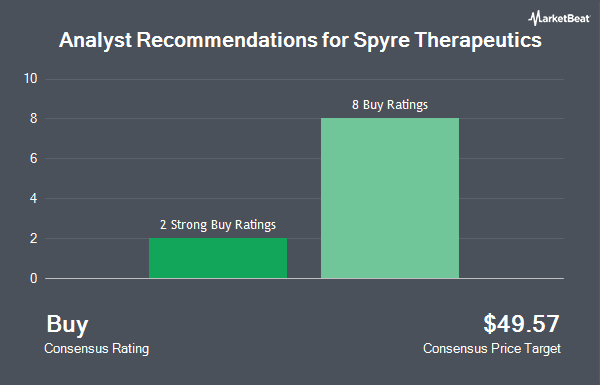

Spyre Therapeutics, Inc. (NASDAQ:SYRE - Get Free Report) has earned a consensus recommendation of "Buy" from the nine research firms that are currently covering the stock, Marketbeat Ratings reports. One equities research analyst has rated the stock with a sell recommendation, six have assigned a buy recommendation and two have assigned a strong buy recommendation to the company. The average 12-month price objective among brokerages that have issued ratings on the stock in the last year is $52.50.

Several research firms have commented on SYRE. Weiss Ratings reaffirmed a "sell (d-)" rating on shares of Spyre Therapeutics in a research note on Wednesday, October 8th. BTIG Research reiterated a "buy" rating and issued a $70.00 price target on shares of Spyre Therapeutics in a report on Tuesday, September 16th. Wedbush reiterated an "outperform" rating and issued a $65.00 price target on shares of Spyre Therapeutics in a report on Wednesday, August 6th. Deutsche Bank Aktiengesellschaft assumed coverage on shares of Spyre Therapeutics in a report on Friday, September 26th. They issued a "buy" rating and a $43.00 price target on the stock. Finally, Wall Street Zen upgraded shares of Spyre Therapeutics from a "sell" rating to a "hold" rating in a report on Tuesday, October 14th.

Check Out Our Latest Stock Analysis on SYRE

Spyre Therapeutics Stock Performance

SYRE stock opened at $23.37 on Friday. The stock has a market capitalization of $1.41 billion, a P/E ratio of -6.87 and a beta of 2.90. Spyre Therapeutics has a one year low of $10.91 and a one year high of $40.26. The company has a 50 day moving average price of $17.63 and a two-hundred day moving average price of $16.14.

Spyre Therapeutics (NASDAQ:SYRE - Get Free Report) last released its earnings results on Tuesday, August 5th. The company reported ($0.49) EPS for the quarter, topping the consensus estimate of ($0.73) by $0.24. Research analysts forecast that Spyre Therapeutics will post -4.46 earnings per share for the current fiscal year.

Insider Buying and Selling at Spyre Therapeutics

In other Spyre Therapeutics news, CFO Scott L. Burrows sold 18,428 shares of Spyre Therapeutics stock in a transaction on Tuesday, September 2nd. The shares were sold at an average price of $16.26, for a total value of $299,639.28. Following the transaction, the chief financial officer owned 97,994 shares in the company, valued at $1,593,382.44. This trade represents a 15.83% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 15.43% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On Spyre Therapeutics

Hedge funds and other institutional investors have recently made changes to their positions in the business. CWM LLC lifted its holdings in shares of Spyre Therapeutics by 357.8% during the 2nd quarter. CWM LLC now owns 1,712 shares of the company's stock valued at $26,000 after acquiring an additional 1,338 shares in the last quarter. AlphaQuest LLC lifted its holdings in shares of Spyre Therapeutics by 45.2% during the 1st quarter. AlphaQuest LLC now owns 3,191 shares of the company's stock valued at $51,000 after acquiring an additional 993 shares in the last quarter. Ameritas Investment Partners Inc. lifted its holdings in shares of Spyre Therapeutics by 25.8% during the 2nd quarter. Ameritas Investment Partners Inc. now owns 5,091 shares of the company's stock valued at $76,000 after acquiring an additional 1,045 shares in the last quarter. Tower Research Capital LLC TRC lifted its holdings in shares of Spyre Therapeutics by 182.2% during the 2nd quarter. Tower Research Capital LLC TRC now owns 5,769 shares of the company's stock valued at $86,000 after acquiring an additional 3,725 shares in the last quarter. Finally, Man Group plc acquired a new position in shares of Spyre Therapeutics during the 2nd quarter valued at $162,000. Institutional investors and hedge funds own 80.39% of the company's stock.

About Spyre Therapeutics

(

Get Free Report)

Spyre Therapeutics, Inc, a preclinical stage biotechnology company, focuses on developing therapeutics for patients living with inflammatory bowel disease (IBD). It develops SPY001, a human monoclonal immunoglobulin G1 antibody designed to bind selectively to the a4ß7 integrin being developed for the treatment of IBD (ulcerative colitis and Crohn's disease).

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Spyre Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spyre Therapeutics wasn't on the list.

While Spyre Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.