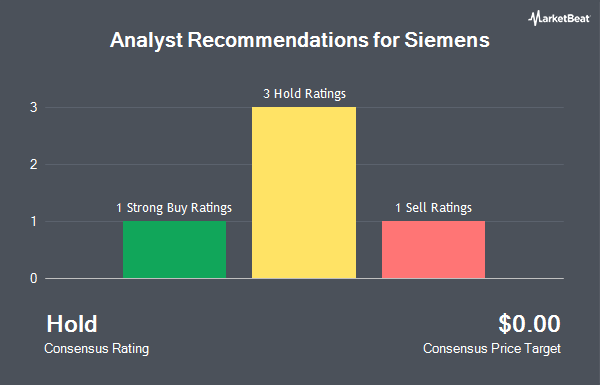

Siemens AG (OTCMKTS:SIEGY - Get Free Report) has been assigned an average recommendation of "Hold" from the six analysts that are covering the firm, MarketBeat reports. One equities research analyst has rated the stock with a sell rating, three have assigned a hold rating, one has assigned a buy rating and one has issued a strong buy rating on the company.

Several research firms have issued reports on SIEGY. Wall Street Zen lowered Siemens from a "buy" rating to a "hold" rating in a report on Wednesday, May 28th. Barclays reissued an "underweight" rating on shares of Siemens in a report on Thursday, July 10th. Finally, Morgan Stanley reissued an "overweight" rating on shares of Siemens in a report on Wednesday, July 30th.

Read Our Latest Research Report on Siemens

Siemens Trading Up 2.4%

SIEGY traded up $3.11 on Monday, hitting $131.06. 119,505 shares of the company were exchanged, compared to its average volume of 268,662. The firm has a fifty day simple moving average of $127.09 and a two-hundred day simple moving average of $119.24. The company has a debt-to-equity ratio of 0.61, a quick ratio of 0.98 and a current ratio of 1.19. Siemens has a 12 month low of $84.82 and a 12 month high of $136.36. The stock has a market capitalization of $209.70 billion, a PE ratio of 19.80, a price-to-earnings-growth ratio of 2.27 and a beta of 1.17.

Siemens (OTCMKTS:SIEGY - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The technology company reported $1.44 earnings per share for the quarter, topping the consensus estimate of $1.28 by $0.16. Siemens had a return on equity of 13.19% and a net margin of 12.61%. Sell-side analysts expect that Siemens will post 6.59 earnings per share for the current year.

Siemens Company Profile

(

Get Free Report)

Siemens Aktiengesellschaft, a technology company, focuses in the areas of automation and digitalization in Europe, Commonwealth of Independent States, Africa, the Middle East, the Americas, Asia, and Australia. It operates through Digital Industries, Smart Infrastructure, Mobility, Siemens Healthineers, and Siemens Financial Services (SFS) segments.

Further Reading

Before you consider Siemens, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Siemens wasn't on the list.

While Siemens currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.