Brown Advisory Inc. decreased its holdings in Sensata Technologies Holding plc (NYSE:ST - Free Report) by 6.4% in the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 1,353,979 shares of the scientific and technical instruments company's stock after selling 92,558 shares during the period. Brown Advisory Inc. owned 0.91% of Sensata Technologies worth $37,099,000 at the end of the most recent reporting period.

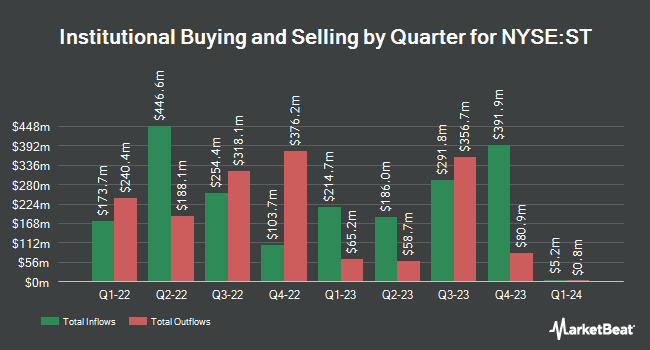

Several other hedge funds and other institutional investors also recently modified their holdings of the business. Fuller & Thaler Asset Management Inc. raised its holdings in shares of Sensata Technologies by 96.8% in the 4th quarter. Fuller & Thaler Asset Management Inc. now owns 5,260,870 shares of the scientific and technical instruments company's stock valued at $144,148,000 after acquiring an additional 2,587,183 shares in the last quarter. Price T Rowe Associates Inc. MD grew its stake in Sensata Technologies by 36.4% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 7,821,428 shares of the scientific and technical instruments company's stock worth $214,308,000 after buying an additional 2,088,161 shares in the last quarter. Norges Bank purchased a new stake in shares of Sensata Technologies during the 4th quarter valued at $48,580,000. Boston Partners lifted its holdings in shares of Sensata Technologies by 11.6% during the 4th quarter. Boston Partners now owns 6,526,941 shares of the scientific and technical instruments company's stock worth $179,087,000 after acquiring an additional 677,316 shares during the last quarter. Finally, Dimensional Fund Advisors LP increased its stake in Sensata Technologies by 12.6% in the fourth quarter. Dimensional Fund Advisors LP now owns 5,808,186 shares of the scientific and technical instruments company's stock valued at $159,143,000 after acquiring an additional 648,028 shares during the last quarter. Institutional investors own 99.42% of the company's stock.

Sensata Technologies Price Performance

ST stock traded up $3.10 during midday trading on Friday, hitting $25.56. The company's stock had a trading volume of 2,991,544 shares, compared to its average volume of 1,710,224. The firm has a market capitalization of $3.74 billion, a price-to-earnings ratio of 30.43, a price-to-earnings-growth ratio of 1.25 and a beta of 1.02. The company has a 50 day moving average of $23.19 and a two-hundred day moving average of $27.46. Sensata Technologies Holding plc has a 12 month low of $17.32 and a 12 month high of $43.14. The company has a quick ratio of 1.99, a current ratio of 2.85 and a debt-to-equity ratio of 1.11.

Sensata Technologies (NYSE:ST - Get Free Report) last posted its earnings results on Thursday, May 8th. The scientific and technical instruments company reported $0.78 EPS for the quarter, topping analysts' consensus estimates of $0.72 by $0.06. Sensata Technologies had a return on equity of 17.54% and a net margin of 3.27%. The company had revenue of $911.26 million for the quarter, compared to the consensus estimate of $878.39 million. During the same period in the previous year, the business earned $0.89 earnings per share. The firm's revenue for the quarter was down 9.5% on a year-over-year basis. On average, analysts expect that Sensata Technologies Holding plc will post 3.21 EPS for the current year.

Sensata Technologies Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Wednesday, May 28th. Investors of record on Wednesday, May 14th will be given a $0.12 dividend. The ex-dividend date is Wednesday, May 14th. This represents a $0.48 annualized dividend and a yield of 1.88%. Sensata Technologies's dividend payout ratio is currently 59.26%.

Analysts Set New Price Targets

A number of equities analysts have recently issued reports on the company. UBS Group cut their price objective on Sensata Technologies from $37.00 to $30.00 and set a "buy" rating for the company in a report on Thursday, April 10th. Evercore ISI lowered shares of Sensata Technologies from an "outperform" rating to an "inline" rating and dropped their target price for the stock from $40.00 to $27.00 in a report on Thursday, April 3rd. Wells Fargo & Company started coverage on Sensata Technologies in a report on Friday, April 25th. They set an "equal weight" rating and a $20.00 price target on the stock. Robert W. Baird lowered their price target on Sensata Technologies from $24.00 to $23.00 and set a "neutral" rating for the company in a research report on Tuesday, April 15th. Finally, The Goldman Sachs Group upped their price objective on shares of Sensata Technologies from $27.00 to $30.00 and gave the stock a "buy" rating in a report on Friday. One analyst has rated the stock with a sell rating, six have assigned a hold rating and five have issued a buy rating to the company's stock. According to MarketBeat.com, the stock has a consensus rating of "Hold" and an average target price of $33.58.

Get Our Latest Research Report on Sensata Technologies

Sensata Technologies Company Profile

(

Free Report)

Sensata Technologies Holding plc develops, manufactures, and sells sensors and sensor-rich solutions, electrical protection components and systems, and other products used in mission-critical systems and applications in the United States and internationally. It operates in two segments, Performance Sensing and Sensing Solutions.

See Also

Before you consider Sensata Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sensata Technologies wasn't on the list.

While Sensata Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.