SL Green Realty (NYSE:SLG - Get Free Report) was upgraded by research analysts at Scotiabank from a "sector perform" rating to a "sector outperform" rating in a report issued on Friday, MarketBeat Ratings reports. The firm presently has a $71.00 target price on the real estate investment trust's stock. Scotiabank's price objective would indicate a potential upside of 19.91% from the company's current price.

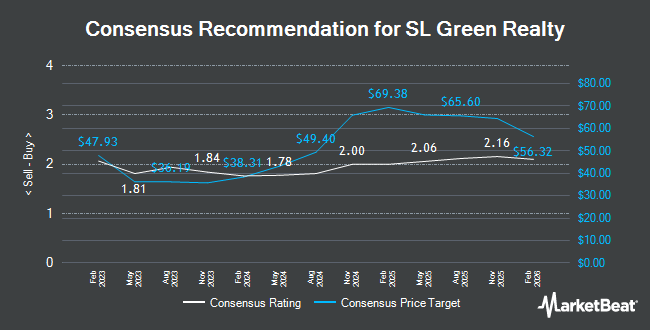

Several other brokerages also recently weighed in on SLG. Barclays decreased their target price on SL Green Realty from $76.00 to $60.00 and set an "equal weight" rating for the company in a research note on Wednesday, April 30th. Wall Street Zen cut SL Green Realty from a "hold" rating to a "sell" rating in a research report on Saturday, May 24th. Deutsche Bank Aktiengesellschaft reaffirmed a "hold" rating on shares of SL Green Realty in a research report on Friday, May 23rd. Piper Sandler cut their target price on shares of SL Green Realty from $90.00 to $72.00 and set an "overweight" rating for the company in a research note on Monday, April 21st. Finally, JPMorgan Chase & Co. decreased their price target on shares of SL Green Realty from $70.00 to $69.00 and set a "neutral" rating on the stock in a research report on Wednesday, July 9th. Two analysts have rated the stock with a sell rating, eleven have issued a hold rating and four have assigned a buy rating to the company. According to data from MarketBeat.com, SL Green Realty has a consensus rating of "Hold" and a consensus price target of $65.60.

Get Our Latest Research Report on SL Green Realty

SL Green Realty Stock Performance

Shares of SL Green Realty stock traded up $0.71 on Friday, reaching $59.21. The stock had a trading volume of 242,903 shares, compared to its average volume of 927,578. The company has a debt-to-equity ratio of 0.98, a quick ratio of 2.85 and a current ratio of 2.72. The business's 50-day moving average price is $61.27 and its two-hundred day moving average price is $59.93. The stock has a market cap of $4.22 billion, a P/E ratio of -109.69 and a beta of 1.65. SL Green Realty has a fifty-two week low of $45.15 and a fifty-two week high of $82.81.

SL Green Realty (NYSE:SLG - Get Free Report) last announced its earnings results on Wednesday, July 16th. The real estate investment trust reported $1.63 EPS for the quarter, topping the consensus estimate of $1.37 by $0.26. SL Green Realty had a negative net margin of 2.21% and a negative return on equity of 1.19%. The firm had revenue of $147.54 million for the quarter, compared to the consensus estimate of $171.24 million. During the same quarter last year, the firm posted $2.05 EPS. The business's quarterly revenue was up 8.6% on a year-over-year basis. On average, sell-side analysts forecast that SL Green Realty will post 5.43 EPS for the current year.

Insider Activity at SL Green Realty

In related news, Director Carol N. Brown sold 2,500 shares of the business's stock in a transaction on Friday, July 18th. The stock was sold at an average price of $60.61, for a total value of $151,525.00. Following the sale, the director owned 937 shares of the company's stock, valued at $56,791.57. The trade was a 72.74% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. 5.04% of the stock is owned by company insiders.

Hedge Funds Weigh In On SL Green Realty

Several institutional investors have recently bought and sold shares of SLG. Quadrant Capital Group LLC increased its position in SL Green Realty by 37.4% in the 4th quarter. Quadrant Capital Group LLC now owns 764 shares of the real estate investment trust's stock valued at $52,000 after acquiring an additional 208 shares in the last quarter. Fourth Dimension Wealth LLC bought a new position in SL Green Realty in the fourth quarter valued at about $75,000. GF Fund Management CO. LTD. acquired a new stake in shares of SL Green Realty during the 4th quarter worth approximately $80,000. Summit Securities Group LLC acquired a new stake in SL Green Realty during the 4th quarter worth $88,000. Finally, FIL Ltd increased its holdings in SL Green Realty by 53.3% in the fourth quarter. FIL Ltd now owns 1,582 shares of the real estate investment trust's stock valued at $107,000 after purchasing an additional 550 shares during the last quarter. Institutional investors own 89.96% of the company's stock.

SL Green Realty Company Profile

(

Get Free Report)

3SL Green Realty Corp., Manhattan's largest office landlord, is a fully integrated real estate investment trust, or REIT, that is focused primarily on acquiring, managing and maximizing value of Manhattan commercial properties. As of June 30, 2022, SL Green held interests in 64 buildings totaling 34.4 million square feet.

Featured Articles

Before you consider SL Green Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SL Green Realty wasn't on the list.

While SL Green Realty currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.