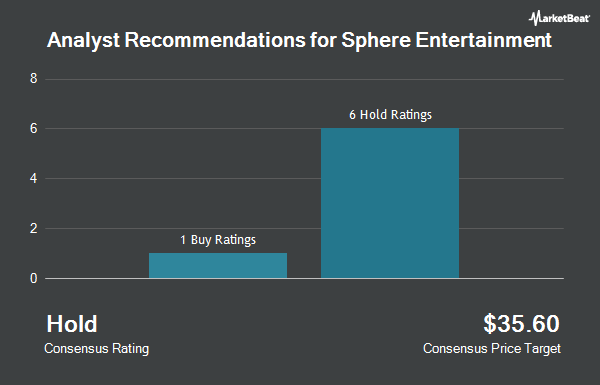

Sphere Entertainment Co. (NYSE:SPHR - Get Free Report) has received a consensus rating of "Moderate Buy" from the ten brokerages that are currently covering the company, Marketbeat reports. One investment analyst has rated the stock with a sell rating, three have given a hold rating and six have assigned a buy rating to the company. The average 12-month target price among brokerages that have issued ratings on the stock in the last year is $48.70.

Several analysts recently weighed in on the stock. Benchmark reiterated a "sell" rating and issued a $35.00 price objective on shares of Sphere Entertainment in a research report on Monday, May 19th. The Goldman Sachs Group set a $36.00 price target on shares of Sphere Entertainment and gave the stock a "buy" rating in a research report on Friday, April 18th. Guggenheim boosted their price target on shares of Sphere Entertainment from $69.00 to $74.00 and gave the stock a "buy" rating in a research report on Friday, May 9th. Susquehanna initiated coverage on shares of Sphere Entertainment in a research report on Monday, April 28th. They set a "positive" rating and a $37.00 price target on the stock. Finally, JPMorgan Chase & Co. boosted their price target on shares of Sphere Entertainment from $54.00 to $55.00 and gave the stock an "overweight" rating in a research report on Wednesday, May 21st.

Get Our Latest Report on SPHR

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently modified their holdings of SPHR. GAMMA Investing LLC grew its position in shares of Sphere Entertainment by 95.3% in the 2nd quarter. GAMMA Investing LLC now owns 744 shares of the company's stock worth $31,000 after buying an additional 363 shares during the last quarter. Boyar Asset Management Inc. increased its position in Sphere Entertainment by 1.2% during the fourth quarter. Boyar Asset Management Inc. now owns 44,457 shares of the company's stock valued at $1,793,000 after acquiring an additional 542 shares during the last quarter. CWM LLC grew its holdings in Sphere Entertainment by 915.3% during the second quarter. CWM LLC now owns 731 shares of the company's stock valued at $31,000 after purchasing an additional 659 shares during the period. Tower Research Capital LLC TRC grew its holdings in Sphere Entertainment by 108.1% during the fourth quarter. Tower Research Capital LLC TRC now owns 1,311 shares of the company's stock valued at $53,000 after purchasing an additional 681 shares during the period. Finally, Legal & General Group Plc grew its holdings in Sphere Entertainment by 2.8% during the fourth quarter. Legal & General Group Plc now owns 26,678 shares of the company's stock valued at $1,076,000 after purchasing an additional 720 shares during the period. Hedge funds and other institutional investors own 92.03% of the company's stock.

Sphere Entertainment Trading Down 0.4%

Shares of SPHR traded down $0.19 on Friday, hitting $41.57. 298,813 shares of the stock traded hands, compared to its average volume of 796,590. The company has a quick ratio of 0.53, a current ratio of 0.53 and a debt-to-equity ratio of 0.24. The firm has a market capitalization of $1.49 billion, a P/E ratio of -4.15 and a beta of 1.71. Sphere Entertainment has a 1 year low of $23.89 and a 1 year high of $50.88. The stock's 50 day moving average is $41.28 and its two-hundred day moving average is $37.88.

Sphere Entertainment (NYSE:SPHR - Get Free Report) last posted its quarterly earnings results on Thursday, May 8th. The company reported ($2.27) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($2.48) by $0.21. The company had revenue of $280.57 million for the quarter, compared to the consensus estimate of $285.01 million. Sphere Entertainment had a negative net margin of 33.00% and a negative return on equity of 16.78%. The company's revenue for the quarter was down 12.7% on a year-over-year basis. During the same period last year, the firm posted ($1.33) EPS. As a group, sell-side analysts predict that Sphere Entertainment will post -11.47 earnings per share for the current year.

About Sphere Entertainment

(

Get Free Report)

Sphere Entertainment Co engages in the entertainment business. It produces, presents, or hosts various live entertainment events, including concerts, family shows, and special events, as well as sporting events, such as professional boxing, college basketball and hockey, professional bull riding, mixed martial arts, and esports and wrestling in its venues, including The Garden, Hulu Theater, Radio City Music Hall, and the Beacon Theatre in New York City; and The Chicago Theatre.

See Also

Before you consider Sphere Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sphere Entertainment wasn't on the list.

While Sphere Entertainment currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.