monday, July 7th. They set a "sell" rating and a $16.00 price objective for the company. Arete Research upgraded SailPoint to a "strong sell" rating and set a $16.00 price objective for the company in a report on Monday, July 7th. Royal Bank Of Canada restated an "outperform" rating and set a $29.00 price objective (up previously from $27.00) on shares of SailPoint in a report on Thursday, June 12th. Finally, Stephens upgraded SailPoint to a "strong-buy" rating in a report on Tuesday. Two analysts have rated the stock with a sell rating, four have assigned a hold rating, twelve have given a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, SailPoint currently has an average rating of "Moderate Buy" and an average price target of $25.50.

Get Our Latest Stock Report on SailPoint

SailPoint Stock Performance

SAIL stock traded up $0.64 during mid-day trading on Wednesday, reaching $20.47. The company's stock had a trading volume of 2,505,429 shares, compared to its average volume of 2,737,022. The business's 50 day moving average price is $21.34. SailPoint has a 12 month low of $15.05 and a 12 month high of $26.35.

SailPoint (NASDAQ:SAIL - Get Free Report) last issued its earnings results on Wednesday, June 11th. The company reported $0.01 earnings per share for the quarter, topping analysts' consensus estimates of ($0.01) by $0.02. The business had revenue of $230.47 million during the quarter, compared to the consensus estimate of $225.18 million. The company's quarterly revenue was up 22.8% compared to the same quarter last year.

Institutional Inflows and Outflows

Institutional investors have recently bought and sold shares of the business. Phoenix Financial Ltd. bought a new position in SailPoint in the 1st quarter valued at $4,321,000. Assetmark Inc. purchased a new position in shares of SailPoint during the 1st quarter valued at $32,000. Allianz Asset Management GmbH purchased a new position in shares of SailPoint during the 1st quarter valued at $3,496,000. US Bancorp DE purchased a new position in shares of SailPoint during the 1st quarter valued at $213,000. Finally, Stephens Investment Management Group LLC purchased a new position in shares of SailPoint during the 1st quarter valued at $23,213,000.

SailPoint Company Profile

(

Get Free Report)

SailPoint, Inc delivers solutions to enable comprehensive identity security for the enterprise. Its solutions enable organizations to establish, control, and automate policies that help them define and maintain a robust security posture and achieve regulatory compliance. The company was founded by Mark David McClain in 2005 and is headquartered in Austin, TX.

See Also

Before you consider SailPoint, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SailPoint wasn't on the list.

While SailPoint currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.