Shoals Technologies Group (NASDAQ:SHLS - Get Free Report) was downgraded by stock analysts at Wall Street Zen from a "strong-buy" rating to a "buy" rating in a note issued to investors on Sunday.

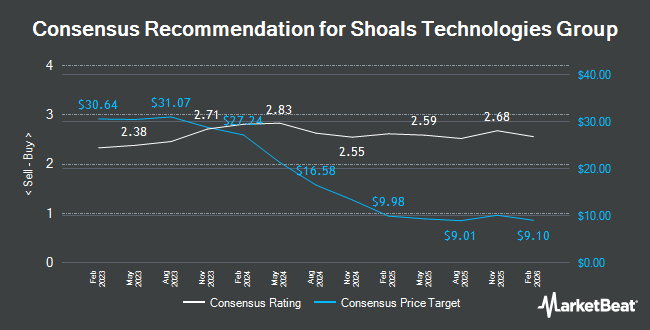

Several other research analysts have also recently weighed in on the company. BNP Paribas Exane cut Shoals Technologies Group from a "neutral" rating to an "underperform" rating and set a $4.00 price objective on the stock. in a research report on Thursday, May 15th. Roth Capital upgraded Shoals Technologies Group from a "neutral" rating to a "buy" rating and set a $10.00 price objective on the stock in a research report on Thursday, August 7th. Mizuho cut Shoals Technologies Group from an "outperform" rating to a "neutral" rating and set a $7.00 price objective on the stock. in a research report on Monday, July 14th. Citigroup increased their price objective on Shoals Technologies Group from $4.50 to $5.50 and gave the stock a "neutral" rating in a research report on Wednesday, May 7th. Finally, BNP Paribas reiterated an "underperform" rating and set a $4.00 price objective (down previously from $4.50) on shares of Shoals Technologies Group in a research report on Thursday, May 15th. Fourteen analysts have rated the stock with a Buy rating, six have given a Hold rating and two have given a Sell rating to the stock. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $9.15.

Read Our Latest Analysis on Shoals Technologies Group

Shoals Technologies Group Stock Performance

SHLS traded up $0.1440 during trading hours on Friday, reaching $6.2740. The company's stock had a trading volume of 2,215,887 shares, compared to its average volume of 6,392,765. Shoals Technologies Group has a 52 week low of $2.71 and a 52 week high of $7.00. The company's 50-day moving average is $5.33 and its 200-day moving average is $4.42. The company has a debt-to-equity ratio of 0.23, a quick ratio of 1.64 and a current ratio of 2.34. The firm has a market cap of $1.05 billion, a PE ratio of 48.19, a price-to-earnings-growth ratio of 0.74 and a beta of 1.61.

Shoals Technologies Group (NASDAQ:SHLS - Get Free Report) last posted its quarterly earnings data on Tuesday, August 5th. The company reported $0.10 earnings per share for the quarter, topping the consensus estimate of $0.08 by $0.02. The firm had revenue of $110.84 million for the quarter, compared to analysts' expectations of $104.87 million. Shoals Technologies Group had a return on equity of 7.57% and a net margin of 5.27%.The company's quarterly revenue was up 11.7% compared to the same quarter last year. During the same quarter last year, the business earned $0.10 EPS. Shoals Technologies Group has set its FY 2025 guidance at EPS. Q3 2025 guidance at EPS. On average, equities analysts forecast that Shoals Technologies Group will post 0.29 EPS for the current year.

Institutional Trading of Shoals Technologies Group

Several large investors have recently bought and sold shares of SHLS. Nisa Investment Advisors LLC boosted its stake in Shoals Technologies Group by 449.1% in the second quarter. Nisa Investment Advisors LLC now owns 7,226 shares of the company's stock valued at $31,000 after buying an additional 5,910 shares in the last quarter. Cerity Partners LLC acquired a new stake in Shoals Technologies Group in the first quarter valued at about $43,000. MQS Management LLC acquired a new stake in Shoals Technologies Group in the first quarter valued at about $43,000. Caitong International Asset Management Co. Ltd acquired a new stake in Shoals Technologies Group in the first quarter valued at about $44,000. Finally, Virtu Financial LLC acquired a new stake in shares of Shoals Technologies Group during the first quarter valued at about $46,000.

About Shoals Technologies Group

(

Get Free Report)

Shoals Technologies Group, Inc provides electrical balance of system (EBOS) solutions and components for solar, battery energy, and electric vehicle (EV) charging applications in the United States and internationally. The company designs, manufactures, and sells system solutions for both homerun and combine-as-you-go wiring architectures, as well as offers technical support services.

Read More

Before you consider Shoals Technologies Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shoals Technologies Group wasn't on the list.

While Shoals Technologies Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.