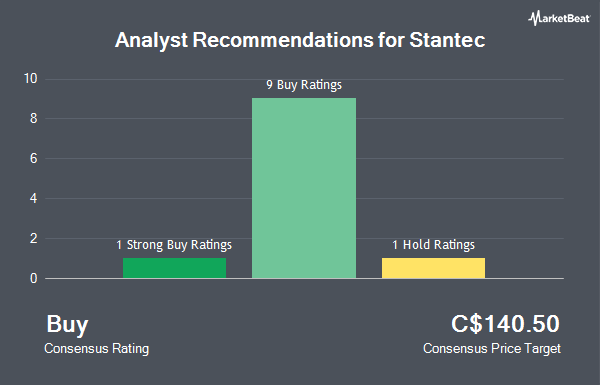

Stantec Inc. (TSE:STN - Get Free Report) NYSE: STN has received a consensus recommendation of "Buy" from the eleven ratings firms that are currently covering the company, Marketbeat.com reports. One analyst has rated the stock with a hold recommendation, nine have issued a buy recommendation and one has issued a strong buy recommendation on the company. The average 1 year price objective among brokers that have issued ratings on the stock in the last year is C$155.50.

STN has been the subject of a number of recent research reports. National Bankshares boosted their price target on Stantec from C$162.00 to C$164.00 and gave the company an "outperform" rating in a research note on Friday, August 15th. Royal Bank Of Canada boosted their price target on Stantec from C$150.00 to C$153.00 and gave the company an "outperform" rating in a research note on Friday, August 15th. Canaccord Genuity Group boosted their price target on Stantec from C$150.00 to C$165.00 and gave the company a "buy" rating in a research note on Wednesday, July 30th. Stifel Nicolaus boosted their price target on Stantec from C$165.00 to C$169.00 and gave the company a "buy" rating in a research note on Friday, August 15th. Finally, CIBC boosted their price target on Stantec from C$156.00 to C$168.00 in a research note on Friday, July 18th.

Get Our Latest Analysis on STN

Insider Buying and Selling at Stantec

In related news, Director Susan Reisbord acquired 2,785 shares of the stock in a transaction dated Thursday, June 26th. The shares were purchased at an average cost of C$147.74 per share, with a total value of C$411,458.13. 0.27% of the stock is currently owned by insiders.

Stantec Trading Down 4.3%

Stantec stock opened at C$148.16 on Wednesday. The business has a 50-day simple moving average of C$150.64 and a two-hundred day simple moving average of C$138.77. The company has a market cap of C$16.90 billion, a P/E ratio of 38.79, a P/E/G ratio of 1.46 and a beta of 0.92. Stantec has a 52-week low of C$107.19 and a 52-week high of C$155.35. The company has a quick ratio of 1.46, a current ratio of 1.42 and a debt-to-equity ratio of 85.29.

Stantec Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, October 15th. Stockholders of record on Wednesday, October 15th will be given a dividend of $0.225 per share. This represents a $0.90 dividend on an annualized basis and a dividend yield of 0.6%. The ex-dividend date of this dividend is Monday, September 29th. Stantec's payout ratio is presently 22.77%.

Stantec Company Profile

(

Get Free Report)

Stantec Inc is a sustainable engineering, architecture, and environmental consulting company. The company is geographically diversified in three regional operating units namely Canada, the United States and Global, offering similar services across all regions. The company offers services in various sectors across the project life cycle through five business operating units infrastructure, water, buildings, environmental services, and energy and resources.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Stantec, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stantec wasn't on the list.

While Stantec currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.