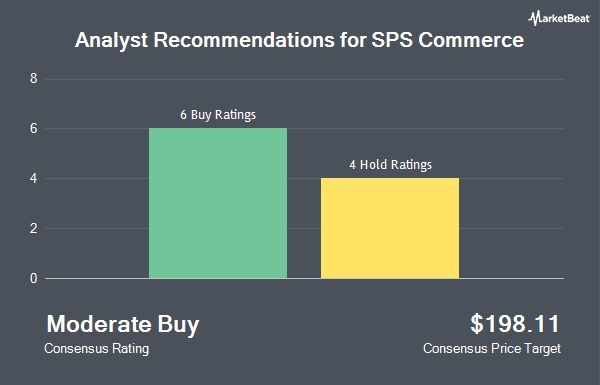

Shares of SPS Commerce, Inc. (NASDAQ:SPSC - Get Free Report) have been given an average recommendation of "Moderate Buy" by the ten research firms that are currently covering the company, Marketbeat reports. Four research analysts have rated the stock with a hold recommendation and six have issued a buy recommendation on the company. The average twelve-month price objective among brokers that have issued a report on the stock in the last year is $187.00.

A number of equities analysts have weighed in on the stock. Robert W. Baird increased their price target on shares of SPS Commerce from $154.00 to $159.00 and gave the stock a "neutral" rating in a research note on Friday, April 25th. Wall Street Zen raised shares of SPS Commerce from a "hold" rating to a "buy" rating in a research note on Friday, July 18th. DA Davidson cut their target price on shares of SPS Commerce from $245.00 to $175.00 and set a "buy" rating on the stock in a research note on Monday, April 14th. Cantor Fitzgerald assumed coverage on shares of SPS Commerce in a research note on Tuesday, June 3rd. They issued an "overweight" rating and a $170.00 target price on the stock. Finally, Morgan Stanley assumed coverage on shares of SPS Commerce in a research note on Monday, July 14th. They issued an "overweight" rating and a $180.00 target price on the stock.

Check Out Our Latest Stock Report on SPS Commerce

Hedge Funds Weigh In On SPS Commerce

Institutional investors have recently added to or reduced their stakes in the company. FMR LLC raised its stake in shares of SPS Commerce by 109.7% in the 4th quarter. FMR LLC now owns 1,419,831 shares of the software maker's stock valued at $261,235,000 after purchasing an additional 742,686 shares in the last quarter. Norges Bank bought a new stake in shares of SPS Commerce during the 4th quarter valued at about $81,543,000. Nuveen LLC bought a new stake in shares of SPS Commerce during the 1st quarter valued at about $37,546,000. JPMorgan Chase & Co. grew its position in shares of SPS Commerce by 99.3% during the 4th quarter. JPMorgan Chase & Co. now owns 507,014 shares of the software maker's stock valued at $93,286,000 after buying an additional 252,575 shares during the last quarter. Finally, Fiera Capital Corp bought a new stake in shares of SPS Commerce during the 1st quarter valued at about $31,311,000. Institutional investors and hedge funds own 98.96% of the company's stock.

SPS Commerce Price Performance

NASDAQ:SPSC traded up $3.39 during trading hours on Friday, reaching $139.88. 105,187 shares of the company were exchanged, compared to its average volume of 324,515. The firm has a market cap of $5.31 billion, a price-to-earnings ratio of 65.29 and a beta of 0.71. SPS Commerce has a 52-week low of $120.08 and a 52-week high of $218.61. The stock has a 50 day simple moving average of $139.33 and a 200 day simple moving average of $145.05.

SPS Commerce (NASDAQ:SPSC - Get Free Report) last posted its quarterly earnings results on Thursday, April 24th. The software maker reported $1.00 earnings per share for the quarter, topping analysts' consensus estimates of $0.85 by $0.15. The company had revenue of $181.55 million for the quarter, compared to the consensus estimate of $179.57 million. SPS Commerce had a net margin of 12.13% and a return on equity of 12.37%. SPS Commerce's revenue was up 21.4% on a year-over-year basis. During the same quarter last year, the firm posted $0.86 earnings per share. On average, analysts predict that SPS Commerce will post 2.73 EPS for the current fiscal year.

About SPS Commerce

(

Get Free ReportSPS Commerce, Inc provides cloud-based supply chain management solutions in the United States and internationally. It offers solutions through the SPS Commerce, a cloud-based platform that enhances the way retailers, grocers, suppliers, distributors, and logistics firms manage and fulfill omnichannel orders, optimize sell-through performance, and automate new trading relationships.

Recommended Stories

Before you consider SPS Commerce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SPS Commerce wasn't on the list.

While SPS Commerce currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.