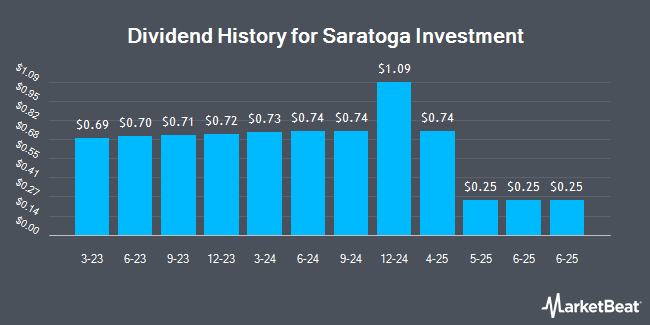

Saratoga Investment Corp (NYSE:SAR - Get Free Report) announced a monthly dividend on Thursday, September 11th. Shareholders of record on Tuesday, November 4th will be given a dividend of 0.25 per share by the financial services provider on Thursday, November 20th. This represents a c) dividend on an annualized basis and a yield of 12.1%. The ex-dividend date of this dividend is Tuesday, November 4th.

Saratoga Investment Stock Performance

NYSE:SAR traded up $0.47 during trading hours on Wednesday, reaching $24.71. The company had a trading volume of 35,469 shares, compared to its average volume of 115,853. The company has a current ratio of 0.32, a quick ratio of 0.32 and a debt-to-equity ratio of 0.18. Saratoga Investment has a 52 week low of $21.10 and a 52 week high of $26.49. The firm has a market cap of $394.14 million, a price-to-earnings ratio of 10.01 and a beta of 0.67. The firm's 50 day moving average price is $25.01 and its 200-day moving average price is $24.51.

Saratoga Investment (NYSE:SAR - Get Free Report) last posted its earnings results on Tuesday, July 8th. The financial services provider reported $0.66 EPS for the quarter, missing analysts' consensus estimates of $0.69 by ($0.03). Saratoga Investment had a return on equity of 12.71% and a net margin of 24.85%.The company had revenue of $35.22 million during the quarter, compared to the consensus estimate of $32.75 million. On average, analysts forecast that Saratoga Investment will post 3.93 EPS for the current year.

Wall Street Analyst Weigh In

Separately, Compass Point downgraded shares of Saratoga Investment from a "buy" rating to a "neutral" rating and cut their price objective for the company from $25.25 to $24.25 in a research report on Monday, June 9th. Four equities research analysts have rated the stock with a Hold rating, According to data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average target price of $24.25.

Get Our Latest Analysis on SAR

Saratoga Investment Company Profile

(

Get Free Report)

Saratoga Investment Corp. is a business development company specializing in leveraged and management buyouts, acquisition financings, growth financings, recapitalization, debt refinancing, and transitional financing transactions at the lower end of middle market companies. It structures its investments as debt and equity by investing through first and second lien loans, mezzanine debt, co-investments, select high yield bonds, senior secured bonds, unsecured bonds, and preferred and common equity.

Featured Articles

Before you consider Saratoga Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Saratoga Investment wasn't on the list.

While Saratoga Investment currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.