Wall Street Zen lowered shares of Solid Biosciences (NASDAQ:SLDB - Free Report) from a hold rating to a sell rating in a research note issued to investors on Saturday morning.

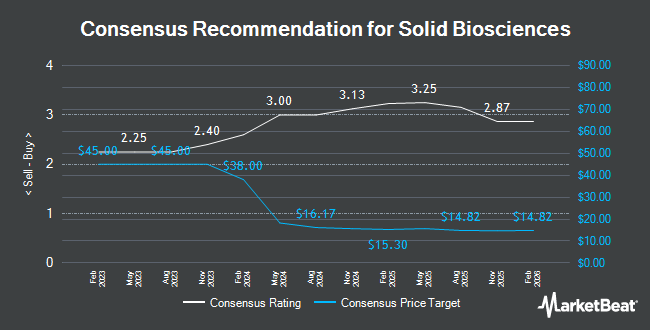

SLDB has been the topic of a number of other research reports. JMP Securities reaffirmed a "market outperform" rating and issued a $15.00 price objective on shares of Solid Biosciences in a research report on Friday, June 6th. Cantor Fitzgerald set a $16.00 price objective on shares of Solid Biosciences and gave the stock an "overweight" rating in a research report on Monday, July 21st. Piper Sandler dropped their target price on shares of Solid Biosciences from $20.00 to $17.00 and set an "overweight" rating on the stock in a research report on Friday, May 16th. Barclays dropped their target price on shares of Solid Biosciences from $15.00 to $10.00 and set an "overweight" rating on the stock in a research report on Friday, May 16th. Finally, HC Wainwright reissued a "buy" rating and set a $20.00 target price on shares of Solid Biosciences in a research report on Tuesday, June 17th. One analyst has rated the stock with a Strong Buy rating and ten have issued a Buy rating to the stock. According to data from MarketBeat, the stock currently has a consensus rating of "Buy" and a consensus price target of $15.00.

Check Out Our Latest Stock Report on SLDB

Solid Biosciences Stock Down 0.5%

Shares of Solid Biosciences stock traded down $0.03 on Friday, reaching $5.44. The stock had a trading volume of 1,252,674 shares, compared to its average volume of 724,116. The company has a 50 day moving average price of $5.96 and a 200 day moving average price of $4.64. Solid Biosciences has a 1 year low of $2.41 and a 1 year high of $8.10. The stock has a market capitalization of $423.61 million, a P/E ratio of -1.94 and a beta of 2.54.

Solid Biosciences (NASDAQ:SLDB - Get Free Report) last issued its quarterly earnings data on Tuesday, August 12th. The company reported ($0.42) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.51) by $0.09. On average, analysts forecast that Solid Biosciences will post -2.84 earnings per share for the current fiscal year.

Hedge Funds Weigh In On Solid Biosciences

Institutional investors have recently made changes to their positions in the company. Legal & General Group Plc increased its holdings in shares of Solid Biosciences by 208.6% during the 2nd quarter. Legal & General Group Plc now owns 6,011 shares of the company's stock valued at $29,000 after purchasing an additional 4,063 shares in the last quarter. Ameritas Investment Partners Inc. increased its holdings in Solid Biosciences by 205.5% in the 2nd quarter. Ameritas Investment Partners Inc. now owns 6,740 shares of the company's stock worth $33,000 after acquiring an additional 4,534 shares in the last quarter. CWM LLC increased its holdings in Solid Biosciences by 15,188.5% in the 1st quarter. CWM LLC now owns 7,950 shares of the company's stock worth $29,000 after acquiring an additional 7,898 shares in the last quarter. Pallas Capital Advisors LLC purchased a new stake in Solid Biosciences in the 2nd quarter worth $54,000. Finally, Ground Swell Capital LLC purchased a new stake in Solid Biosciences in the 1st quarter worth $42,000. 81.46% of the stock is owned by hedge funds and other institutional investors.

About Solid Biosciences

(

Get Free Report)

Solid Biosciences Inc, a life science company, develops therapies for neuromuscular and cardiac diseases in the United States. The company's lead product candidate is SGT-003, a gene transfer candidate for the treatment of Duchenne muscular dystrophy; and SGT-501 to treat Catecholaminergic polymorphic ventricular tachycardia.

Featured Stories

Before you consider Solid Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Solid Biosciences wasn't on the list.

While Solid Biosciences currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.