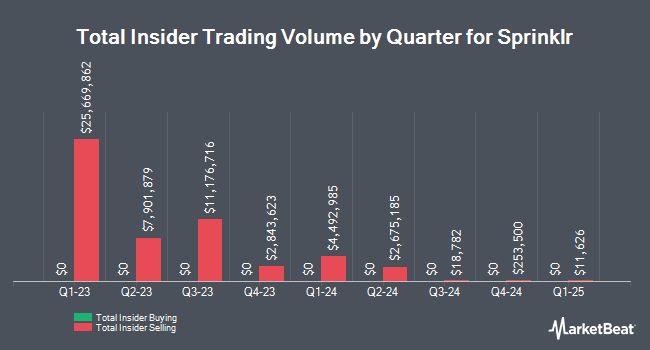

Sprinklr, Inc. (NYSE:CXM - Get Free Report) CFO Manish Sarin sold 24,468 shares of the company's stock in a transaction on Monday, July 7th. The stock was sold at an average price of $9.00, for a total value of $220,212.00. Following the transaction, the chief financial officer owned 907,770 shares of the company's stock, valued at approximately $8,169,930. The trade was a 2.62% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink.

Manish Sarin also recently made the following trade(s):

- On Wednesday, July 9th, Manish Sarin sold 174,749 shares of Sprinklr stock. The stock was sold at an average price of $9.07, for a total value of $1,584,973.43.

- On Tuesday, July 8th, Manish Sarin sold 600 shares of Sprinklr stock. The stock was sold at an average price of $9.00, for a total value of $5,400.00.

- On Monday, June 16th, Manish Sarin sold 35,744 shares of Sprinklr stock. The stock was sold at an average price of $8.17, for a total value of $292,028.48.

Sprinklr Stock Down 5.4%

Shares of NYSE CXM traded down $0.49 during mid-day trading on Friday, hitting $8.55. 3,591,396 shares of the company traded hands, compared to its average volume of 2,050,484. Sprinklr, Inc. has a 1 year low of $6.75 and a 1 year high of $9.93. The stock has a market capitalization of $2.21 billion, a price-to-earnings ratio of 20.85, a PEG ratio of 1.88 and a beta of 0.80. The business has a 50 day moving average of $8.38 and a two-hundred day moving average of $8.39.

Sprinklr (NYSE:CXM - Get Free Report) last announced its earnings results on Wednesday, June 4th. The company reported $0.12 EPS for the quarter, beating the consensus estimate of $0.10 by $0.02. Sprinklr had a return on equity of 6.86% and a net margin of 13.57%. The business had revenue of $205.50 million during the quarter, compared to the consensus estimate of $201.83 million. During the same period in the prior year, the business posted $0.09 earnings per share. Sprinklr's revenue was up 4.9% compared to the same quarter last year. As a group, research analysts anticipate that Sprinklr, Inc. will post 0.1 EPS for the current year.

Analyst Upgrades and Downgrades

CXM has been the subject of a number of analyst reports. Morgan Stanley boosted their price target on Sprinklr from $8.00 to $10.00 and gave the stock an "equal weight" rating in a research report on Thursday, June 5th. JMP Securities reiterated a "market outperform" rating and set a $17.00 price target on shares of Sprinklr in a research report on Friday, June 27th. Rosenblatt Securities reiterated a "buy" rating and set a $12.00 price target on shares of Sprinklr in a research report on Thursday, June 5th. Cantor Fitzgerald assumed coverage on Sprinklr in a report on Tuesday, June 3rd. They issued a "neutral" rating and a $8.00 price objective for the company. Finally, Wells Fargo & Company upped their price objective on Sprinklr from $6.00 to $7.00 and gave the company an "underweight" rating in a report on Thursday, June 5th. Two investment analysts have rated the stock with a sell rating, eight have issued a hold rating and three have issued a buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $10.25.

View Our Latest Stock Analysis on CXM

Institutional Investors Weigh In On Sprinklr

Several hedge funds have recently modified their holdings of CXM. Bank of New York Mellon Corp raised its position in Sprinklr by 0.8% during the fourth quarter. Bank of New York Mellon Corp now owns 1,494,287 shares of the company's stock valued at $12,627,000 after buying an additional 11,513 shares during the period. Charles Schwab Investment Management Inc. raised its position in Sprinklr by 1.7% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 1,055,292 shares of the company's stock valued at $8,917,000 after buying an additional 18,021 shares during the period. Victory Capital Management Inc. raised its position in Sprinklr by 41.5% during the fourth quarter. Victory Capital Management Inc. now owns 87,070 shares of the company's stock valued at $736,000 after buying an additional 25,552 shares during the period. PNC Financial Services Group Inc. raised its position in Sprinklr by 100.0% during the fourth quarter. PNC Financial Services Group Inc. now owns 3,856 shares of the company's stock valued at $33,000 after buying an additional 1,928 shares during the period. Finally, First Eagle Investment Management LLC acquired a new position in Sprinklr during the fourth quarter valued at $452,000. 40.19% of the stock is owned by hedge funds and other institutional investors.

Sprinklr Company Profile

(

Get Free Report)

Sprinklr, Inc provides enterprise cloud software products worldwide. The company operates Unified Customer Experience Management platform, a software that enables customer-facing teams to collaborate across internal silos, communicate across digital channels, and leverage a complete suite of capabilities to deliver customer experiences.

Read More

Before you consider Sprinklr, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sprinklr wasn't on the list.

While Sprinklr currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.