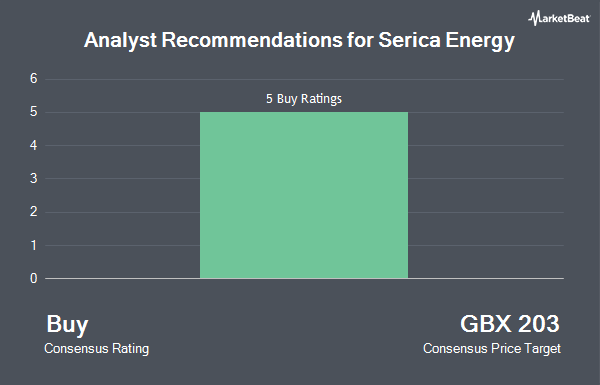

Shares of Serica Energy plc (LON:SQZ - Get Free Report) have earned a consensus rating of "Buy" from the six ratings firms that are currently covering the company, Marketbeat Ratings reports. Six research analysts have rated the stock with a buy rating. The average 12 month target price among analysts that have issued a report on the stock in the last year is GBX 219.50.

Several equities research analysts have weighed in on SQZ shares. Shore Capital reissued a "buy" rating and set a GBX 225 price target on shares of Serica Energy in a research report on Wednesday, October 8th. JPMorgan Chase & Co. reiterated a "buy" rating and set a GBX 215 target price on shares of Serica Energy in a report on Wednesday, August 13th. Canaccord Genuity Group increased their target price on shares of Serica Energy from GBX 215 to GBX 240 and gave the stock a "buy" rating in a report on Friday, October 3rd. Jefferies Financial Group increased their price objective on Serica Energy from GBX 190 to GBX 230 and gave the stock a "buy" rating in a report on Monday, October 20th. Finally, Peel Hunt reiterated a "buy" rating and issued a GBX 207 price objective on shares of Serica Energy in a report on Wednesday, October 8th.

View Our Latest Report on SQZ

Serica Energy Stock Up 5.9%

SQZ stock opened at GBX 207 on Friday. The company has a current ratio of 1.69, a quick ratio of 1.22 and a debt-to-equity ratio of 26.31. The company's 50 day moving average is GBX 178.58 and its 200 day moving average is GBX 160.95. The stock has a market cap of £808.39 million, a price-to-earnings ratio of -25.88, a price-to-earnings-growth ratio of 2.15 and a beta of 0.44. Serica Energy has a 1-year low of GBX 112 and a 1-year high of GBX 217.

Serica Energy Company Profile

(

Get Free Report)

Serica Energy plc, an upstream oil and gas company, identifies, acquires, explores, exploits, and produces oil and gas reserves in the United Kingdom. The company holds 100% interest in the Keith oil field; 98% interest in the Bruce field; and 50% interest in the Rhum gas field located in the Northern North Sea, as well as 18% non-operating interest in the Erskine field located in Central North Sea.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Serica Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Serica Energy wasn't on the list.

While Serica Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.