Sprout Social (NASDAQ:SPT - Get Free Report) is expected to be releasing its Q2 2025 earnings data after the market closes on Wednesday, August 6th. Analysts expect Sprout Social to post earnings of $0.15 per share and revenue of $110.93 million for the quarter. Sprout Social has set its FY 2025 guidance at 0.690-0.770 EPS and its Q2 2025 guidance at 0.140-0.160 EPS.

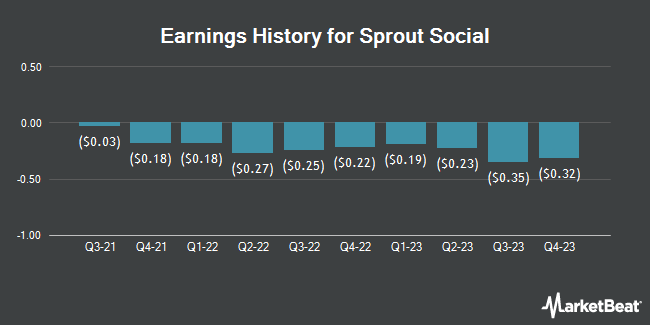

Sprout Social (NASDAQ:SPT - Get Free Report) last posted its quarterly earnings data on Thursday, May 8th. The company reported $0.22 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.15 by $0.07. The business had revenue of $109.29 million during the quarter, compared to analysts' expectations of $107.63 million. Sprout Social had a negative net margin of 14.25% and a negative return on equity of 31.03%. The business's revenue was up 12.9% on a year-over-year basis. During the same period last year, the firm posted $0.10 earnings per share. On average, analysts expect Sprout Social to post $-1 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

Sprout Social Price Performance

NASDAQ:SPT traded down $0.61 during trading hours on Friday, reaching $16.54. 704,343 shares of the company's stock were exchanged, compared to its average volume of 608,468. The company has a market capitalization of $962.30 million, a P/E ratio of -15.90 and a beta of 0.99. Sprout Social has a 12 month low of $16.40 and a 12 month high of $36.30. The company has a quick ratio of 0.97, a current ratio of 0.97 and a debt-to-equity ratio of 0.11. The business's 50-day simple moving average is $20.26 and its two-hundred day simple moving average is $23.60.

Insiders Place Their Bets

In other news, CEO Ryan Paul Barretto sold 16,800 shares of the stock in a transaction on Tuesday, July 8th. The shares were sold at an average price of $21.16, for a total transaction of $355,488.00. Following the transaction, the chief executive officer owned 119,775 shares in the company, valued at $2,534,439. This represents a 12.30% decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director Karen Walker sold 5,000 shares of the stock in a transaction on Monday, July 14th. The stock was sold at an average price of $19.05, for a total transaction of $95,250.00. Following the transaction, the director owned 28,963 shares in the company, valued at approximately $551,745.15. This trade represents a 14.72% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 152,375 shares of company stock worth $3,221,935 in the last quarter. 10.12% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Several hedge funds have recently modified their holdings of SPT. Empowered Funds LLC acquired a new stake in Sprout Social in the 1st quarter worth $325,000. AQR Capital Management LLC bought a new position in shares of Sprout Social during the 1st quarter worth about $365,000. Brighton Jones LLC lifted its holdings in shares of Sprout Social by 391.7% during the 4th quarter. Brighton Jones LLC now owns 35,985 shares of the company's stock worth $1,105,000 after acquiring an additional 28,667 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. lifted its holdings in shares of Sprout Social by 2.4% during the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 53,127 shares of the company's stock worth $1,168,000 after acquiring an additional 1,265 shares during the period. Finally, Goldman Sachs Group Inc. lifted its holdings in Sprout Social by 23.0% during the 1st quarter. Goldman Sachs Group Inc. now owns 325,750 shares of the company's stock valued at $7,163,000 after purchasing an additional 60,947 shares during the last quarter.

Analyst Ratings Changes

A number of analysts recently weighed in on SPT shares. Morgan Stanley reduced their target price on shares of Sprout Social from $30.00 to $22.00 and set an "equal weight" rating for the company in a report on Wednesday, April 16th. Oppenheimer reduced their price target on shares of Sprout Social from $38.00 to $32.00 and set an "outperform" rating for the company in a research report on Friday, May 9th. Cantor Fitzgerald restated a "neutral" rating and issued a $24.00 price target on shares of Sprout Social in a research report on Tuesday, June 3rd. Barclays reduced their price target on shares of Sprout Social from $34.00 to $26.00 and set an "overweight" rating for the company in a research report on Monday, April 21st. Finally, Needham & Company LLC restated a "buy" rating and issued a $32.00 price target on shares of Sprout Social in a research report on Wednesday, May 28th. One equities research analyst has rated the stock with a sell rating, five have issued a hold rating and six have given a buy rating to the company's stock. According to data from MarketBeat, Sprout Social presently has a consensus rating of "Hold" and a consensus price target of $29.17.

View Our Latest Research Report on Sprout Social

Sprout Social Company Profile

(

Get Free Report)

Sprout Social, Inc designs, develops, and operates a web-based social media management platform in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company provides cloud software for social messaging, data and workflows in a unified system of record, intelligence, and action.

Further Reading

Before you consider Sprout Social, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sprout Social wasn't on the list.

While Sprout Social currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.