Sally Beauty (NYSE:SBH - Get Free Report) is projected to post its Q3 2025 quarterly earnings results before the market opens on Tuesday, August 5th. Analysts expect Sally Beauty to post earnings of $0.41 per share and revenue of $928.78 million for the quarter. Sally Beauty has set its FY 2025 guidance at EPS and its Q3 2025 guidance at EPS.

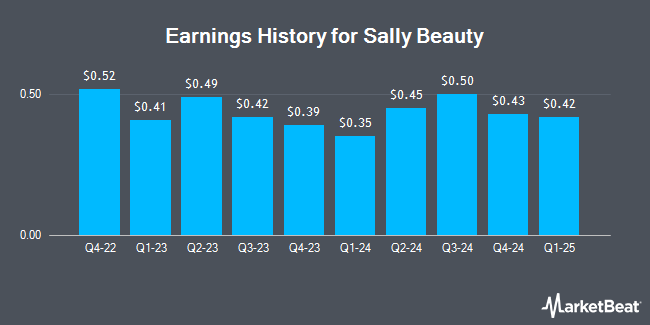

Sally Beauty (NYSE:SBH - Get Free Report) last announced its quarterly earnings results on Monday, May 12th. The specialty retailer reported $0.42 earnings per share for the quarter, beating analysts' consensus estimates of $0.39 by $0.03. Sally Beauty had a net margin of 5.03% and a return on equity of 29.48%. The firm had revenue of $883.15 million for the quarter, compared to analyst estimates of $901.00 million. During the same quarter in the previous year, the firm posted $0.35 earnings per share. The business's revenue was down 2.8% on a year-over-year basis. On average, analysts expect Sally Beauty to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

Sally Beauty Stock Down 0.9%

SBH traded down $0.09 during trading on Friday, reaching $9.65. The company had a trading volume of 1,836,107 shares, compared to its average volume of 1,527,888. The company has a debt-to-equity ratio of 1.29, a current ratio of 2.32 and a quick ratio of 0.44. Sally Beauty has a 12 month low of $7.54 and a 12 month high of $14.79. The business's fifty day moving average price is $9.39 and its 200 day moving average price is $9.24. The company has a market cap of $973.59 million, a P/E ratio of 5.42 and a beta of 1.30.

Hedge Funds Weigh In On Sally Beauty

Institutional investors and hedge funds have recently modified their holdings of the stock. Royal Bank of Canada increased its holdings in shares of Sally Beauty by 150,390.9% in the first quarter. Royal Bank of Canada now owns 33,108 shares of the specialty retailer's stock valued at $299,000 after purchasing an additional 33,086 shares during the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its stake in shares of Sally Beauty by 3.5% in the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 60,595 shares of the specialty retailer's stock valued at $547,000 after acquiring an additional 2,026 shares in the last quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC grew its stake in shares of Sally Beauty by 10.6% in the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 324,906 shares of the specialty retailer's stock valued at $2,934,000 after acquiring an additional 31,040 shares in the last quarter. Finally, AQR Capital Management LLC grew its stake in shares of Sally Beauty by 53.7% in the first quarter. AQR Capital Management LLC now owns 476,966 shares of the specialty retailer's stock valued at $4,188,000 after acquiring an additional 166,637 shares in the last quarter.

Analysts Set New Price Targets

Separately, Wall Street Zen lowered shares of Sally Beauty from a "buy" rating to a "hold" rating in a research note on Thursday, May 22nd. One equities research analyst has rated the stock with a sell rating, three have given a hold rating and two have assigned a buy rating to the company. According to MarketBeat, Sally Beauty currently has an average rating of "Hold" and a consensus target price of $12.63.

Check Out Our Latest Report on SBH

Sally Beauty Company Profile

(

Get Free Report)

Sally Beauty Holdings, Inc operates as a specialty retailer and distributor of professional beauty supplies. The company operates through two segments, Sally Beauty Supply and Beauty Systems Group. The Sally Beauty Supply segment offers beauty products, including hair color and care products, skin and nail care products, styling tools, and other beauty products for retail customers, salons, and salon professionals.

Further Reading

Before you consider Sally Beauty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sally Beauty wasn't on the list.

While Sally Beauty currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.