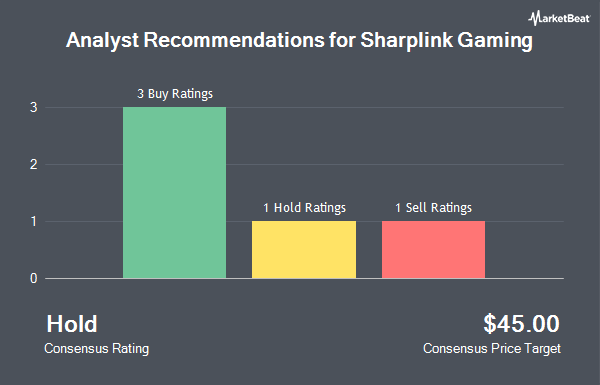

Sharplink Gaming Inc. (NASDAQ:SBET - Get Free Report) has received an average rating of "Hold" from the five ratings firms that are currently covering the stock, MarketBeat reports. One equities research analyst has rated the stock with a sell rating, one has issued a hold rating and three have assigned a buy rating to the company. The average 1 year price objective among analysts that have updated their coverage on the stock in the last year is $45.00.

A number of equities analysts have weighed in on SBET shares. JMP Securities initiated coverage on Sharplink Gaming in a research note on Thursday, October 16th. They issued a "market outperform" rating and a $50.00 target price on the stock. Citizens Jmp initiated coverage on shares of Sharplink Gaming in a research note on Thursday, October 16th. They issued a "mkt outperform" rating and a $50.00 target price on the stock. Zacks Research upgraded shares of Sharplink Gaming to a "hold" rating in a research report on Friday. Alliance Global Partners initiated coverage on shares of Sharplink Gaming in a research report on Tuesday, August 26th. They set a "buy" rating and a $48.00 price objective on the stock. Finally, Weiss Ratings reiterated a "sell (d)" rating on shares of Sharplink Gaming in a research report on Wednesday, October 8th.

Get Our Latest Analysis on SBET

Sharplink Gaming Price Performance

Shares of SBET stock opened at $14.79 on Tuesday. The company's fifty day simple moving average is $17.59 and its two-hundred day simple moving average is $16.56. Sharplink Gaming has a 1 year low of $2.26 and a 1 year high of $124.12.

Sharplink Gaming (NASDAQ:SBET - Get Free Report) last posted its earnings results on Thursday, August 14th. The company reported ($0.64) earnings per share for the quarter. Sharplink Gaming had a negative net margin of 3,377.39% and a negative return on equity of 15.93%. The company had revenue of $0.70 million for the quarter.

Insider Activity at Sharplink Gaming

In other Sharplink Gaming news, Director Robert M. Gutkowski sold 18,334 shares of the business's stock in a transaction on Monday, August 18th. The shares were sold at an average price of $19.17, for a total value of $351,462.78. Following the completion of the sale, the director directly owned 24,998 shares of the company's stock, valued at $479,211.66. The trade was a 42.31% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Also, Director Leslie Bernhard sold 18,334 shares of the company's stock in a transaction dated Monday, August 18th. The shares were sold at an average price of $19.17, for a total transaction of $351,462.78. Following the sale, the director owned 24,998 shares of the company's stock, valued at approximately $479,211.66. The trade was a 42.31% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 55,002 shares of company stock valued at $1,054,388. Insiders own 3.40% of the company's stock.

Hedge Funds Weigh In On Sharplink Gaming

A number of large investors have recently bought and sold shares of the stock. NewEdge Advisors LLC bought a new stake in Sharplink Gaming in the second quarter valued at approximately $101,000. Qube Research & Technologies Ltd purchased a new position in shares of Sharplink Gaming in the second quarter worth $151,000. S.A. Mason LLC bought a new stake in Sharplink Gaming during the 3rd quarter valued at $249,000. HUB Investment Partners LLC purchased a new stake in Sharplink Gaming during the 2nd quarter valued at $298,000. Finally, Generali Investments CEE investicni spolecnost a.s. purchased a new stake in Sharplink Gaming during the 3rd quarter valued at $407,000. 13.75% of the stock is owned by hedge funds and other institutional investors.

About Sharplink Gaming

(

Get Free Report)

SharpLink Gaming, Inc operates as an online technology company that connects sports fans, leagues, and sports websites to sports betting and iGaming content. The company operates through four segments: Affiliate Marketing Services United States, Affiliate Marketing Services International, Sports Gaming Client Services, and SportsHub Games Network.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sharplink Gaming, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sharplink Gaming wasn't on the list.

While Sharplink Gaming currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.