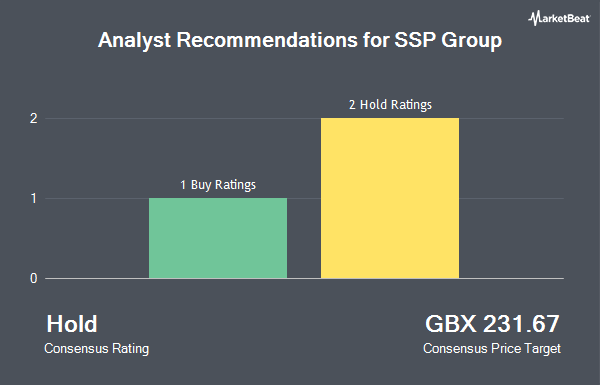

Shares of SSP Group plc (LON:SSPG - Get Free Report) have been given a consensus recommendation of "Hold" by the five ratings firms that are covering the company, Marketbeat reports. One analyst has rated the stock with a sell recommendation, one has issued a hold recommendation and three have issued a buy recommendation on the company. The average twelve-month price objective among brokers that have issued ratings on the stock in the last year is GBX 233.

Several brokerages have recently commented on SSPG. Shore Capital restated a "house stock" rating on shares of SSP Group in a report on Tuesday, July 29th. Berenberg Bank upgraded shares of SSP Group to a "buy" rating and raised their price objective for the company from GBX 180 to GBX 190 in a report on Thursday, September 11th. JPMorgan Chase & Co. lowered their price objective on shares of SSP Group from GBX 200 to GBX 190 and set a "neutral" rating on the stock in a research report on Thursday, August 7th. Deutsche Bank Aktiengesellschaft restated a "buy" rating and set a GBX 285 target price on shares of SSP Group in a research report on Wednesday, July 30th. Finally, Citigroup lifted their price target on shares of SSP Group from GBX 320 to GBX 330 and gave the stock a "buy" rating in a report on Wednesday, July 30th.

View Our Latest Stock Report on SSP Group

SSP Group Trading Down 0.4%

Shares of SSPG stock traded down GBX 0.60 during trading hours on Thursday, hitting GBX 155.80. The company had a trading volume of 1,513,954 shares, compared to its average volume of 3,104,307. The company's fifty day moving average is GBX 163.22 and its 200 day moving average is GBX 160.86. The company has a debt-to-equity ratio of 852.29, a current ratio of 0.44 and a quick ratio of 0.66. SSP Group has a fifty-two week low of GBX 134.10 and a fifty-two week high of GBX 196.30. The stock has a market capitalization of £1.25 billion, a PE ratio of -5,193.33, a price-to-earnings-growth ratio of -0.77 and a beta of 1.88.

SSP Group Company Profile

(

Get Free Report)

SSP is a leading operator of food and beverage outlets in travel locations worldwide, with c.37,000 colleagues in over 600 locations across 36 countries. We operate sit-down and quick service restaurants, cafes, lounges and food-led convenience stores, principally in airports and train stations, with a portfolio of more than 550 international, national and local brands.

Featured Stories

Before you consider SSP Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SSP Group wasn't on the list.

While SSP Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.