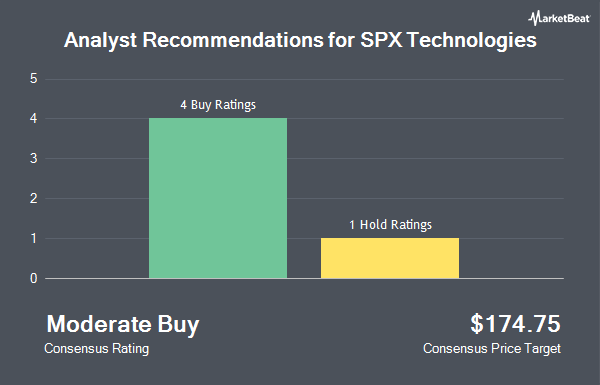

Shares of SPX Technologies, Inc. (NYSE:SPXC - Get Free Report) have been given an average recommendation of "Buy" by the five research firms that are covering the stock, MarketBeat Ratings reports. Four research analysts have rated the stock with a buy recommendation and one has given a strong buy recommendation to the company. The average 1-year price objective among analysts that have updated their coverage on the stock in the last year is $195.20.

A number of research analysts have issued reports on SPXC shares. UBS Group boosted their target price on shares of SPX Technologies from $182.00 to $210.00 and gave the company a "buy" rating in a research note on Friday, August 1st. Oppenheimer boosted their target price on shares of SPX Technologies from $170.00 to $197.00 and gave the company an "outperform" rating in a research note on Tuesday, July 8th. Wall Street Zen raised shares of SPX Technologies from a "hold" rating to a "buy" rating in a research note on Saturday. Finally, B. Riley started coverage on shares of SPX Technologies in a research note on Thursday, May 15th. They set a "buy" rating and a $195.00 target price for the company.

Get Our Latest Analysis on SPX Technologies

SPX Technologies Trading Down 0.6%

Shares of SPXC traded down $1.14 during mid-day trading on Friday, reaching $200.43. The company had a trading volume of 286,226 shares, compared to its average volume of 292,619. The company has a current ratio of 1.97, a quick ratio of 1.28 and a debt-to-equity ratio of 0.62. The stock has a market cap of $9.37 billion, a price-to-earnings ratio of 45.04, a price-to-earnings-growth ratio of 1.72 and a beta of 1.27. The firm has a fifty day simple moving average of $172.56 and a 200-day simple moving average of $152.09. SPX Technologies has a fifty-two week low of $115.00 and a fifty-two week high of $209.38.

SPX Technologies (NYSE:SPXC - Get Free Report) last issued its quarterly earnings data on Thursday, July 31st. The company reported $1.65 EPS for the quarter, topping analysts' consensus estimates of $1.45 by $0.20. The firm had revenue of $552.40 million for the quarter, compared to analyst estimates of $546.03 million. SPX Technologies had a net margin of 10.27% and a return on equity of 19.59%. The firm's revenue was up 10.2% compared to the same quarter last year. During the same quarter in the previous year, the business posted $1.42 EPS. On average, sell-side analysts anticipate that SPX Technologies will post 5.57 EPS for the current fiscal year.

Insider Buying and Selling

In related news, Director Rick D. Puckett sold 6,823 shares of the firm's stock in a transaction on Thursday, May 29th. The shares were sold at an average price of $153.01, for a total value of $1,043,987.23. Following the transaction, the director directly owned 33,770 shares in the company, valued at approximately $5,167,147.70. This trade represents a 16.81% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. 3.32% of the stock is owned by corporate insiders.

Institutional Trading of SPX Technologies

Hedge funds have recently bought and sold shares of the stock. Intrust Bank NA acquired a new stake in shares of SPX Technologies during the 2nd quarter worth approximately $256,000. Universal Beteiligungs und Servicegesellschaft mbH lifted its stake in SPX Technologies by 526.4% in the second quarter. Universal Beteiligungs und Servicegesellschaft mbH now owns 26,248 shares of the company's stock valued at $4,401,000 after buying an additional 22,058 shares in the last quarter. Summitry LLC bought a new position in SPX Technologies in the second quarter valued at approximately $235,000. Creative Planning lifted its position in shares of SPX Technologies by 5.7% in the second quarter. Creative Planning now owns 23,694 shares of the company's stock worth $3,973,000 after purchasing an additional 1,269 shares in the last quarter. Finally, Commonwealth of Pennsylvania Public School Empls Retrmt SYS lifted its position in shares of SPX Technologies by 8.1% in the second quarter. Commonwealth of Pennsylvania Public School Empls Retrmt SYS now owns 11,991 shares of the company's stock worth $2,011,000 after purchasing an additional 897 shares in the last quarter. 92.82% of the stock is owned by institutional investors.

About SPX Technologies

(

Get Free Report)

SPX Technologies, Inc supplies infrastructure equipment serving the heating, ventilation, and cooling (HVAC); and detection and measurement markets worldwide. The company operates in two segments, HVAC and Detection and Measurement. The HVAC segment engineers, designs, manufactures, installs, and services package and process cooling products and engineered air movement solutions for the HVAC industrial and power generation markets, as well as boilers, heating, and ventilation products for the residential and commercial markets.

Featured Stories

Before you consider SPX Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SPX Technologies wasn't on the list.

While SPX Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.