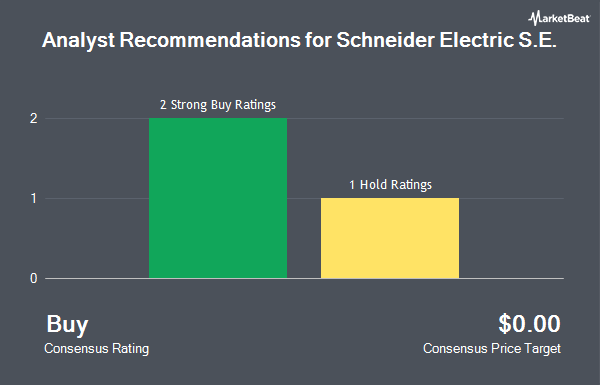

Schneider Electric SE (OTCMKTS:SBGSY - Get Free Report) has received a consensus rating of "Moderate Buy" from the nine analysts that are covering the firm, MarketBeat Ratings reports. Four research analysts have rated the stock with a hold rating, two have given a buy rating and three have issued a strong buy rating on the company.

Several research firms have recently issued reports on SBGSY. Kepler Capital Markets lowered Schneider Electric from a "strong-buy" rating to a "hold" rating in a research report on Friday, July 25th. Deutsche Bank Aktiengesellschaft upgraded Schneider Electric from a "hold" rating to a "buy" rating in a research note on Tuesday, September 2nd. Erste Group Bank upgraded Schneider Electric from a "hold" rating to a "strong-buy" rating in a research note on Thursday, September 11th. Zacks Research lowered Schneider Electric from a "strong-buy" rating to a "hold" rating in a report on Wednesday. Finally, Santander raised Schneider Electric to an "outperform" rating in a report on Wednesday, September 3rd.

Read Our Latest Analysis on SBGSY

Schneider Electric Stock Performance

Shares of OTCMKTS SBGSY traded down $0.53 during midday trading on Thursday, reaching $54.34. 363,624 shares of the company traded hands, compared to its average volume of 279,152. The stock's 50-day simple moving average is $52.28 and its 200-day simple moving average is $50.16. Schneider Electric has a 12 month low of $39.77 and a 12 month high of $56.98. The company has a quick ratio of 0.95, a current ratio of 1.23 and a debt-to-equity ratio of 0.35.

Schneider Electric Company Profile

(

Get Free Report)

Schneider Electric S.E. engages in the energy management and industrial automation businesses in the France, Western Europe, North America, the Asia Pacific, Eastern Europe, the Middle East, Africa, South America, and internationally. The company offers busway and cable management products, circuit breakers and switches, contactors and protection relays, electrical car charging, electrical protection and control products, energy management software solutions, load banks, power monitoring and control systems, power quality and power factor correction products, push buttons, switches, pilot lights and joysticks, surge protection and power conditioning services, switchboards and enclosures, and transfer switches.

See Also

Before you consider Schneider Electric, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Schneider Electric wasn't on the list.

While Schneider Electric currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.